Answered step by step

Verified Expert Solution

Question

1 Approved Answer

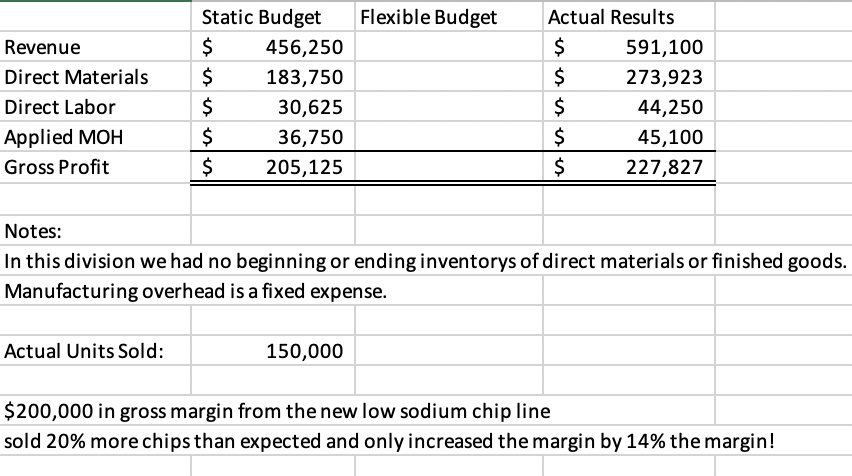

Calculate each raw materials price and quantity (efficiency) variances Flexible Budget Revenue Direct Materials Direct Labor Applied MOH Gross Profit Static Budget $ 456,250 $

Calculate each raw materials price and quantity (efficiency) variances

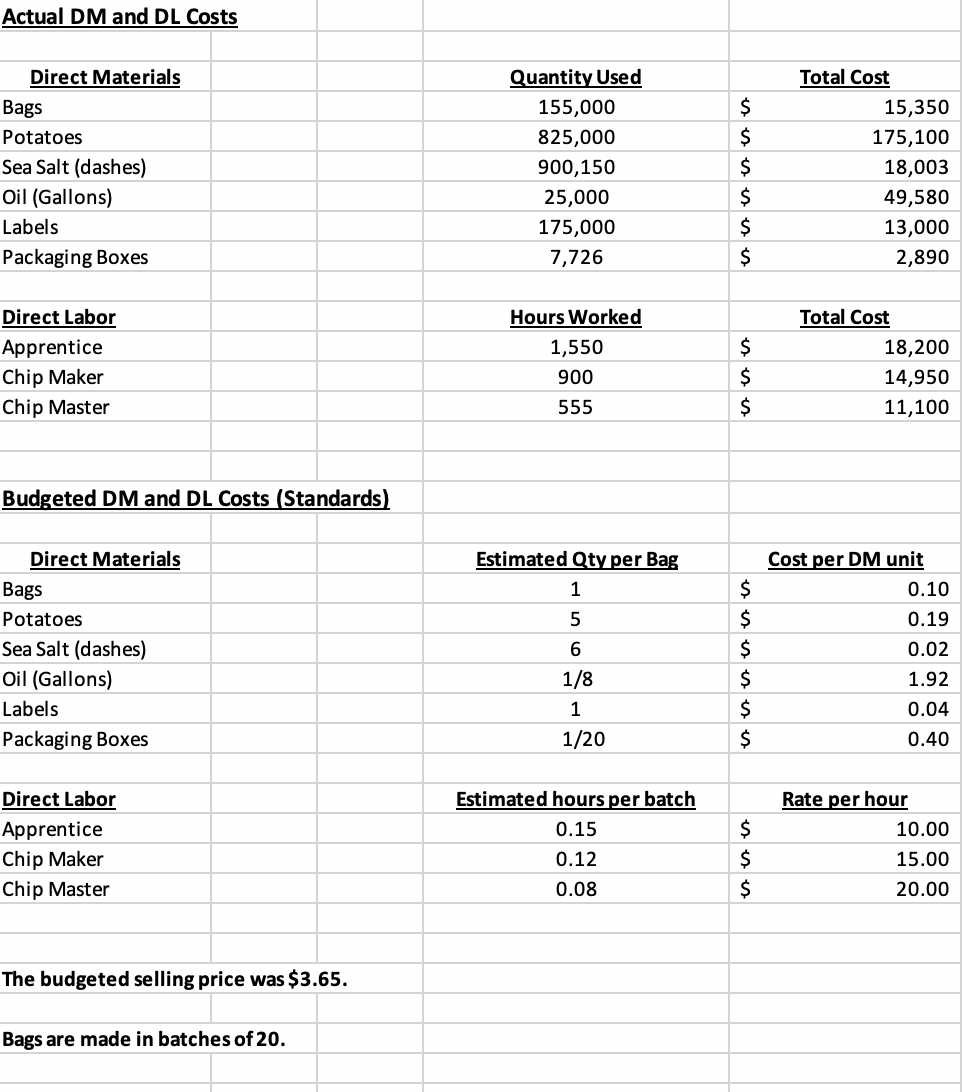

Flexible Budget Revenue Direct Materials Direct Labor Applied MOH Gross Profit Static Budget $ 456,250 $ 183,750 $ 30,625 $ 36,750 $ 205,125 Actual Results $ 591,100 $ 273,923 $ 44,250 $ 45,100 $ 227,827 Notes: In this division we had no beginning or ending inventorys of direct materials or finished goods. Manufacturing overhead is a fixed expense. Actual Units Sold: 150,000 $200,000 in gross margin from the new low sodium chip line sold 20% more chips than expected and only increased the margin by 14% the margin! Actual DM and DL Costs Direct Materials Bags Potatoes Sea Salt (dashes) Oil (Gallons) Labels Packaging Boxes Quantity Used 155,000 825,000 900,150 25,000 175,000 7,726 $ $ $ $ Total Cost 15,350 175,100 18,003 49,580 13,000 2,890 $ $ Direct Labor Apprentice Chip Maker Chip Master Hours Worked 1,550 900 555 $ $ $ Total Cost 18,200 14,950 11,100 Budgeted DM and DL Costs (Standards) Estimated Qty per Bag 1 5 Direct Materials Bags Potatoes Sea Salt (dashes) Oil (Gallons) Labels Packaging Boxes Cost per DM unit 0.10 0.19 0.02 1.92 0.04 $ $ $ $ $ $ 6 1/8 1 1/20 0.40 Direct Labor Apprentice Chip Maker Chip Master Estimated hours per batch 0.15 0.12 0.08 $ $ $ Rate per hour 10.00 15.00 20.00 The budgeted selling price was $3.65. Bags are made in batches of 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started