Calculate market cap for Walt Disney Company at September 29, 2018 and at September 30, 2017 and at February 22, 2019. For all three calculations refer to the Weighted average number of common and common equivalent shares outstanding basic not diluted (abbreviated in millions) found in the footnotes to the financial statements [use the Sept. 29, 2018 number for the Feb 22, 2019 calculation]. You must provide the details of the calculation.

FootNotes

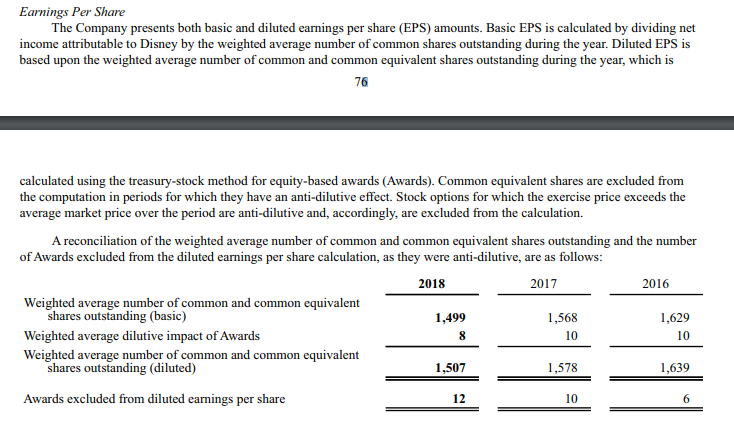

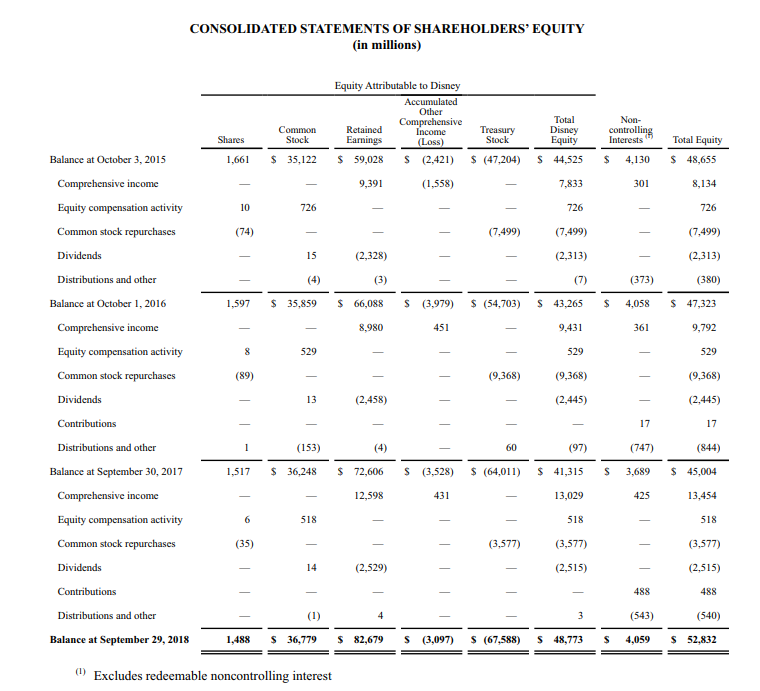

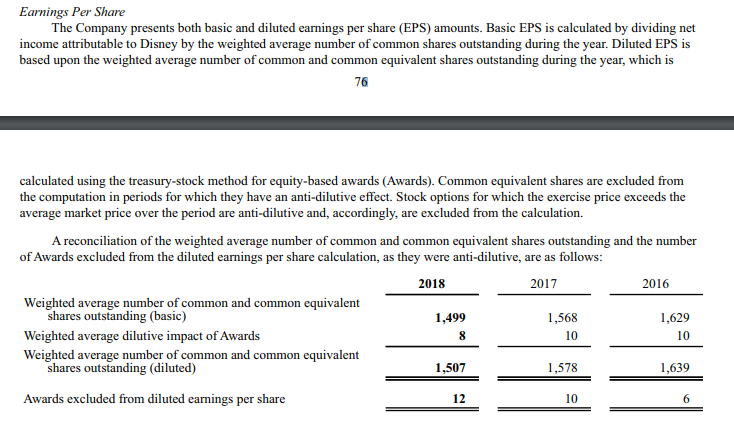

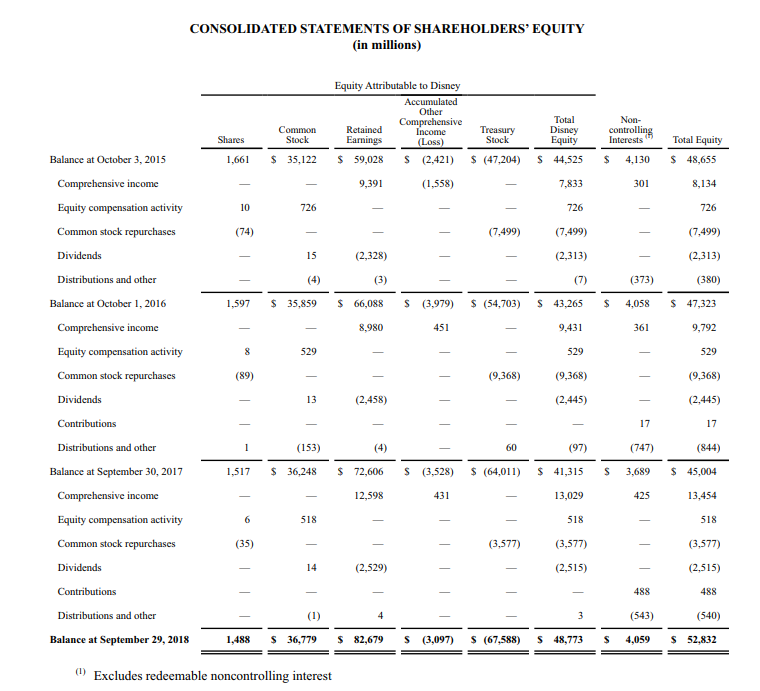

Earnings Per Share The Company presents both basic and diluted earnings per share (EPS) amounts. Basic EPS is calculated by dividing net income attributable to Disney by the weighted average number of common shares outstanding during the year. Diluted EPS is based upon the weighted average number of common and common equivalent shares outstanding during the year, which is 76 calculated using the treasury-stock method for equity-based awards (Awards). Common equivalent shares are excluded from the computation in periods for which they have an anti-dilutive effect. Stock options for which the exercise price exceeds the average market price over the period are anti-dilutive and, accordingly, are excluded from the calculation. A reconciliation of the weighted average number of common and common equivalent shares outstanding and the number of Awards excluded from the diluted earnings per share calculation, as they were anti-dilutive, are as follows 2018 2017 2016 Weighted average number of common and common equivalent shares outstanding (basic) Weighted average dilutive impact of Awards Weighted average number of common and common equivalent 1,499 1,568 10 1,629 10 shares outstanding (diluted) 1,507 1,578 1,639 Awards excluded from diluted earnings per share 12 10 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) Equity Attributable to Disney Total DisneyInterests CommonRetained cTreasury Disey controlling 1,661 35,122 59,028 S (2,421) S(47,204) S 44,525 4,130 301 Total Equity -Loss) Balance at October 3, 2015 48,655 Comprehensive income Equity compensation activity Common stock repurchases 7,833 726 (7,499) (2,313) 9,391 (1,558) 8,134 10 (74) (7,499) (7,499) (2,313) (380) 15 (2,328) Distributions and other (373) Balance at October 1, 2016 1,597 35,859 66,088 S (3,979) (54,703) S 43,265 4,058 47,323 8,980 9.431 529 (9,368) (2,445) 361 Comprehensive income Equity compensation activity Common stock repurchases 9,792 529 (9,368) (2,445) 451 529 (9,368) (2,458) 17 17 Distributions and other (153) (97) (747) (844) Balance at September 30, 2017 1,517 36,248 72,606 S (3,528) S (64,011) 41,315 3,689 45,004 431 13,029 518 (3,577) (2,515) 13,454 518 (3,577) (2,515) 488 (540) Comprehensive income Equity compensation activity Common stock repurchases 12,598 425 518 (35) (3,577) (2,529) 488 Distributions and other (543) Balance at September 29, 2018 1,488 S 36,779 82,679 S 3,097) (67,588) 48,773 S 4,05952,832 Excludes redeemable noncontrolling interest Earnings Per Share The Company presents both basic and diluted earnings per share (EPS) amounts. Basic EPS is calculated by dividing net income attributable to Disney by the weighted average number of common shares outstanding during the year. Diluted EPS is based upon the weighted average number of common and common equivalent shares outstanding during the year, which is 76 calculated using the treasury-stock method for equity-based awards (Awards). Common equivalent shares are excluded from the computation in periods for which they have an anti-dilutive effect. Stock options for which the exercise price exceeds the average market price over the period are anti-dilutive and, accordingly, are excluded from the calculation. A reconciliation of the weighted average number of common and common equivalent shares outstanding and the number of Awards excluded from the diluted earnings per share calculation, as they were anti-dilutive, are as follows 2018 2017 2016 Weighted average number of common and common equivalent shares outstanding (basic) Weighted average dilutive impact of Awards Weighted average number of common and common equivalent 1,499 1,568 10 1,629 10 shares outstanding (diluted) 1,507 1,578 1,639 Awards excluded from diluted earnings per share 12 10 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) Equity Attributable to Disney Total DisneyInterests CommonRetained cTreasury Disey controlling 1,661 35,122 59,028 S (2,421) S(47,204) S 44,525 4,130 301 Total Equity -Loss) Balance at October 3, 2015 48,655 Comprehensive income Equity compensation activity Common stock repurchases 7,833 726 (7,499) (2,313) 9,391 (1,558) 8,134 10 (74) (7,499) (7,499) (2,313) (380) 15 (2,328) Distributions and other (373) Balance at October 1, 2016 1,597 35,859 66,088 S (3,979) (54,703) S 43,265 4,058 47,323 8,980 9.431 529 (9,368) (2,445) 361 Comprehensive income Equity compensation activity Common stock repurchases 9,792 529 (9,368) (2,445) 451 529 (9,368) (2,458) 17 17 Distributions and other (153) (97) (747) (844) Balance at September 30, 2017 1,517 36,248 72,606 S (3,528) S (64,011) 41,315 3,689 45,004 431 13,029 518 (3,577) (2,515) 13,454 518 (3,577) (2,515) 488 (540) Comprehensive income Equity compensation activity Common stock repurchases 12,598 425 518 (35) (3,577) (2,529) 488 Distributions and other (543) Balance at September 29, 2018 1,488 S 36,779 82,679 S 3,097) (67,588) 48,773 S 4,05952,832 Excludes redeemable noncontrolling interest