Answered step by step

Verified Expert Solution

Question

1 Approved Answer

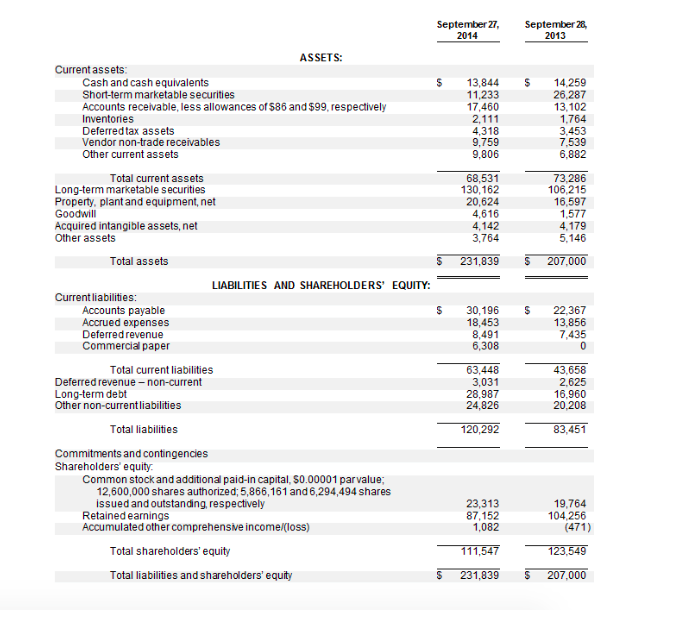

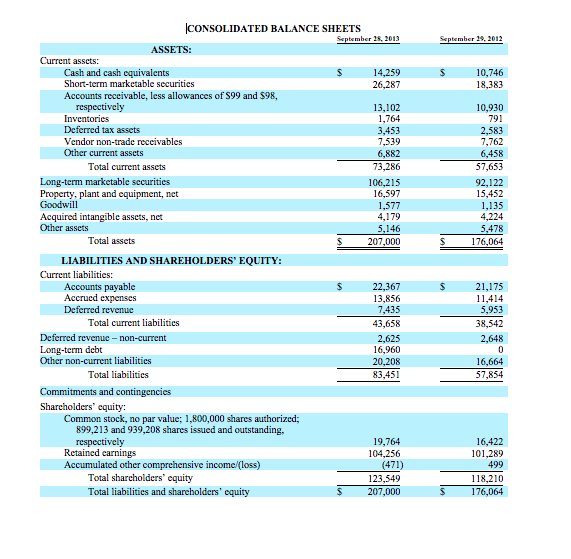

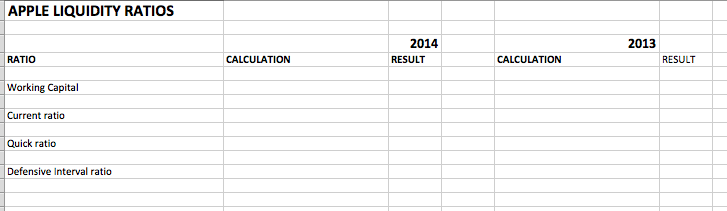

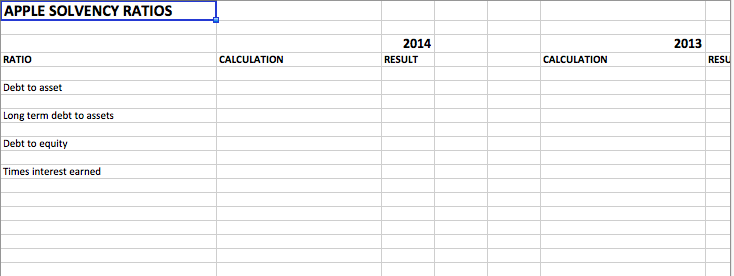

Calculate liquidity and solvency ratios for 2014 and 2013 Compare these ratios between 2014 and 2013. Analyze any increases or decreases. Is the companys liquidity

Calculate liquidity and solvency ratios for 2014 and 2013

Compare these ratios between 2014 and 2013. Analyze any increases or decreases. Is the companys liquidity and solvency better in 2014 or in 2013? What can be done in the future to improve liquidity and solvency?

P.S.: The Income Statement does not have Interest Expense. Therefore the Times Interest Earned ratio will not be calculated.

September 27, 2014 September 28, 2013 ASSETS: Current assets Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of 586 and $99, respectively Inventories Deferredtax assets Vendor non-trade receivables Other current assets S 13,84414 259 26,287 13.102 1,764 3.453 7.539 6,882 11,233 17,460 2,111 4,318 9,759 9,806 Total current assets 68,531 130,162 20,624 Long-term mketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other assets 73,286 106,215 16,597 1,577 4.179 5.146 4.142 3,764 Total assets 1,839S 207,000 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses Deferredrevenue Commercial paper $ 30,196 18,453 8,491 6,308 22,367 13,856 7,435 Total current liabilities 63,448 3,031 28,987 24,826 43,658 2,625 16,960 20,208 Deferred revenue-non-current Long-term debt Other non-currentliabilities Total liabilities 120,292 83,451 Commitments and contingencies Shareholders' equity. Common stock and additional paid-in capital, S0.00001 parvalue 12,600,000 shares authorized; 5,866,161 and 6,294,494 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) 23,313 87,152 1,082 19,764 104,256 (471) 111547-123545 S231,839 207,000 Total shareholders' equity Total liabilities and shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started