Answered step by step

Verified Expert Solution

Question

1 Approved Answer

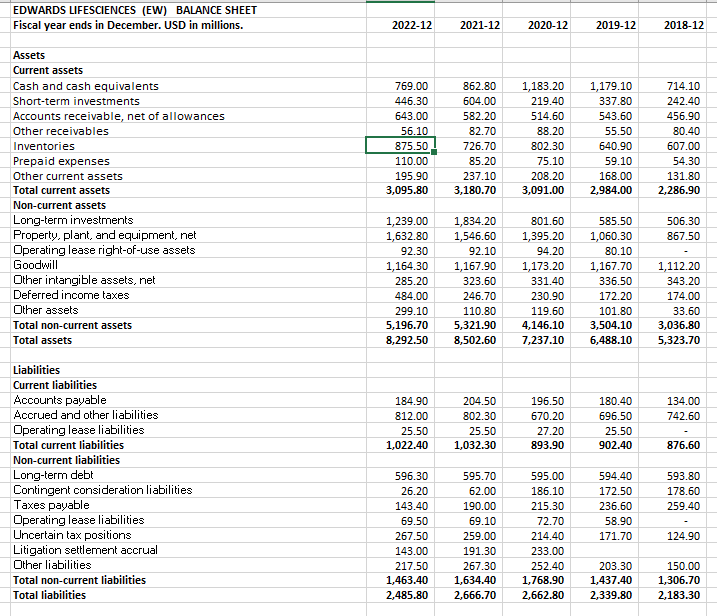

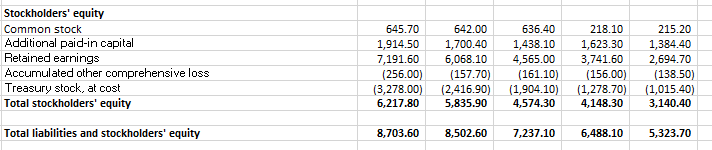

Calculate inventory turnover and receivables turnover for each year. EDWARDS LIFESCIENCES (EW) BALANCE SHEET Fiscal year ends in December. USD in millions. begin{tabular}{|l|l|l|l|l|} hline 202212

Calculate inventory turnover and receivables turnover for each year.

EDWARDS LIFESCIENCES (EW) BALANCE SHEET Fiscal year ends in December. USD in millions. \begin{tabular}{|l|l|l|l|l|} \hline 202212 & 202112 & 202012 & 201912 & 201812 \\ \hline \end{tabular} Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable, net of allowances Other receivables Inventories Prepaid expenses Other current assets Total current assets Non-current assets Long-term investments Property, plant, and equipment, net Dperating lease right-of-use assets Goodwill Dther intangible assets, net Deferred income taxes Dther assets Total non-current assets Total assets \begin{tabular}{|r|r|r|r|r|} \hline 769.00 & 862.80 & 1,183.20 & 1,179.10 & 714.10 \\ \hline 446.30 & 604.00 & 219.40 & 337.80 & 242.40 \\ \hline 643.00 & 582.20 & 514.60 & 543.60 & 456.90 \\ \hline 56.10 & 82.70 & 88.20 & 55.50 & 80.40 \\ \hline 875.50 & 726.70 & 802.30 & 640.90 & 607.00 \\ \hline 110.00 & 85.20 & 75.10 & 59.10 & 54.30 \\ \hline 195.90 & 237.10 & 208.20 & 168.00 & 131.80 \\ \hline 3,095.80 & 3,180.70 & 3,091.00 & 2,984.00 & 2,286.90 \\ \hline 1,239.00 & 1,834.20 & 801.60 & 585.50 & 506.30 \\ \hline 1,632.80 & 1,546.60 & 1,395.20 & 1,060.30 & 867.50 \\ \hline 92.30 & 92.10 & 94.20 & 80.10 & \\ \hline 1,164.30 & 1,167.90 & 1,173.20 & 1,167.70 & 1,112.20 \\ \hline 285.20 & 323.60 & 331.40 & 336.50 & 343.20 \\ \hline 484.00 & 246.70 & 230.90 & 172.20 & 174.00 \\ \hline 299.10 & 110.80 & 119.60 & 101.80 & 33.60 \\ \hline 5,196.70 & 5,321.90 & 4,146.10 & 3,504.10 & 3,036.80 \\ \hline 8,292.50 & 8,502.60 & 7,237.10 & 6,488.10 & 5,323.70 \\ \hline \end{tabular} Liabilities Current liabilities Accounts payable Accrued and other liabilities Dperating lease liabilities Total current liabilities Non-current liabilities Long-term debt Contingent consideration liabilities Taxes payable Dperating lease liabilities Uncertain tax positions Litigation settlement accrual Dther liabilities Total non-current liabilities Total liabilities \begin{tabular}{|r|r|r|r|r|} \hline 184.90 & 204.50 & 196.50 & 180.40 & 134.00 \\ \hline 812.00 & 802.30 & 670.20 & 696.50 & 742.60 \\ \hline 25.50 & 25.50 & 27.20 & 25.50 & \\ \hline 1,022.40 & 1,032.30 & 893.90 & 902.40 & 876.60 \\ \hline & & & & \\ \hline 596.30 & 595.70 & 595.00 & 594.40 & 593.80 \\ \hline 26.20 & 62.00 & 186.10 & 172.50 & 178.60 \\ \hline 143.40 & 190.00 & 215.30 & 236.60 & 259.40 \\ \hline 69.50 & 69.10 & 72.70 & 58.90 & \\ \hline 267.50 & 259.00 & 214.40 & 171.70 & 124.90 \\ \hline 143.00 & 191.30 & 233.00 & & \\ \hline 217.50 & 267.30 & 252.40 & 203.30 & 150.00 \\ \hline 1,463.40 & 1,634.40 & 1,768.90 & 1,437.40 & 1,306.70 \\ \hline 2,485.80 & 2,666.70 & 2,662.80 & 2,339.80 & 2,183.30 \\ \hline \end{tabular} Stockholders' equity EDWARDS LIFESCIENCES (EW) BALANCE SHEET Fiscal year ends in December. USD in millions. \begin{tabular}{|l|l|l|l|l|} \hline 202212 & 202112 & 202012 & 201912 & 201812 \\ \hline \end{tabular} Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable, net of allowances Other receivables Inventories Prepaid expenses Other current assets Total current assets Non-current assets Long-term investments Property, plant, and equipment, net Dperating lease right-of-use assets Goodwill Dther intangible assets, net Deferred income taxes Dther assets Total non-current assets Total assets \begin{tabular}{|r|r|r|r|r|} \hline 769.00 & 862.80 & 1,183.20 & 1,179.10 & 714.10 \\ \hline 446.30 & 604.00 & 219.40 & 337.80 & 242.40 \\ \hline 643.00 & 582.20 & 514.60 & 543.60 & 456.90 \\ \hline 56.10 & 82.70 & 88.20 & 55.50 & 80.40 \\ \hline 875.50 & 726.70 & 802.30 & 640.90 & 607.00 \\ \hline 110.00 & 85.20 & 75.10 & 59.10 & 54.30 \\ \hline 195.90 & 237.10 & 208.20 & 168.00 & 131.80 \\ \hline 3,095.80 & 3,180.70 & 3,091.00 & 2,984.00 & 2,286.90 \\ \hline 1,239.00 & 1,834.20 & 801.60 & 585.50 & 506.30 \\ \hline 1,632.80 & 1,546.60 & 1,395.20 & 1,060.30 & 867.50 \\ \hline 92.30 & 92.10 & 94.20 & 80.10 & \\ \hline 1,164.30 & 1,167.90 & 1,173.20 & 1,167.70 & 1,112.20 \\ \hline 285.20 & 323.60 & 331.40 & 336.50 & 343.20 \\ \hline 484.00 & 246.70 & 230.90 & 172.20 & 174.00 \\ \hline 299.10 & 110.80 & 119.60 & 101.80 & 33.60 \\ \hline 5,196.70 & 5,321.90 & 4,146.10 & 3,504.10 & 3,036.80 \\ \hline 8,292.50 & 8,502.60 & 7,237.10 & 6,488.10 & 5,323.70 \\ \hline \end{tabular} Liabilities Current liabilities Accounts payable Accrued and other liabilities Dperating lease liabilities Total current liabilities Non-current liabilities Long-term debt Contingent consideration liabilities Taxes payable Dperating lease liabilities Uncertain tax positions Litigation settlement accrual Dther liabilities Total non-current liabilities Total liabilities \begin{tabular}{|r|r|r|r|r|} \hline 184.90 & 204.50 & 196.50 & 180.40 & 134.00 \\ \hline 812.00 & 802.30 & 670.20 & 696.50 & 742.60 \\ \hline 25.50 & 25.50 & 27.20 & 25.50 & \\ \hline 1,022.40 & 1,032.30 & 893.90 & 902.40 & 876.60 \\ \hline & & & & \\ \hline 596.30 & 595.70 & 595.00 & 594.40 & 593.80 \\ \hline 26.20 & 62.00 & 186.10 & 172.50 & 178.60 \\ \hline 143.40 & 190.00 & 215.30 & 236.60 & 259.40 \\ \hline 69.50 & 69.10 & 72.70 & 58.90 & \\ \hline 267.50 & 259.00 & 214.40 & 171.70 & 124.90 \\ \hline 143.00 & 191.30 & 233.00 & & \\ \hline 217.50 & 267.30 & 252.40 & 203.30 & 150.00 \\ \hline 1,463.40 & 1,634.40 & 1,768.90 & 1,437.40 & 1,306.70 \\ \hline 2,485.80 & 2,666.70 & 2,662.80 & 2,339.80 & 2,183.30 \\ \hline \end{tabular} Stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started