Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate for 2020: inventory turnover accruals debt ratio common stock net fixed assets turnover cash flow from operating activities cash flow from financing cash flow

Calculate for 2020:

inventory turnover

accruals

debt ratio

common stock

net fixed assets turnover

cash flow from operating activities

cash flow from financing

cash flow from investing activities

net operating working capital

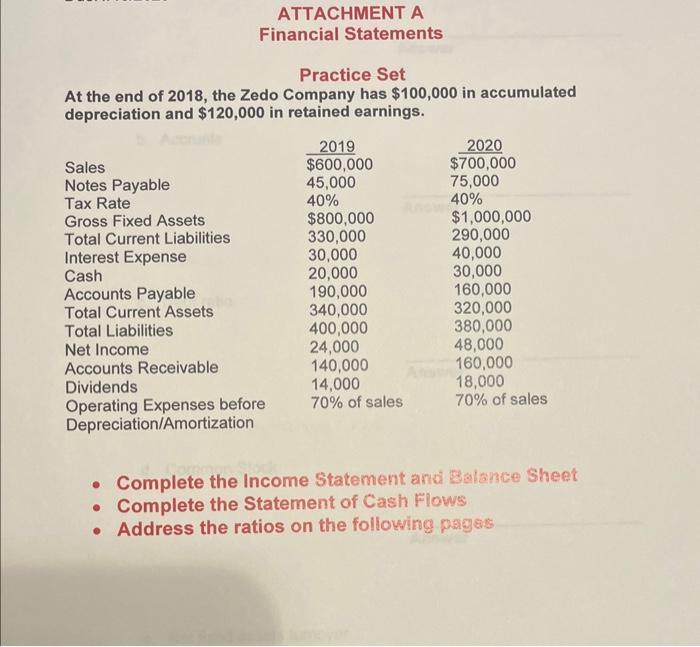

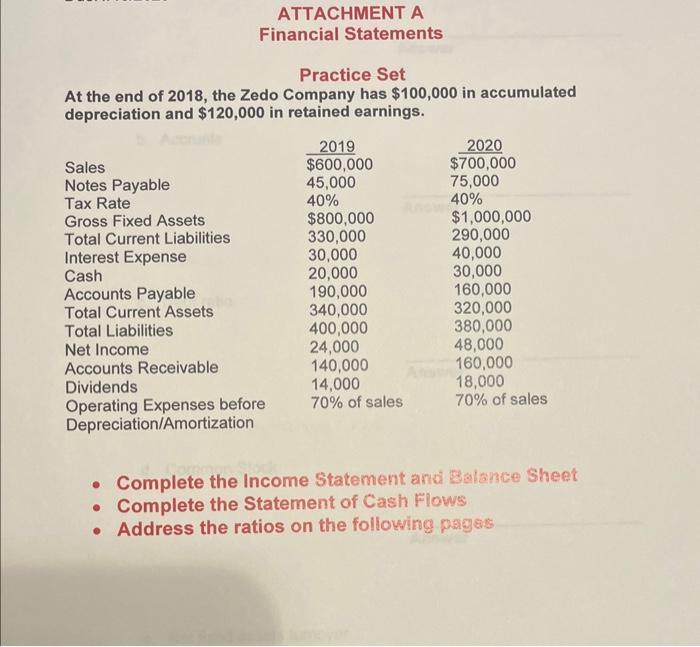

Practice Set At the end of 2018, the Zedo Company has $100,000 in accumulated depreciation and $120,000 in retained earnings. Sales Notes Payable Tax Rate Gross Fixed Assets Total Current Liabilities Interest Expense Cash ATTACHMENT A Financial Statements Accounts Payable Total Current Assets Total Liabilities Net Income Accounts Receivable Dividends Operating Expenses before Depreciation/Amortization 2019 $600,000 45,000 40% $800,000 330,000 30,000 20,000 190,000 340,000 400,000 24,000 140,000 14,000 70% of sales 2020 $700,000 75,000 40% $1,000,000 290,000 40,000 30,000 160,000 320,000 380,000 48,000 160,000 18,000 70% of sales Complete the Income Statement and Balance Sheet Complete the Statement of Cash Flows . Address the ratios on the following pages

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Inventory Turnover 2020 7 700000100000 Accruals ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started