Calculate

- Inventory turns = COGS / Total inventory b. IDOS =Inventory days of supply/Days inventory = Total inventory /(COGS/365 days) c. Days receivable = DSO = Days sales outstanding =Account receivable / (Sales/365 days) d. DPO = Days payable outstanding =Account payable / (COGS/365 days) e. C2C = Cash-to-Cash Cycle Time or Cash conversion cycle = b + c -d f. ROA = Net income / Assets

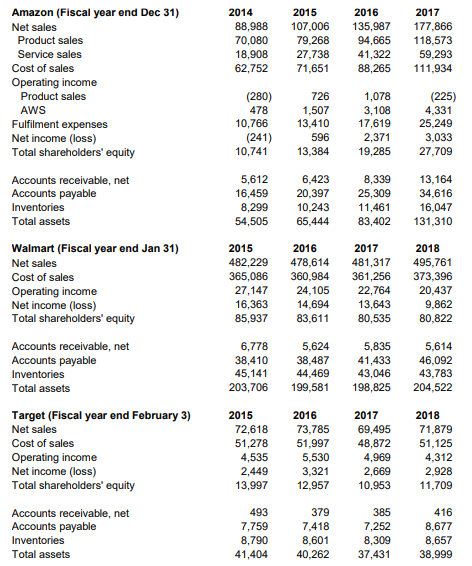

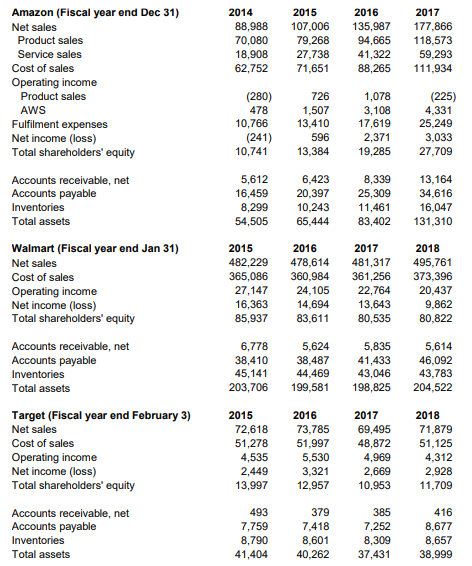

For Amazon, Target, and Walmart for the years 2015,2016,& 2017

\begin{tabular}{lrrrr} Amazon (Fiscal year end Dec 31) & 2014 & \multicolumn{1}{c}{2015} & 2016 & 2017 \\ Net sales & 88,988 & 107,006 & 135,987 & 177,866 \\ Product sales & 70,080 & 79,268 & 94,665 & 118,573 \\ Service sales & 18,908 & 27,738 & 41,322 & 59,293 \\ Cost of sales & 62,752 & 71,651 & 88,265 & 111,934 \\ Operating income & & & & \\ Product sales & (280) & 726 & 1,078 & (225) \\ AWS & 478 & 1,507 & 3,108 & 4,331 \\ Fulfilment expenses & 10,766 & 13,410 & 17,619 & 25,249 \\ Net income (loss) & (241) & 596 & 2,371 & 3,033 \\ Total shareholders' equity & 10,741 & 13,384 & 19,285 & 27,709 \\ & & & & \\ Accounts receivable, net & 5,612 & 6,423 & 8,339 & 13,164 \\ Accounts payable & 16,459 & 20,397 & 25,309 & 34,616 \\ Inventories & 8,299 & 10,243 & 11,461 & 16,047 \\ Total assets & 54,505 & 65,444 & 83,402 & 131,310 \\ & & & & \\ Walmart (Fiscal year end Jan 31) & 2015 & 2016 & 2017 & 2018 \\ Net sales & 482,229 & 478,614 & 481,317 & 495,761 \\ Cost of sales & 365,086 & 360,984 & 361,256 & 373,396 \\ Operating income & 27,147 & 24,105 & 22,764 & 20,437 \\ Net income (loss) & 16,363 & 14,694 & 13,643 & 9,862 \\ Total shareholders' equity & 85,937 & 83,611 & 80,535 & 80,822 \\ & & & & \\ Accounts receivable, net & 6,778 & 5,624 & 5,835 & 5,614 \\ Accounts payable & 38,410 & 38,487 & 41,433 & 46,092 \\ Inventories & 45,141 & 44,469 & 43,046 & 43,783 \\ Total assets & 203,706 & 199,581 & 198,825 & 204,522 \\ & & & & \\ Target (Fiscal year end February 3) & 2015 & 2016 & 2017 & 2018 \\ Net sales & 72,618 & 73,785 & 69,495 & 71,879 \\ Cost of sales & 51,278 & 51,997 & 48,872 & 51,125 \\ Operating income & 4,535 & 5,530 & 4,969 & 4,312 \\ Net income (loss) & 2,449 & 3,321 & 2,669 & 2,928 \\ Total shareholders' equity & 13,997 & 12,957 & 10,953 & 11,709 \\ & & & & \\ Accounts receivable, net & 493 & 379 & 3 \end{tabular} \begin{tabular}{lrrrr} Amazon (Fiscal year end Dec 31) & 2014 & \multicolumn{1}{c}{2015} & 2016 & 2017 \\ Net sales & 88,988 & 107,006 & 135,987 & 177,866 \\ Product sales & 70,080 & 79,268 & 94,665 & 118,573 \\ Service sales & 18,908 & 27,738 & 41,322 & 59,293 \\ Cost of sales & 62,752 & 71,651 & 88,265 & 111,934 \\ Operating income & & & & \\ Product sales & (280) & 726 & 1,078 & (225) \\ AWS & 478 & 1,507 & 3,108 & 4,331 \\ Fulfilment expenses & 10,766 & 13,410 & 17,619 & 25,249 \\ Net income (loss) & (241) & 596 & 2,371 & 3,033 \\ Total shareholders' equity & 10,741 & 13,384 & 19,285 & 27,709 \\ & & & & \\ Accounts receivable, net & 5,612 & 6,423 & 8,339 & 13,164 \\ Accounts payable & 16,459 & 20,397 & 25,309 & 34,616 \\ Inventories & 8,299 & 10,243 & 11,461 & 16,047 \\ Total assets & 54,505 & 65,444 & 83,402 & 131,310 \\ & & & & \\ Walmart (Fiscal year end Jan 31) & 2015 & 2016 & 2017 & 2018 \\ Net sales & 482,229 & 478,614 & 481,317 & 495,761 \\ Cost of sales & 365,086 & 360,984 & 361,256 & 373,396 \\ Operating income & 27,147 & 24,105 & 22,764 & 20,437 \\ Net income (loss) & 16,363 & 14,694 & 13,643 & 9,862 \\ Total shareholders' equity & 85,937 & 83,611 & 80,535 & 80,822 \\ & & & & \\ Accounts receivable, net & 6,778 & 5,624 & 5,835 & 5,614 \\ Accounts payable & 38,410 & 38,487 & 41,433 & 46,092 \\ Inventories & 45,141 & 44,469 & 43,046 & 43,783 \\ Total assets & 203,706 & 199,581 & 198,825 & 204,522 \\ & & & & \\ Target (Fiscal year end February 3) & 2015 & 2016 & 2017 & 2018 \\ Net sales & 72,618 & 73,785 & 69,495 & 71,879 \\ Cost of sales & 51,278 & 51,997 & 48,872 & 51,125 \\ Operating income & 4,535 & 5,530 & 4,969 & 4,312 \\ Net income (loss) & 2,449 & 3,321 & 2,669 & 2,928 \\ Total shareholders' equity & 13,997 & 12,957 & 10,953 & 11,709 \\ & & & & \\ Accounts receivable, net & 493 & 379 & 3 \end{tabular}