Question

Calculate free cash flows for Valspar (that is, before the acquisition) for the five-year period 2016 through 2020? Use the assumptions provided below. Additional Valspar

-

Calculate free cash flows for Valspar (that is, before the acquisition) for the five-year period 2016 through 2020? Use the assumptions provided below.

Additional Valspar Baseline (Stand-Alone) valuation assumptions:

-

$60 million of Valspars current cash balance is considered excess cash.

-

Sales growth (annual) 3.0%

-

Terminal growth rate 2.5%

-

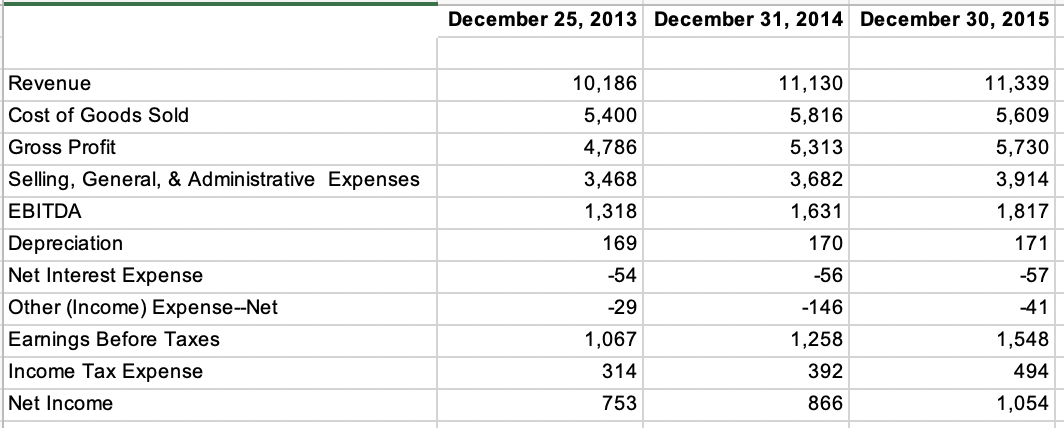

COGS, R&D, SG&A, and Depreciation expense are a constant percentage of sales at 2015 levels

-

Working capital is also a constant percentage of sales at 2015 levels

-

The tax rate is the same as the implied tax rate from the 2015 income statement

-

Capital expenditures are expected to be equal to depreciation expense each year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started