Answered step by step

Verified Expert Solution

Question

1 Approved Answer

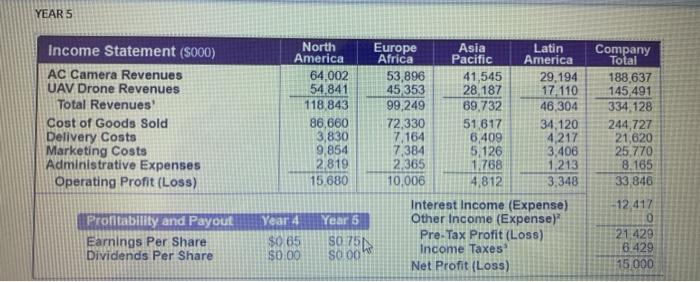

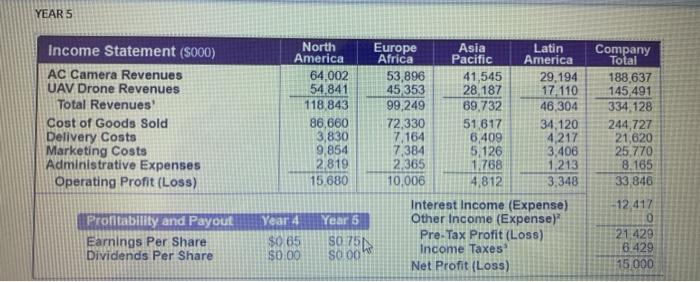

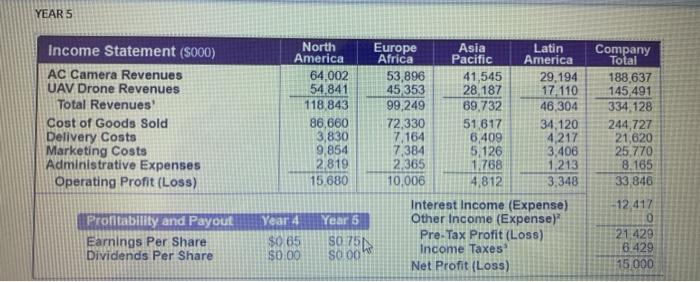

calculate inventory turnover and days in inventory YEAR 5 Income Statement (5000) AC Camera Revenues UAV Drone Revenues Total Revenues Cost of Goods Sold Delivery

calculate inventory turnover and days in inventory

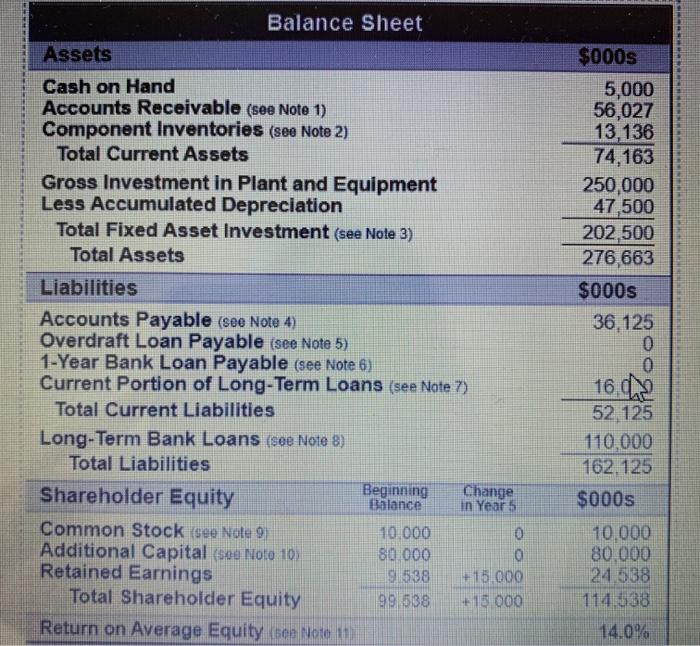

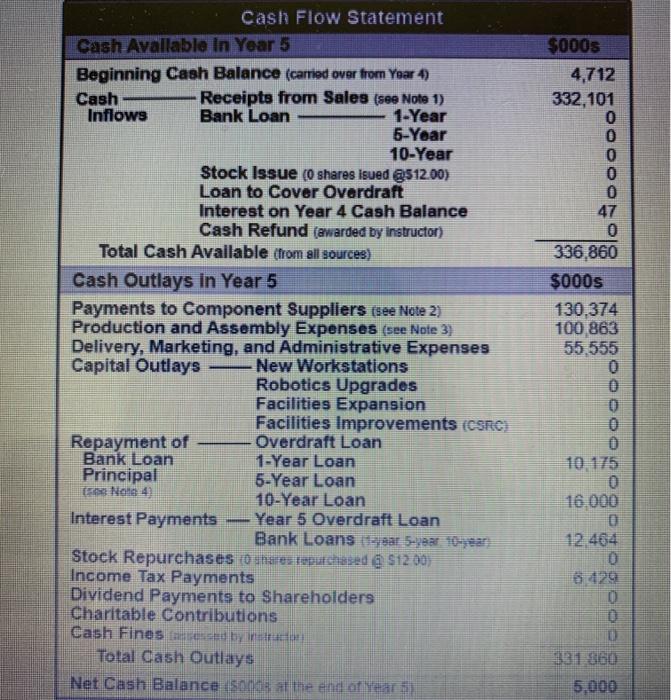

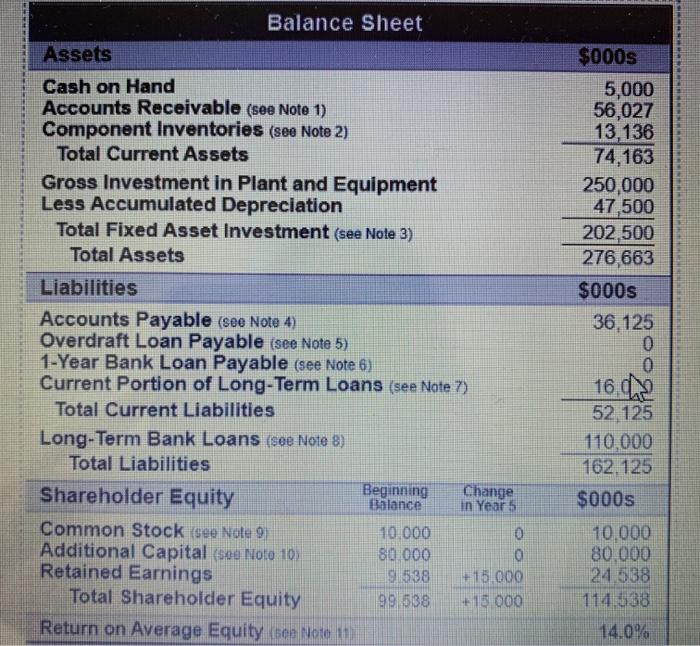

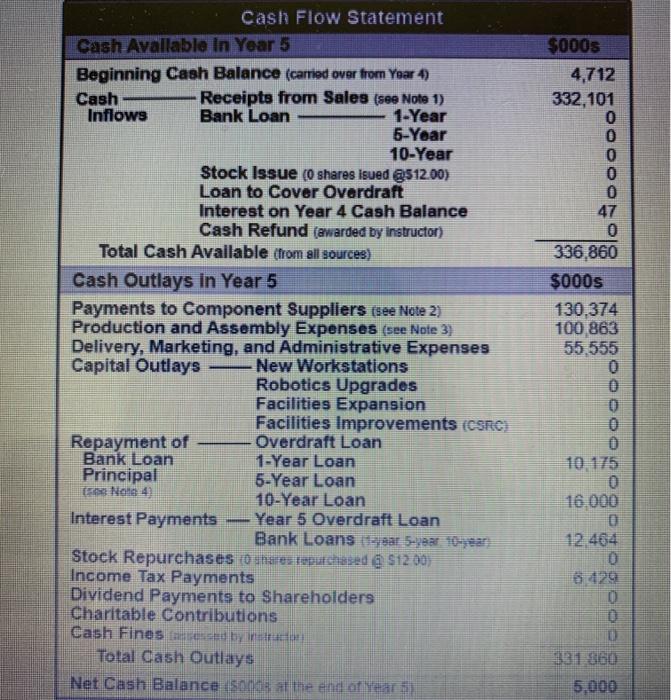

YEAR 5 Income Statement (5000) AC Camera Revenues UAV Drone Revenues Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) North America 64,002 54 841 118.843 86,660 3,830 9,854 2.819 15.680 Europe Asia Latin Africa Pacific America 53,896 41,545 29,194 45 353 28.187 17. 110 99,249 89,732 46,304 72,330 51617 34,120 7,164 6,409 4,217 7,384 5.126 3,406 2.365 1.768 1,213 10,006 4,812 3,348 Interest Income (Expense) Other Income (Expense) Pre-Tax Profit (Loss) Income Taxes Net Profit (Loss) Company Total 188,637 145,491 334,128 244,727 21,620 25.770 8.165 33 846 Year 6 Profitability and Payout Earnings Per Share Dividends Per Share Year A $0.65 $0.00 SO 75 12 417 0 21 429 6.429 15000 S000 Balance Sheet Assets Cash on Hand Accounts Receivable (see Note 1) Component Inventories (see Note 2) Total Current Assets Gross Investment in Plant and Equipment Less Accumulated Depreciation Total Fixed Asset Investment (see Note 3) Total Assets Liabilities Accounts Payable (see Note 4) Overdraft Loan Payable (see Note 5) 1-Year Bank Loan Payable (see Note 6) Current Portion of Long-Term Loans (see Note 7) Total Current Liabilities Long-Term Bank Loans (see Note 8) Total Liabilities Shareholder Equity Beginning Change Balance in Year 5 Common Stock see Note 9) 10.000 0 Additional Capital (soo Note 10) 80.000 0 Retained Earnings 9538 +15.000 Total Shareholder Equity 99 538 +15 000 Return on Average Equity (100 Noto 11 $000s 5,000 56,027 13,136 74,163 250,000 47,500 202,500 276 663 $000s 36,125 0 0 162 52 125 110,000 162.125 $000s 10,000 80.000 24.538 114,338 14.0% Cash Flow Statement Cash Avallable In Year 5 Beginning Cash Balance (carried over from Year 4) Cash Receipts from Sales (see Note 1) Inflows Bank Loan 1-Year 5-Yoar 10-Year Stock Issue (0 shares isued @512.00) Loan to Cover Overdraft Interest on Year 4 Cash Balance Cash Refund (awarded by Instructor) Total Cash Available (from all sources) Cash Outlays In Year 5 Payments to Component Suppliers (see Note 2) Production and Assembly Expenses (see Note 3) Delivery, Marketing, and Administrative Expenses Capital Outlays New Workstations Robotics Upgrades Facilities Expansion Facilities Improvements (CSRC) Repayment of Overdraft Loan Bank Loan 1-Year Loan Principal 5-Year Loan Note 4 10-Year Loan Interest Payments Year 5 Overdraft Loan Bank Loans 13sar 5-year 10ean Stock Repurchases to shares toputchased $1200) Income Tax Payments Dividend Payments to Shareholders Charitable Contributions Cash Finestressed by instuctor Total Cash Outlays Net Cash Balance sons at the end of years $000s 4,712 332,101 0 0 0 0 O 47 0 336,860 $000s 130,374 100 863 55 555 0 0 0 10.175 0 16.000 0 12 464 6 429 0

YEAR 5 Income Statement (5000) AC Camera Revenues UAV Drone Revenues Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) North America 64,002 54 841 118.843 86,660 3,830 9,854 2.819 15.680 Europe Asia Latin Africa Pacific America 53,896 41,545 29,194 45 353 28.187 17. 110 99,249 89,732 46,304 72,330 51617 34,120 7,164 6,409 4,217 7,384 5.126 3,406 2.365 1.768 1,213 10,006 4,812 3,348 Interest Income (Expense) Other Income (Expense) Pre-Tax Profit (Loss) Income Taxes Net Profit (Loss) Company Total 188,637 145,491 334,128 244,727 21,620 25.770 8.165 33 846 Year 6 Profitability and Payout Earnings Per Share Dividends Per Share Year A $0.65 $0.00 SO 75 12 417 0 21 429 6.429 15000 S000 Balance Sheet Assets Cash on Hand Accounts Receivable (see Note 1) Component Inventories (see Note 2) Total Current Assets Gross Investment in Plant and Equipment Less Accumulated Depreciation Total Fixed Asset Investment (see Note 3) Total Assets Liabilities Accounts Payable (see Note 4) Overdraft Loan Payable (see Note 5) 1-Year Bank Loan Payable (see Note 6) Current Portion of Long-Term Loans (see Note 7) Total Current Liabilities Long-Term Bank Loans (see Note 8) Total Liabilities Shareholder Equity Beginning Change Balance in Year 5 Common Stock see Note 9) 10.000 0 Additional Capital (soo Note 10) 80.000 0 Retained Earnings 9538 +15.000 Total Shareholder Equity 99 538 +15 000 Return on Average Equity (100 Noto 11 $000s 5,000 56,027 13,136 74,163 250,000 47,500 202,500 276 663 $000s 36,125 0 0 162 52 125 110,000 162.125 $000s 10,000 80.000 24.538 114,338 14.0% Cash Flow Statement Cash Avallable In Year 5 Beginning Cash Balance (carried over from Year 4) Cash Receipts from Sales (see Note 1) Inflows Bank Loan 1-Year 5-Yoar 10-Year Stock Issue (0 shares isued @512.00) Loan to Cover Overdraft Interest on Year 4 Cash Balance Cash Refund (awarded by Instructor) Total Cash Available (from all sources) Cash Outlays In Year 5 Payments to Component Suppliers (see Note 2) Production and Assembly Expenses (see Note 3) Delivery, Marketing, and Administrative Expenses Capital Outlays New Workstations Robotics Upgrades Facilities Expansion Facilities Improvements (CSRC) Repayment of Overdraft Loan Bank Loan 1-Year Loan Principal 5-Year Loan Note 4 10-Year Loan Interest Payments Year 5 Overdraft Loan Bank Loans 13sar 5-year 10ean Stock Repurchases to shares toputchased $1200) Income Tax Payments Dividend Payments to Shareholders Charitable Contributions Cash Finestressed by instuctor Total Cash Outlays Net Cash Balance sons at the end of years $000s 4,712 332,101 0 0 0 0 O 47 0 336,860 $000s 130,374 100 863 55 555 0 0 0 10.175 0 16.000 0 12 464 6 429 0

calculate inventory turnover and days in inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started