Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate depreciation using the straight-line method [DETAILS ON how a photocopier depreciates every year is not needed]. c. With the amounts calculated in (I) and

Calculate depreciation using the straight-line method [DETAILS ON how a photocopier depreciates every year is not needed].

c. With the amounts calculated in (I) and (II), complete the (partial) Income Statement (Image 2) showing the Gross Profit and the Net Profit for the year ending 31 Dec 2015.

c. With the amounts calculated in (I) and (II), complete the (partial) Income Statement (Image 2) showing the Gross Profit and the Net Profit for the year ending 31 Dec 2015.

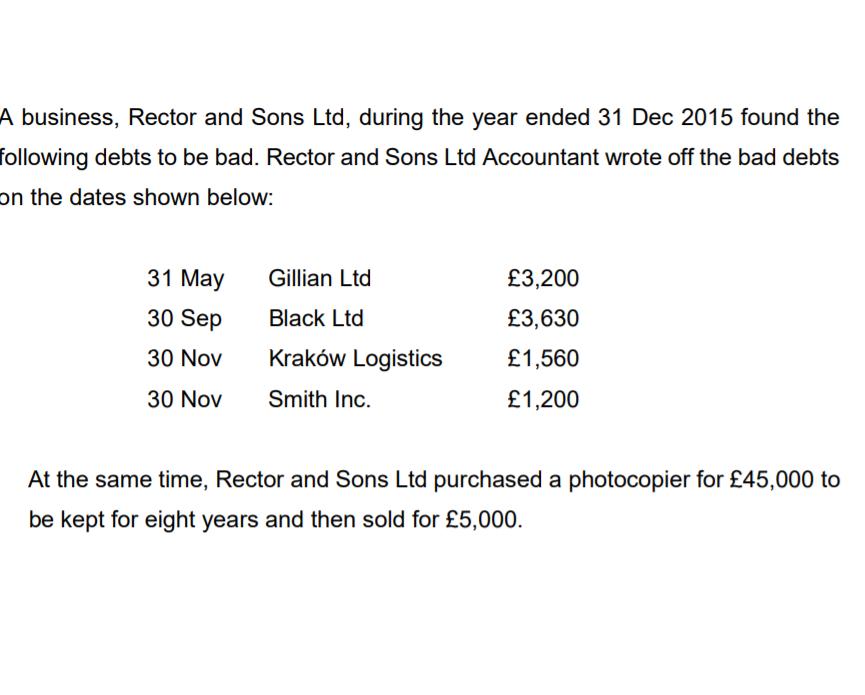

A business, Rector and Sons Ltd, during the year ended 31 Dec 2015 found the following debts to be bad. Rector and Sons Ltd Accountant wrote off the bad debts on the dates shown below: 31 May 30 Sep 30 Nov 30 Nov Gillian Ltd Black Ltd Krakw Logistics Smith Inc. 3,200 3,630 1,560 1,200 At the same time, Rector and Sons Ltd purchased a photocopier for 45,000 to be kept for eight years and then sold for 5,000.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Given Bad Debts Written Off Gillian Ltd 3200 Black Ltd 3630 Krakw Logistics 1560 Smith ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started