Answered step by step

Verified Expert Solution

Question

1 Approved Answer

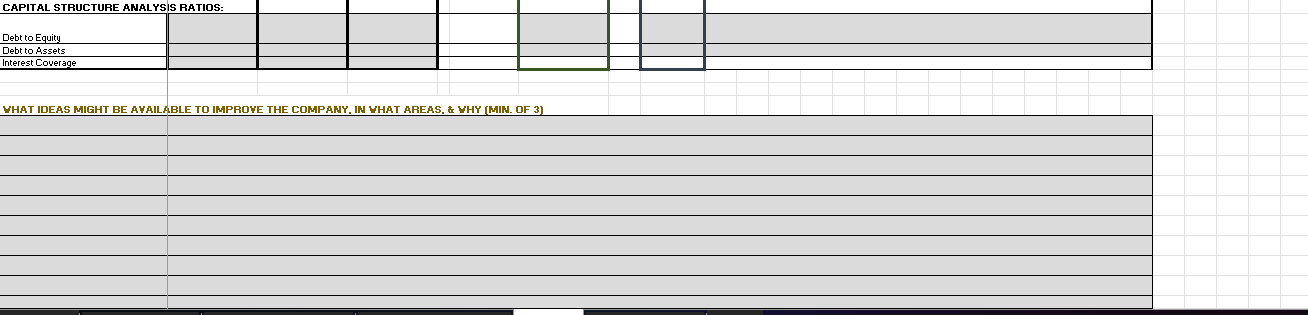

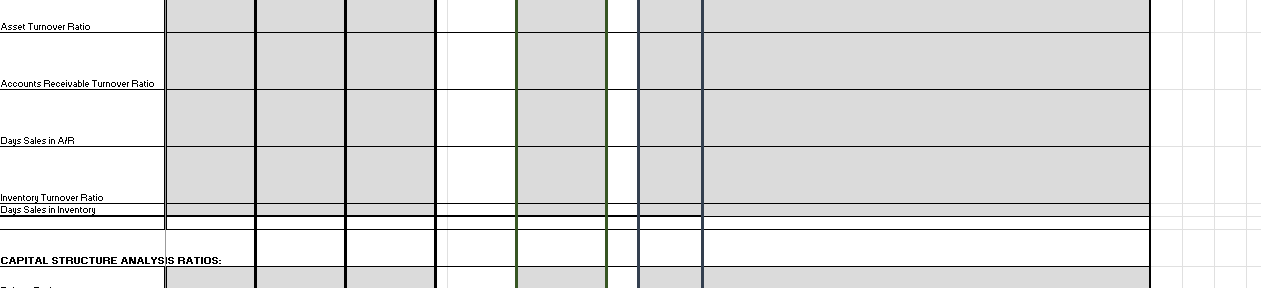

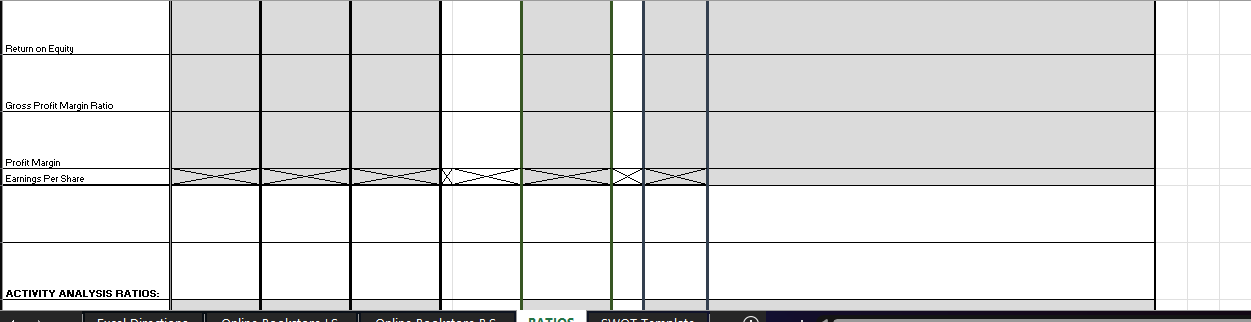

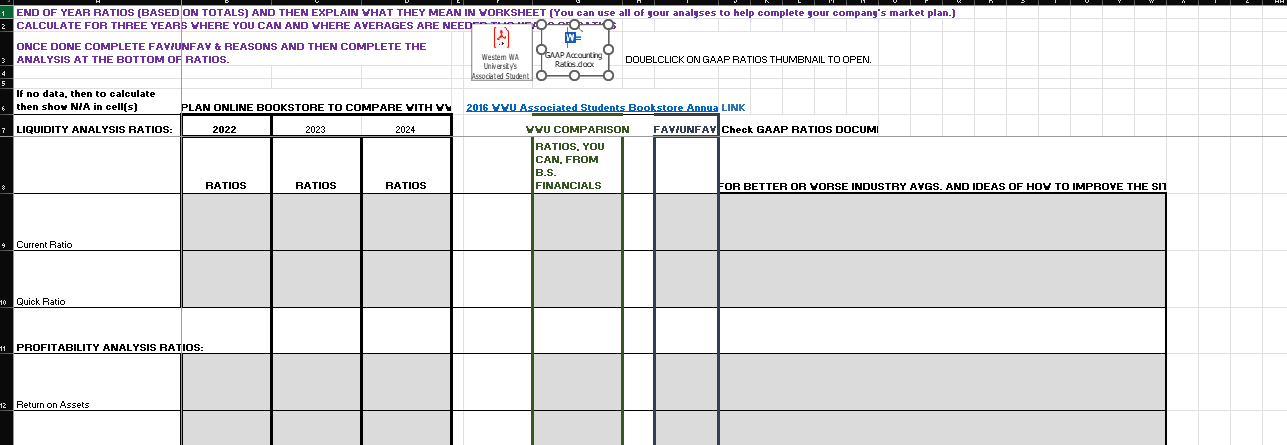

CALCULATE FOR THREE YEAR5 YHERE YOU CAN AND YHERE AYERAGES ARE NEED ONCE DONE COMPLETE FAYIUNAY & REASONS AND THEN COMPLETE THE ANALYSIS AT THE

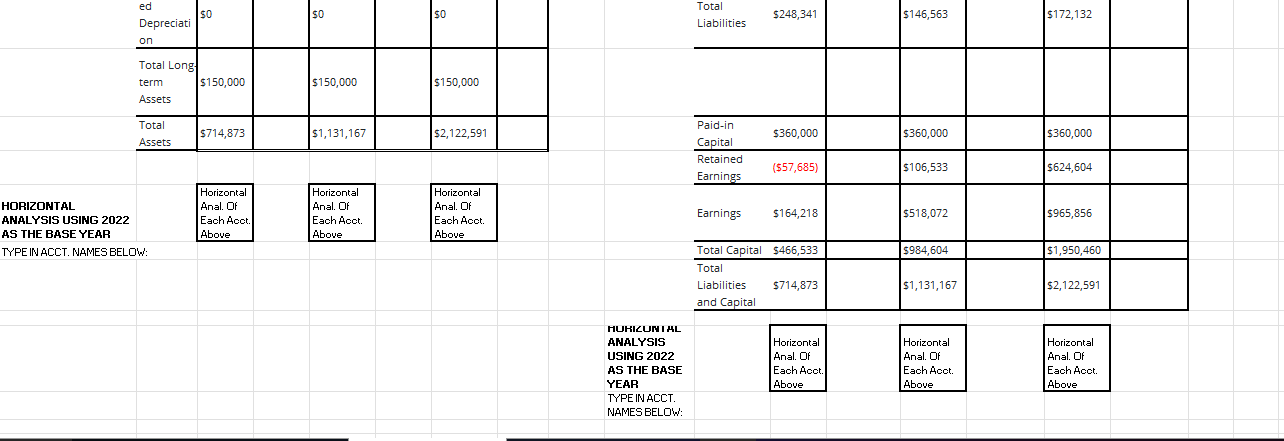

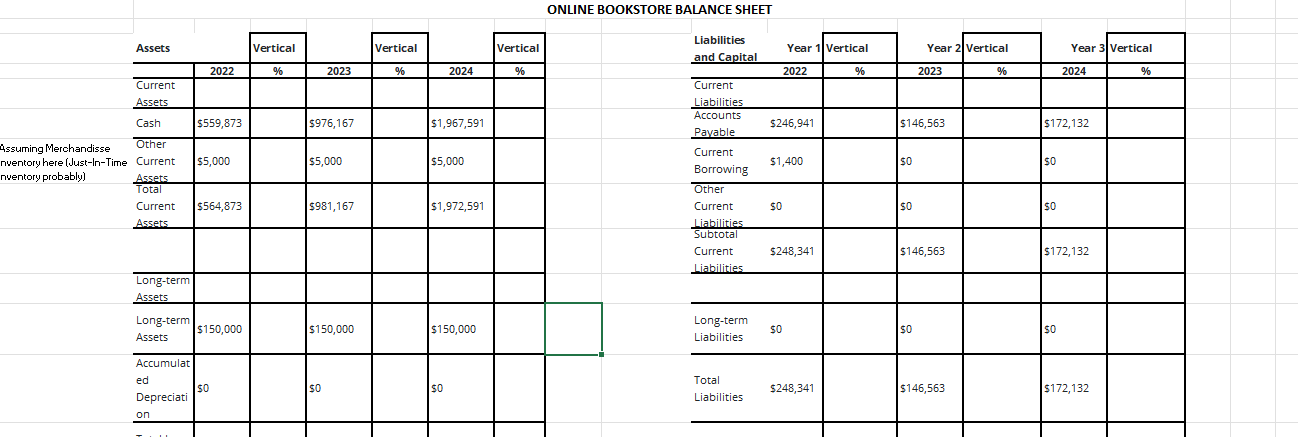

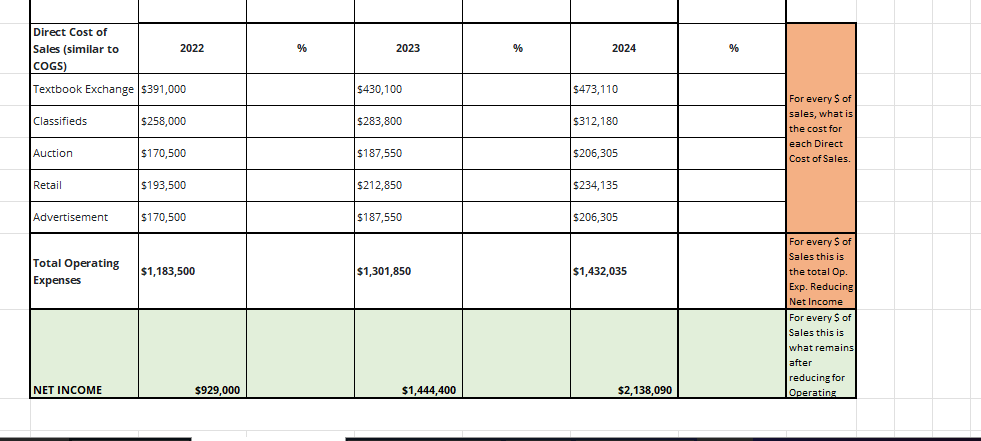

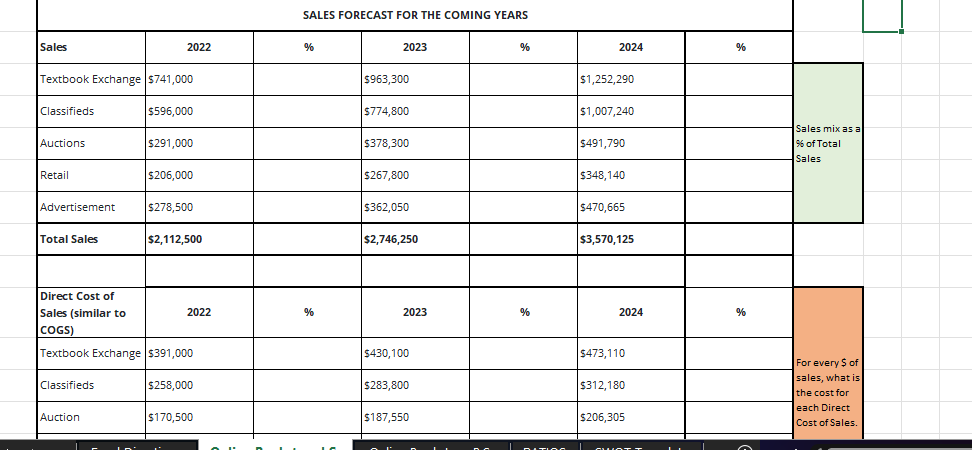

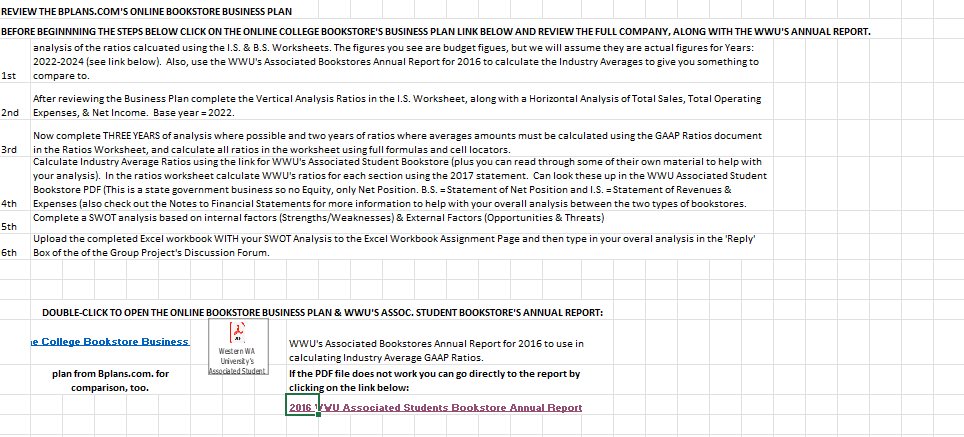

CALCULATE FOR THREE YEAR5 YHERE YOU CAN AND YHERE AYERAGES ARE NEED ONCE DONE COMPLETE FAYIUNAY \& REASONS AND THEN COMPLETE THE ANALYSIS AT THE BOTTOM OF RATIOS. ONLINE BOOKSTORE BALANCE SHEET \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|l|}{ Assets } & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & \multirow[b]{2}{*}{2023} & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} Liabilities \\ and Capital \\ \end{tabular}} & Year 1 & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & Year 2 & \multirow{2}{*}{\begin{tabular}{|r|} Vertical \\ % \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{c} Year 3 \\ 2024 \end{tabular}} & \multirow{2}{*}{\begin{tabular}{|r|} Vertical \\ % \\ \end{tabular}} \\ \hline & & 2022 & & & & 2024 & & & 2022 & & 2023 & & & \\ \hline & \begin{tabular}{l} Current \\ Assets \end{tabular} & & & & & & & \begin{tabular}{l} Current \\ Liabilities \end{tabular} & & & & & & \\ \hline & Cash & $559,873 & & $976,167 & & $1,967,591 & & \begin{tabular}{l} Accounts \\ Payable \end{tabular} & $246,941 & & $146,563 & & $172,132 & \\ \hline \begin{tabular}{l} Assuming Merchandisse \\ nuentory here (Just-In-Time \\ nuentory probably) \end{tabular} & \begin{tabular}{l} Other \\ Current \\ Assets \end{tabular} & $5,000 & & $5,000 & & $5,000 & & \begin{tabular}{l} Current \\ Borrowing \end{tabular} & $1,400 & & $0 & & so & \\ \hline & \begin{tabular}{l} Total \\ Current \\ Assets \end{tabular} & $564,873 & & $981,167 & & $1,972,591 & & \begin{tabular}{l} Other \\ Current \\ Liabilities \end{tabular} & so & & so & & 50 & \\ \hline & & & & & & & & \begin{tabular}{l} Subtotal \\ Current \\ Liabilities \end{tabular} & $248,341 & & $146,563 & & $172,132 & \\ \hline & \begin{tabular}{l} Long-term \\ Assets \\ \end{tabular} & & & & & & & & & & & & & \\ \hline & \begin{tabular}{l} Long-term \\ Assets \end{tabular} & $150,000 & & $150,000 & & $150,000 & & \begin{tabular}{l} Long-term \\ Liabilities \end{tabular} & so & & $0 & & so & \\ \hline & \begin{tabular}{l} Accumulat \\ ed \\ Depreciati \\ on \end{tabular} & so & & so & & so & & \begin{tabular}{l} Total \\ Liabilities \end{tabular} & $248,341 & & $146,563 & & $172,132 & \\ \hline \end{tabular} SALES FORECAST FOR THE COMING YEARS REVIEW THE BPLANS.COM'S ONLINE BOOKSTORE BUSINESS PLAN analysis of the ratios calcuated using the I.S. \& B.S. Worksheets. The figures you see are budget figues, but we will assume they are actual figures for Years: 2022-2024 (see link below). Also, use the WWU's Associated Bookstores Annual Report for 2016 to calculate the Industry Averages to give you something to 1st compare to. After reviewing the Business Plan complete the Vertical Analysis Ratios in the I.S. Worksheet, along with a Horizontal Analysis of Total Sales, Total Operating 2nd Expenses, \& Net Income. Base year =2022. Now complete THREE YEARS of analysis where possible and two years of ratios where averages amounts must be calculated using the GAAP Ratios document 3rd in the Ratios Worksheet, and calculate all ratios in the worksheet using full formulas and cell locators. Calculate Industry Average Ratios using the link for WWU's Associated Student Bookstore (plus you can read through some of their own material to help with your analysis). In the ratios worksheet calculate WWU's ratios for each section using the 2017 statement. Can look these up in the WWU Associated Student Bookstore PDF (This is a state government business so no Equity, only Net Position. B.S. = Statement of Net Position and I.S. = Statement of Revenues \&. Expenses (also check out the Notes to Financial Statements for more information to help with your overall analysis between the two types of bookstores. Complete a SWOT analysis based on internal factors (Strengths/Weaknesses) \&. External Factors (Opportunities \& Threats) Upload the completed Excel workbook WITH your SWOT Analysis to the Excel Workbook Assignment Page and then type in your overal analysis in the 'Reply' Box of the of the Group Project's Discussion Forum. DOUBLE-CLICK TO OPEN THE ONLINE BOOKSTORE BUSINESS PLAN \& WWU'S ASSOC. STUDENT BOOKSTORE'S ANNUAL REPORT: Le College Bookstore Business. plan from Bplans.com. for comparison, too. WWU's Associated Bookstores Annual Report for 2016 to use in calculating Industry Average GAAP Ratios. If the PDF file does not work you can go directly to the report by clicking on the link below: 2016'1 MU Associated Students Bookstore Annual Beport

CALCULATE FOR THREE YEAR5 YHERE YOU CAN AND YHERE AYERAGES ARE NEED ONCE DONE COMPLETE FAYIUNAY \& REASONS AND THEN COMPLETE THE ANALYSIS AT THE BOTTOM OF RATIOS. ONLINE BOOKSTORE BALANCE SHEET \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|l|}{ Assets } & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & \multirow[b]{2}{*}{2023} & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} Liabilities \\ and Capital \\ \end{tabular}} & Year 1 & \multirow{2}{*}{\begin{tabular}{|c|} Vertical \\ % \\ \end{tabular}} & Year 2 & \multirow{2}{*}{\begin{tabular}{|r|} Vertical \\ % \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{c} Year 3 \\ 2024 \end{tabular}} & \multirow{2}{*}{\begin{tabular}{|r|} Vertical \\ % \\ \end{tabular}} \\ \hline & & 2022 & & & & 2024 & & & 2022 & & 2023 & & & \\ \hline & \begin{tabular}{l} Current \\ Assets \end{tabular} & & & & & & & \begin{tabular}{l} Current \\ Liabilities \end{tabular} & & & & & & \\ \hline & Cash & $559,873 & & $976,167 & & $1,967,591 & & \begin{tabular}{l} Accounts \\ Payable \end{tabular} & $246,941 & & $146,563 & & $172,132 & \\ \hline \begin{tabular}{l} Assuming Merchandisse \\ nuentory here (Just-In-Time \\ nuentory probably) \end{tabular} & \begin{tabular}{l} Other \\ Current \\ Assets \end{tabular} & $5,000 & & $5,000 & & $5,000 & & \begin{tabular}{l} Current \\ Borrowing \end{tabular} & $1,400 & & $0 & & so & \\ \hline & \begin{tabular}{l} Total \\ Current \\ Assets \end{tabular} & $564,873 & & $981,167 & & $1,972,591 & & \begin{tabular}{l} Other \\ Current \\ Liabilities \end{tabular} & so & & so & & 50 & \\ \hline & & & & & & & & \begin{tabular}{l} Subtotal \\ Current \\ Liabilities \end{tabular} & $248,341 & & $146,563 & & $172,132 & \\ \hline & \begin{tabular}{l} Long-term \\ Assets \\ \end{tabular} & & & & & & & & & & & & & \\ \hline & \begin{tabular}{l} Long-term \\ Assets \end{tabular} & $150,000 & & $150,000 & & $150,000 & & \begin{tabular}{l} Long-term \\ Liabilities \end{tabular} & so & & $0 & & so & \\ \hline & \begin{tabular}{l} Accumulat \\ ed \\ Depreciati \\ on \end{tabular} & so & & so & & so & & \begin{tabular}{l} Total \\ Liabilities \end{tabular} & $248,341 & & $146,563 & & $172,132 & \\ \hline \end{tabular} SALES FORECAST FOR THE COMING YEARS REVIEW THE BPLANS.COM'S ONLINE BOOKSTORE BUSINESS PLAN analysis of the ratios calcuated using the I.S. \& B.S. Worksheets. The figures you see are budget figues, but we will assume they are actual figures for Years: 2022-2024 (see link below). Also, use the WWU's Associated Bookstores Annual Report for 2016 to calculate the Industry Averages to give you something to 1st compare to. After reviewing the Business Plan complete the Vertical Analysis Ratios in the I.S. Worksheet, along with a Horizontal Analysis of Total Sales, Total Operating 2nd Expenses, \& Net Income. Base year =2022. Now complete THREE YEARS of analysis where possible and two years of ratios where averages amounts must be calculated using the GAAP Ratios document 3rd in the Ratios Worksheet, and calculate all ratios in the worksheet using full formulas and cell locators. Calculate Industry Average Ratios using the link for WWU's Associated Student Bookstore (plus you can read through some of their own material to help with your analysis). In the ratios worksheet calculate WWU's ratios for each section using the 2017 statement. Can look these up in the WWU Associated Student Bookstore PDF (This is a state government business so no Equity, only Net Position. B.S. = Statement of Net Position and I.S. = Statement of Revenues \&. Expenses (also check out the Notes to Financial Statements for more information to help with your overall analysis between the two types of bookstores. Complete a SWOT analysis based on internal factors (Strengths/Weaknesses) \&. External Factors (Opportunities \& Threats) Upload the completed Excel workbook WITH your SWOT Analysis to the Excel Workbook Assignment Page and then type in your overal analysis in the 'Reply' Box of the of the Group Project's Discussion Forum. DOUBLE-CLICK TO OPEN THE ONLINE BOOKSTORE BUSINESS PLAN \& WWU'S ASSOC. STUDENT BOOKSTORE'S ANNUAL REPORT: Le College Bookstore Business. plan from Bplans.com. for comparison, too. WWU's Associated Bookstores Annual Report for 2016 to use in calculating Industry Average GAAP Ratios. If the PDF file does not work you can go directly to the report by clicking on the link below: 2016'1 MU Associated Students Bookstore Annual Beport Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started