Question

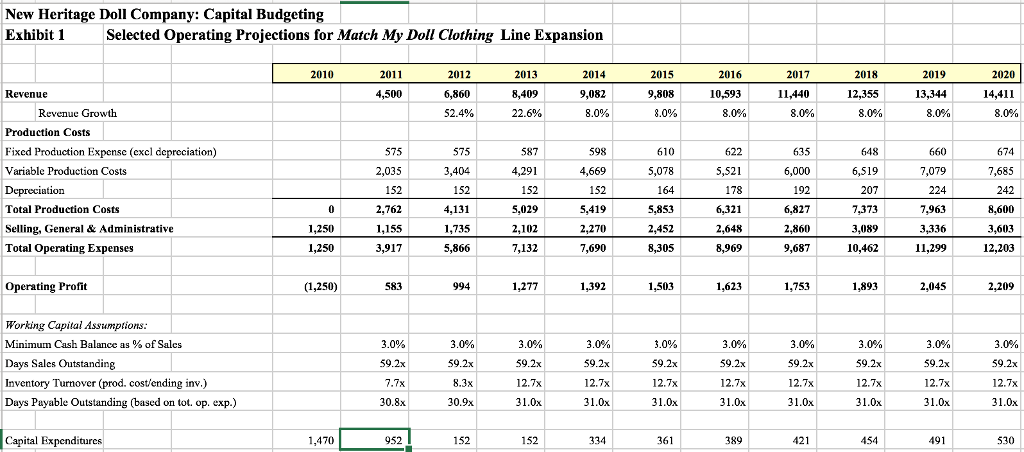

Calculate, for each project, Net Working Capital, for each year. (In this case, cash is included in NWC.) Note that you will need to separately

Calculate, for each project, Net Working Capital, for each year. (In this case, cash is included in NWC.) Note that you will need to separately calculate: Cash, Accounts Receivable, Inventory, and Accounts Payable. (Note: For A/P, you need to remove depreciation from Total Operating Expense before applying the given Days Payable Outstanding.)

Calculate, for each project, Free Cash Flow, for each year. Given FCF, then calculate the NPV/IRR/Payback and profitability index for both projects.

Calculate, for each project, the terminal value in year 2020. Use the discount rates and permanent growth rates given in the case.

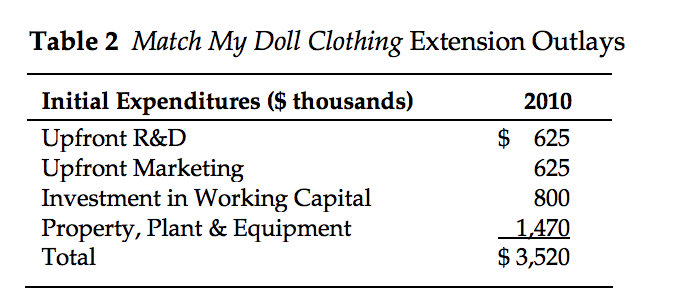

Table 2 is supposed to help with calculating NWC

Table 2 Match My Doll Clothing Extension Outlays Initial Expenditures ($ thousands) Upfront R&D Upfront Marketing Investment in Working Capital Property, Plant & Equipment Total 2010 $ 625 625 800 1470 $ 3,520 Table 2 Match My Doll Clothing Extension Outlays Initial Expenditures ($ thousands) Upfront R&D Upfront Marketing Investment in Working Capital Property, Plant & Equipment Total 2010 $ 625 625 800 1470 $ 3,520

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started