Question

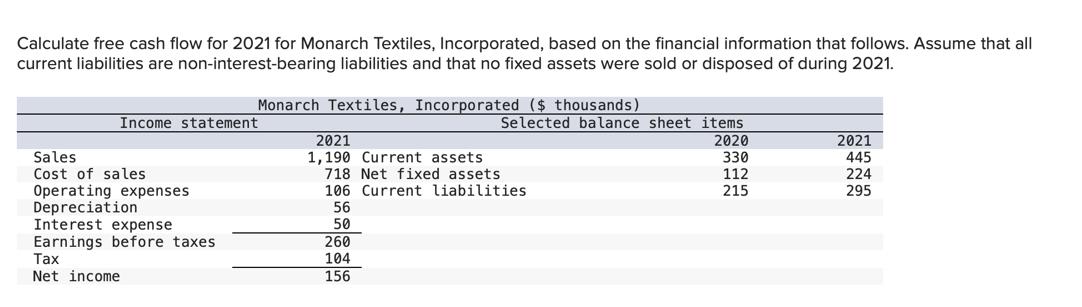

Calculate free cash flow for 2021 for Monarch Textiles, Incorporated, based on the financial information that follows. Assume that all current liabilities are non-interest-bearing

Calculate free cash flow for 2021 for Monarch Textiles, Incorporated, based on the financial information that follows. Assume that all current liabilities are non-interest-bearing liabilities and that no fixed assets were sold or disposed of during 2021. Sales Cost of sales Income statement Operating expenses Depreciation Interest expense Earnings before taxes. Tax Net income Monarch Textiles, Incorporated ($ thousands) 2021 1,190 Current assets 718 Net fixed assets 106 Current liabilities 56 50 Selected balance sheet items 260 104 156 2020 330 112 215 2021 445 224 295

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the free cash flow for Monarch textiles for the year ended 2021 by following formula Fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Analysis for Financial Management

Authors: Robert Higgins

11th edition

77861787, 978-0077861780

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App