Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate gross profit margin ii) operating profit margin iii) return on ordinary share holders current ratio The income statement and the statement of financial position

Calculate gross profit margin ii) operating profit margin iii) return on ordinary share holders current ratio

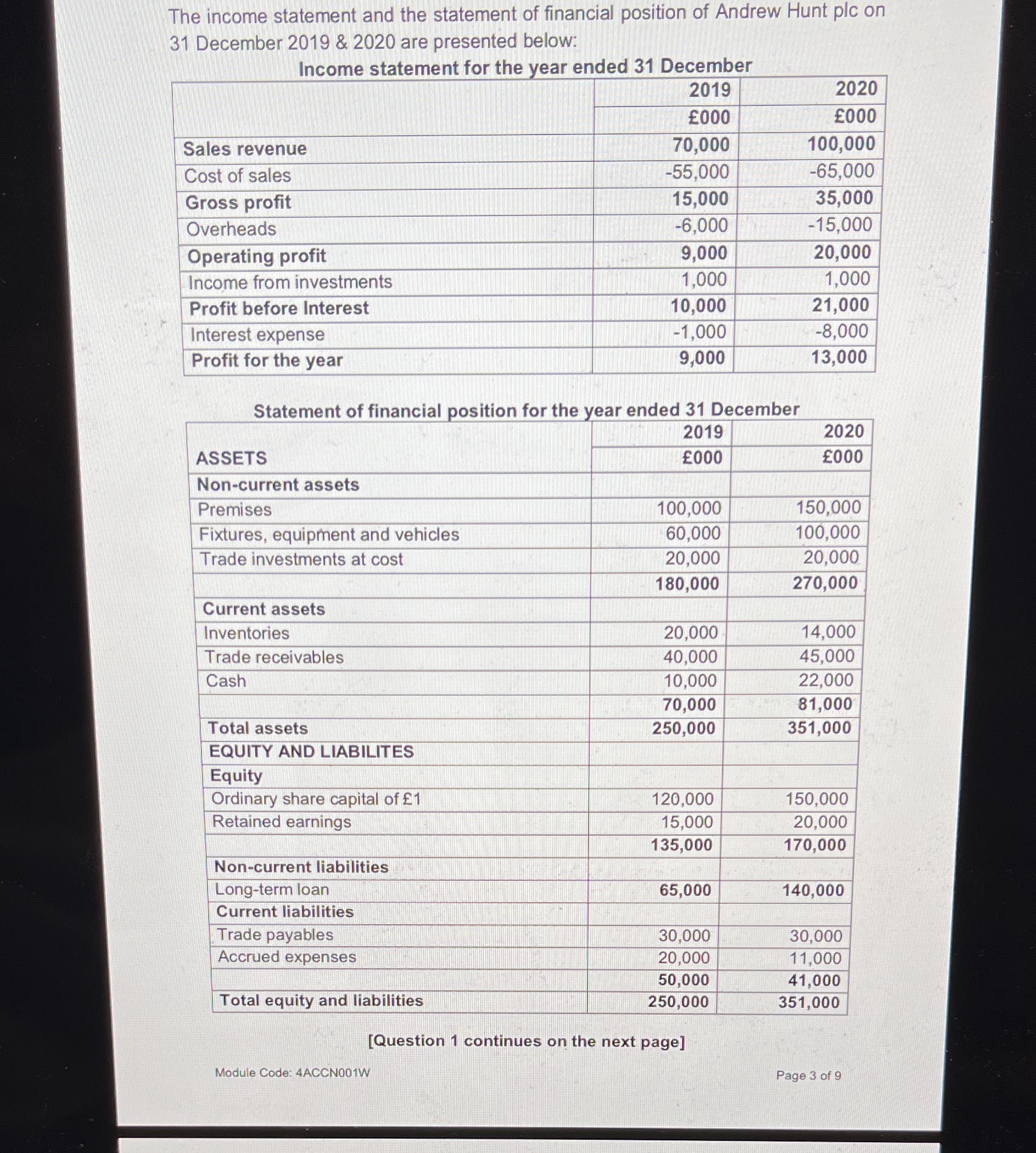

The income statement and the statement of financial position of Andrew Hunt plc on 31 December 2019 & 2020 are presented below: Income statement for the year ended 31 December 2019 2020 000 000 Sales revenue 70,000 100,000 Cost of sales Gross profit Overheads Operating profit Income from investments Profit before Interest -55,000 -65,000 15,000 35,000 -6,000 -15,000 9,000 20,000 1,000 1,000 10,000 21,000 Interest expense -1,000 -8,000 Profit for the year 9,000 13,000 Statement of financial position for the year ended 31 December 2019 2020 ASSETS 000 000 Non-current assets Premises 100,000 150,000 Fixtures, equipment and vehicles 60,000 100,000 Trade investments at cost 20,000 20,000 180,000 270,000 Current assets Inventories Trade receivables Cash 20,000 14,000 40,000 45,000 10,000 22,000 70,000 81,000 250,000 351,000 Total assets EQUITY AND LIABILITES Equity Ordinary share capital of 1 120,000 150,000 Retained earnings 15,000 20,000 135,000 170,000 Non-current liabilities Long-term loan 65,000 140,000 Current liabilities Trade payables Accrued expenses Total equity and liabilities 30,000 30,000 20,000 11,000 50,000 41,000 250,000 351,000 Module Code: 4ACCN001W [Question 1 continues on the next page] Page 3 of 9

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Financial Ratios Formula Calculation Gross Profit Margin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started