Answered step by step

Verified Expert Solution

Question

1 Approved Answer

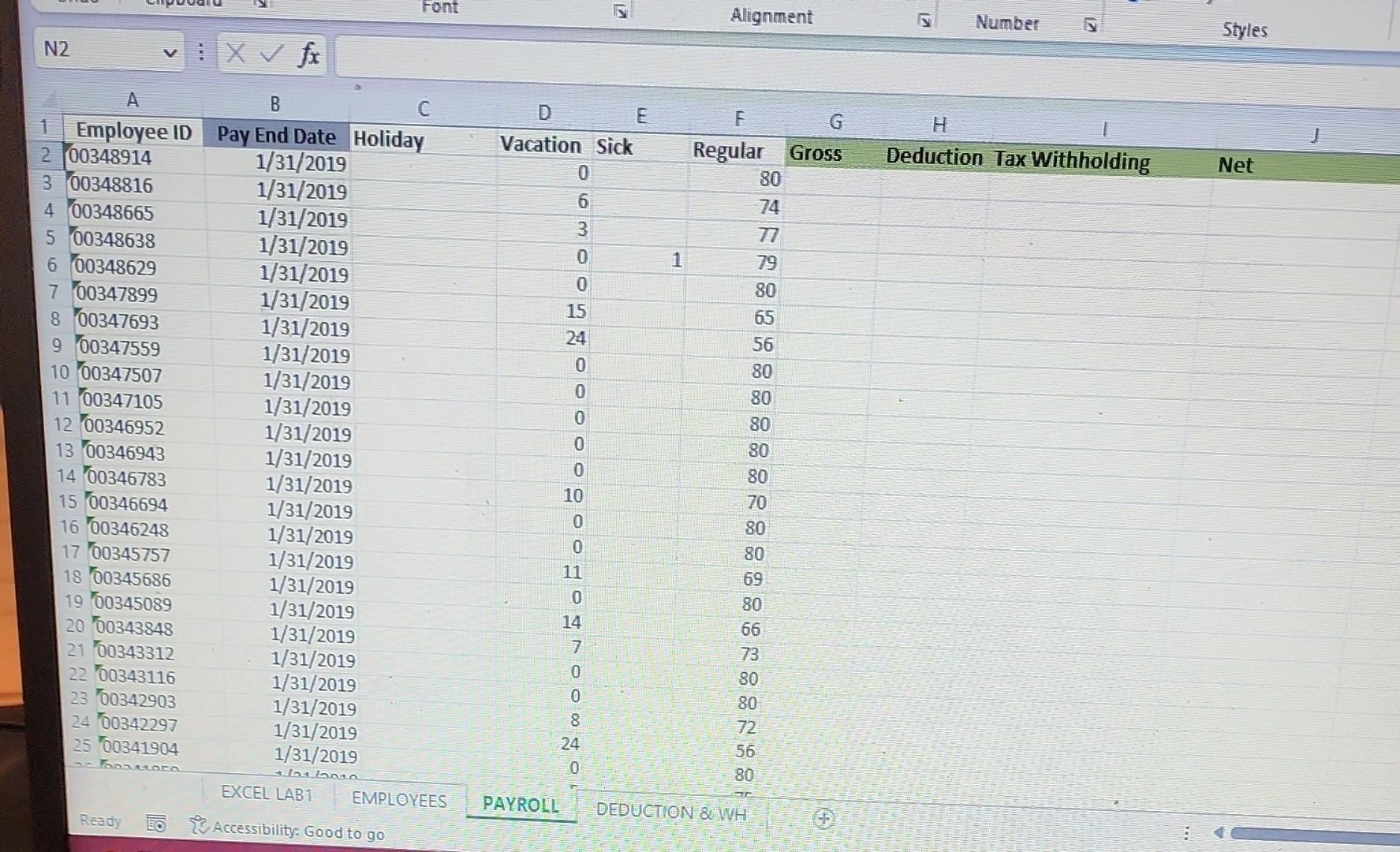

calculate Gross Earnings, Tax deduction, and state withholding for the employees with Excel functions. only the payroll(5) - (7) on Excel TAB EMPLOYEES 1. Clean

calculate Gross Earnings, Tax deduction, and state withholding for the employees with Excel functions.

calculate Gross Earnings, Tax deduction, and state withholding for the employees with Excel functions.

only the payroll(5) - (7) on Excel

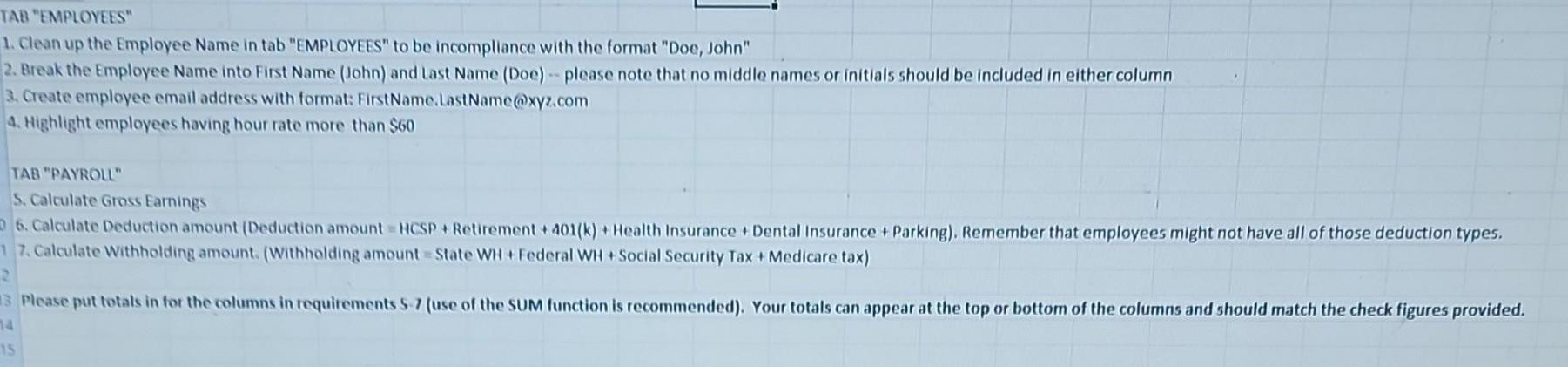

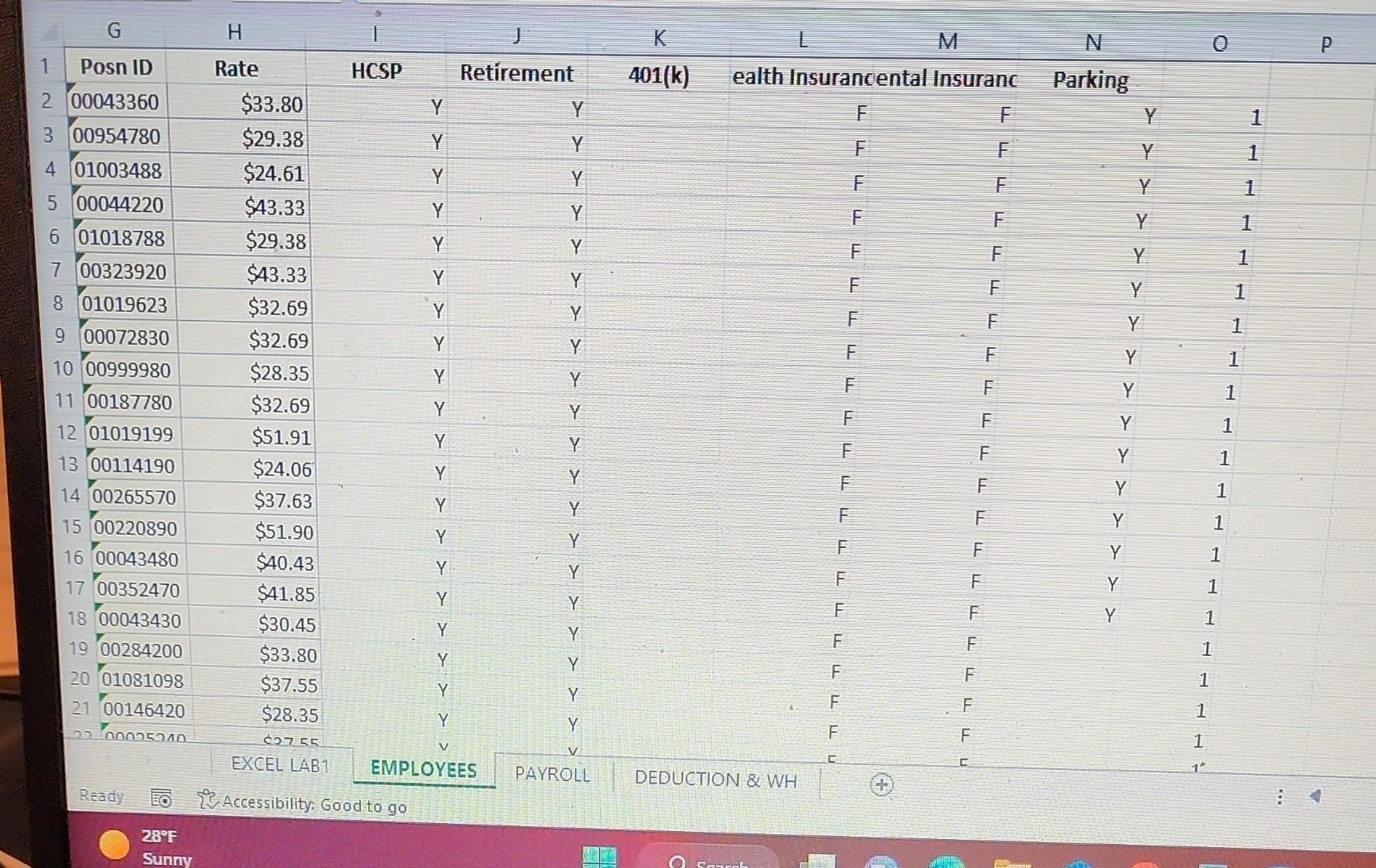

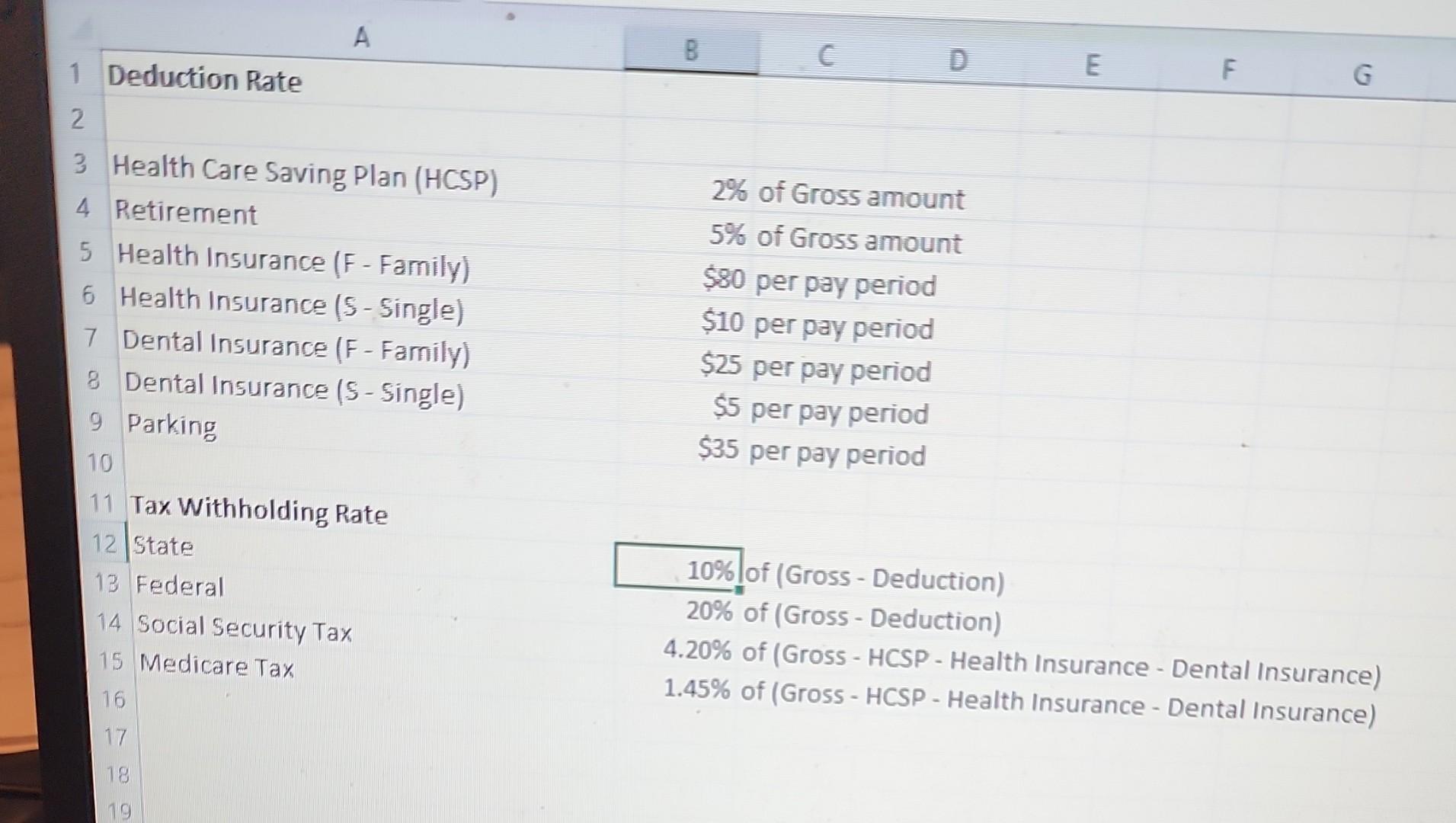

TAB "EMPLOYEES" 1. Clean up the Employee Name in tab "EMPLOYEES" to be incompliance with the format "Doe, John" 2. Break the Employee Name into First Name (John) and Last Name (Doe) -- please note that no middle names or initials should be included in either column 3. Create employee email address with format: FirstName.LastName@xyz.com 4. Highlight employees having hour rate more than $60 TAB "PAYROLL" S. Calculate Gross Earnings 6. Calculate Deduction amount (Deduction amount HCSP + Retirement + 401(k)+ Health Insurance + Dental Insurance + Parking). Remember that employees might not have all of those deduction types. 17. Calculate Withholding amount. (Withholding amount State WH + Federal WH + Social Security Tax + Medicare tax) 2 3 Please put totals in for the columns in requirements 5-7 (use of the SUM function is recommended). Your totals can appear at the top or bottom of the columns and should match the check figures provided. 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started