Question

Calculate Financial Statement Ratios Using the chart below (which replicates portions of the: 10 Point Test Ratios for Overland Park, KS in FY2015 on page

Calculate Financial Statement Ratios

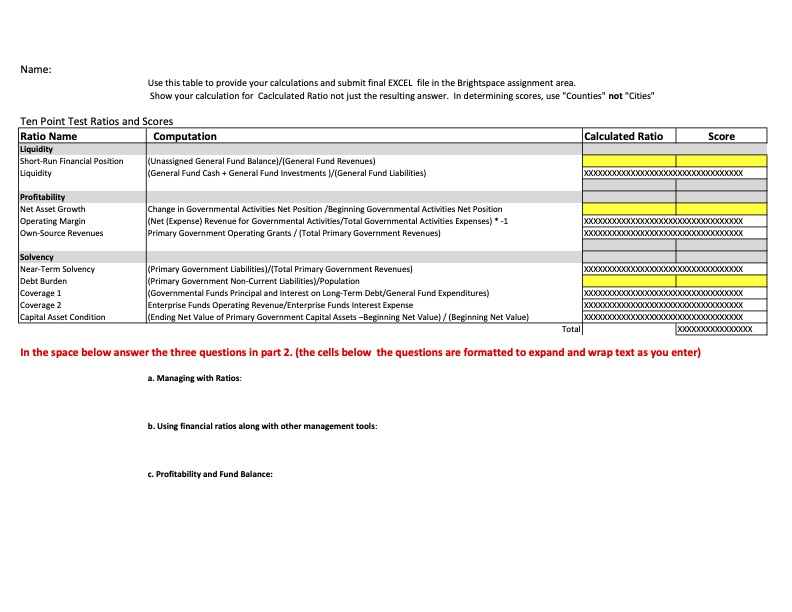

Using the chart below (which replicates portions of the: "10 Point Test" Ratios for Overland Park, KS in FY2015 on page 88 in Kyoko and Marlowe). In the Ten Point Test EXCEL file (below) calculate the three highlighted ratios using financial data for the Town of Chili. After calculating the ratios use the table at the bottom (also in the EXCEL spreadsheet) to assign 10 Point Test values to each calculated ratio as indicated in Kioko and Marlowe on pages 88-92. Use the "Score" column in the Excel spreadsheet to record the assigned value (based on the quartile of the calculated ratio).

Show the calculations used to find the ratio and explain the test score.

The Town is in the southwest quadrant of Monroe County with a population of 29,123 in 2020

http://www.townofchili.org/wp-content/uploads/2020/04/2019C-Financial-Statements.pdf

answer the following questions:

Name: Use this table to provide your calculations and submit final EXCEL file in the Brightspace assignment area. Show your calculation for Caciculated Ratio not just the resulting answer. In determining scores, use "Counties" not "Cities" Ten Point Test Ratios and Scores Ratio Name Liquidity Short-Run Financial Position Liquidity Profitability Net Asset Growth Operating Margin Own-Source Revenues Solvency Near-Term Solvency Debt Burden Coverage 1 Coverage 2 Capital Asset Condition Computation (Unassigned General Fund Balance)/(General Fund Revenues) (General Fund Cash + General Fund Investments )/(General Fund Liabilities) Change in Governmental Activities Net Position/Beginning Governmental Activities Net Position (Net (Expense) Revenue for Governmental Activities/Total Governmental Activities Expenses) * -1 Primary Government Operating Grants / (Total Primary Government Revenues) (Primary Government Liabilities)/(Total Primary Government Revenues) (Primary Government Non-Current Liabilities)/Population (Governmental Funds Principal and Interest on Long-Term Debt/General Fund Expenditures) Enterprise Funds Operating Revenue/Enterprise Funds Interest Expense (Ending Net Value of Primary Government Capital Assets-Beginning Net Value)/(Beginning Net Value) Total Calculated Ratio Score XxXXXXXXXXXXXXXXXXX In the space below answer the three questions in part 2. (the cells below the questions are formatted to expand and wrap text as you enter) a. Managing with Ratios: XXXXXXXX XXXXXXXX XXXXXXXX XXXXXX b. Using financial ratios along with other management tools: c. Profitability and Fund Balance:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Managing with Ratios Financial ratios are important management tools that provide insights into an organizations financial health performance and ef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e8027e537f_880881.pdf

180 KBs PDF File

661e8027e537f_880881.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started