Answered step by step

Verified Expert Solution

Question

1 Approved Answer

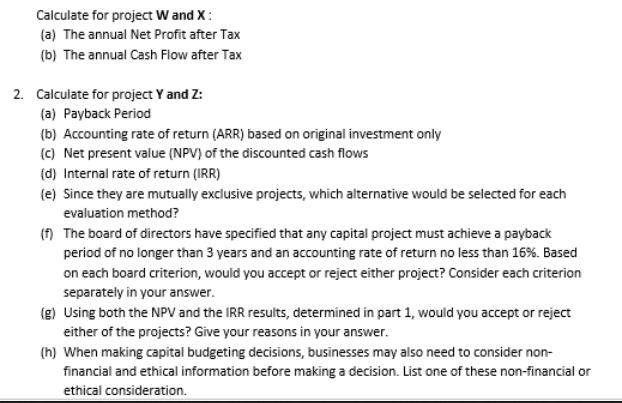

Calculate for project W and X: (a) The annual Net Profit after Tax (b) The annual Cash Flow after Tax 2. Calculate for project

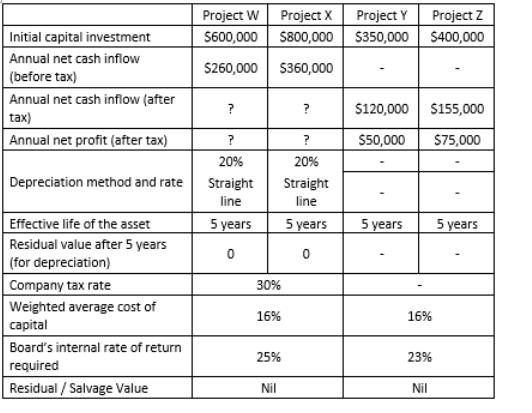

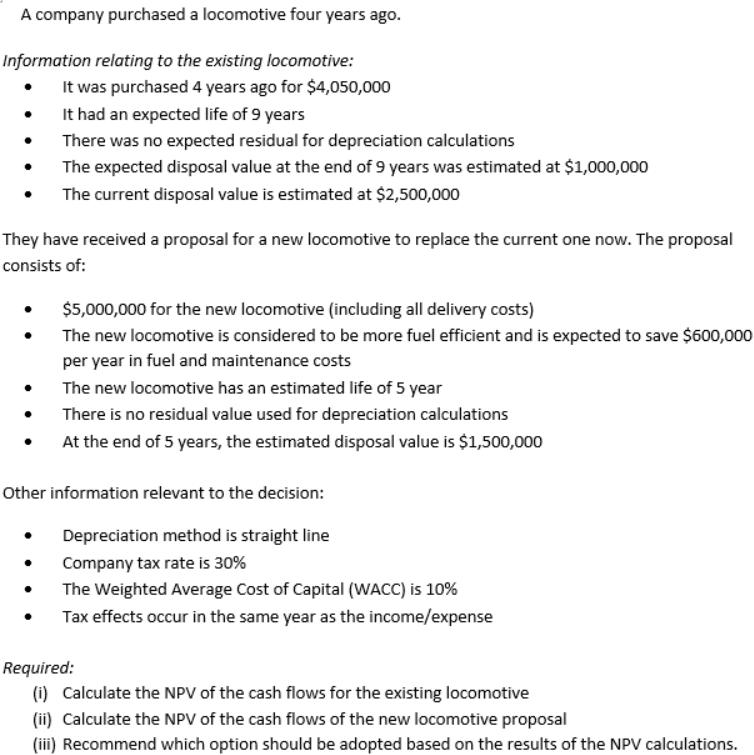

Calculate for project W and X: (a) The annual Net Profit after Tax (b) The annual Cash Flow after Tax 2. Calculate for project Y and Z: (a) Payback Period (b) Accounting rate of return (ARR) based on original investment only (c) Net present value (NPV) of the discounted cash flows (d) Internal rate of return (IRR) (e) Since they are mutually exclusive projects, which alternative would be selected for each evaluation method? (f) The board of directors have specified that any capital project must achieve a payback period of no longer than 3 years and an accounting rate of return no less than 16%. Based on each board criterion, would you accept or reject either project? Consider each criterion separately in your answer. (g) Using both the NPV and the IRR results, determined in part 1, would you accept or reject either of the projects? Give your reasons in your answer. (h) When making capital budgeting decisions, businesses may also need to consider non- financial and ethical information before making a decision. List one of these non-financial or ethical consideration. Initial capital investment Annual net cash inflow (before tax) Annual net cash inflow (after tax) Annual net profit (after tax) Depreciation method and rate Effective life of the asset Residual value after 5 years (for depreciation) Company tax rate Weighted average cost of capital Board's internal rate of return required Residual / Salvage Value Project W $600,000 $260,000 ? ? 20% Straight line 5 years 0 Project X $800,000 $360,000 30% 16% 25% Nil ? ? 20% Straight line 5 years 0 Project Y $350,000 $120,000 $155,000 $50,000 $75,000 5 years Project Z $400,000 16% 23% Nil 5 years A company purchased a locomotive four years ago. Information relating to the existing locomotive: It was purchased 4 years ago for $4,050,000 It had an expected life of 9 years There was no expected residual for depreciation calculations The expected disposal value at the end of 9 years was estimated at $1,000,000 The current disposal value is estimated at $2,500,000 They have received a proposal for a new locomotive to replace the current one now. The proposal consists of: . $5,000,000 for the new locomotive (including all delivery costs) The new locomotive is considered to be more fuel efficient and is expected to save $600,000 per year in fuel and maintenance costs The new locomotive has an estimated life of 5 year There is no residual value used for depreciation calculations At the end of 5 years, the estimated disposal value is $1,500,000 Other information relevant to the decision: Depreciation method is straight line Company tax rate is 30% The Weighted Average Cost of Capital (WACC) is 10% Tax effects occur in the same year as the income/expense Required: (i) Calculate the NPV of the cash flows for the existing locomotive (ii) Calculate the NPV of the cash flows of the new locomotive proposal (iii) Recommend which option should be adopted based on the results of the NPV calculations.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the cash flows for the existing locomotive and the new locomotive proposal we need to determine the annual cash flows for each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started