Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are three separate transactions that pertain to prepaid items. Evaluate each item and prepare the journal entries that would be needed for the

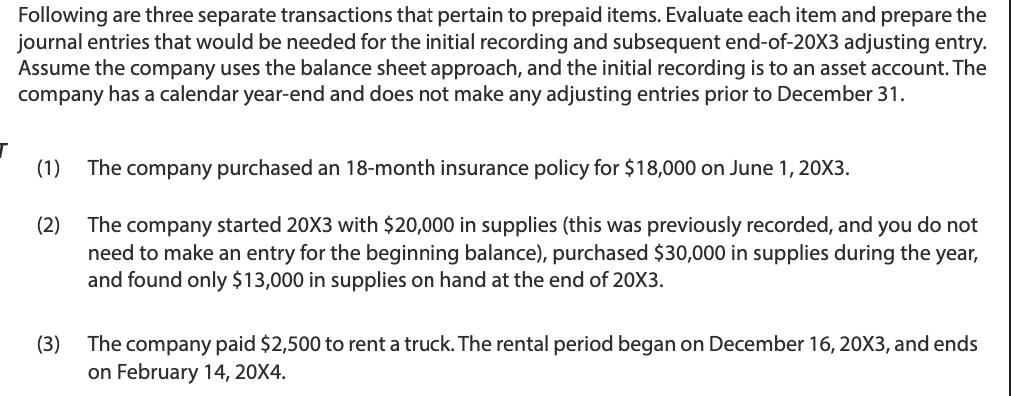

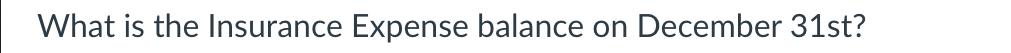

Following are three separate transactions that pertain to prepaid items. Evaluate each item and prepare the journal entries that would be needed for the initial recording and subsequent end-of-20X3 adjusting entry. Assume the company uses the balance sheet approach, and the initial recording is to an asset account. The company has a calendar year-end and does not make any adjusting entries prior to December 31. (1) The company purchased an 18-month insurance policy for $18,000 on June 1, 20X3. The company started 20X3 with $20,000 in supplies (this was previously recorded, and you do not need to make an entry for the beginning balance), purchased $30,000 in supplies during the year, and found only $13,000 in supplies on hand at the end of 20X3. (2) (3) The company paid $2,500 to rent a truck. The rental period began on December 16, 20X3, and ends on February 14, 20X4. What is the Insurance Expense balance on December 31st? What is the Supplies Expense balance on December 31st? What is the Rent Expense balance on December 31st?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze each transaction and prepare the journal entries for the initial recording and subseque...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started