Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate Net income for tax purposes, taxable income and federal tax owing. please provide reasons for omitting items that you have not included in your

calculate Net income for tax purposes, taxable income and federal tax owing. please provide reasons for omitting items that you have not included in your calculations. please ignore home relocation loan rules and simply treat $500,000 loan as a low-interest employee loan. use excel as it will enable you to include formulas and verify calculations.

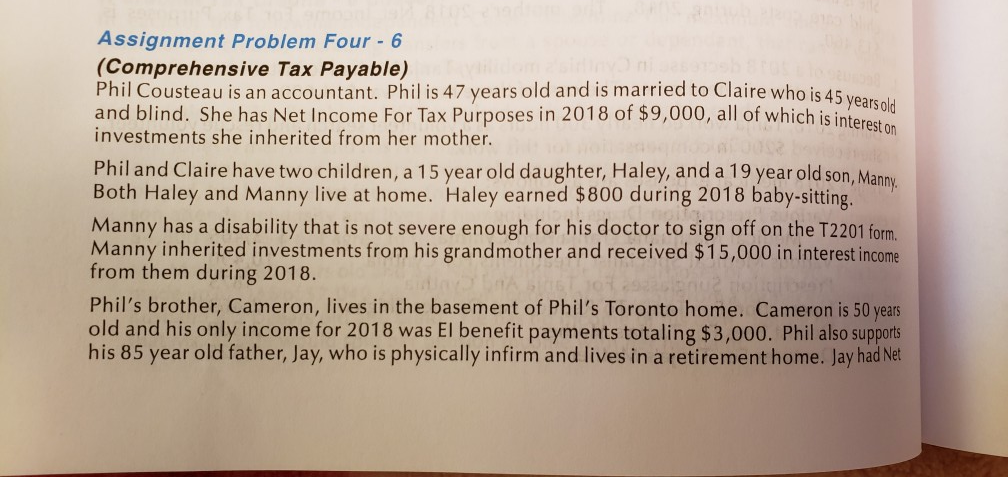

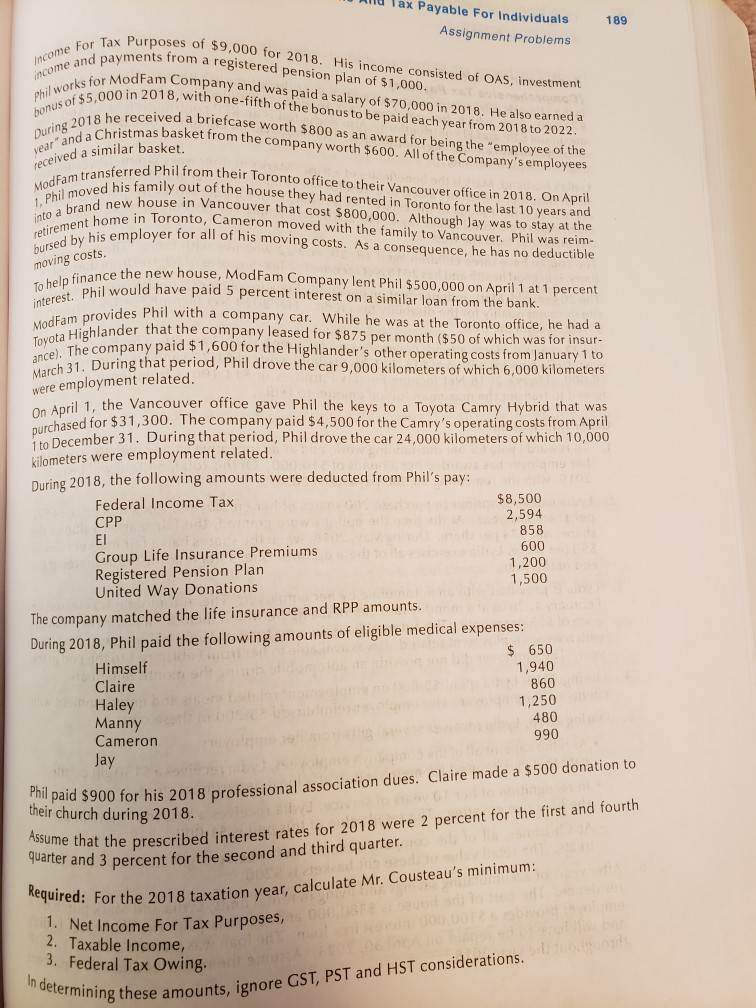

Assignment Problem Four - 6 (Comprehensive Tax Payable) Phil Cousteau is an accountant. Phil is 47 years old and is married to Claire who is 45 yearsolh and blind. She has Net Income For Tax Purposes in 2018 of $9,000, all of which is intereste Is interest on investments she inherited from her mother Phil and Claire have two children, a 15 year old daughter, Haley, and a 19 year old son, Many Both Haley and Manny live at home. Haley earned $800 during 2018 baby-sitting. Manny has a disability that is not severe enough for his doctor to sign off on the T2201 form. Manny inherited investments from his grandmother and received $15,000 in interest income from them during 2018. Phil's brother, Cameron, lives in the basement of Phil's Toronto home. Cameron is 50 years old and his only income for 2018 was El benefit payments totaling $3,000. Phil also supports his 85 year old father, Jay, who is physically infirm and lives in a retirement home. Jay had Net u Tax Payable For Individuals Assignment Problems 189 Tax Purposes of $9,000 for d payments trom a registered pension plan of $1,000 r 2018. His income consisted of OAS, investment incos for ModFam Company and was paid a salary of $70,000 in 2018. He also earned a works.000 in 2018, with one-fifth of the bonus to be paid each year from 2018 to 2022 he received a briefcase worth $800 as an award for being the "employee of the tmas basket from the company worth $600. All of the Company's employees ferred Phil from their Toronto office to their Vancouver office in 2018. On Apri se in Vancouver that cost $800,000. Although Jay was to stay at th ved a similar basket ily out of the house they had rented in Toronto for the last 10 years a Mo 1, Phil moved his family into a Drat home in Toronto, Cameron moved with the family to Vancouver. Phil was reirm brand new house Vanc moving costs To he phil would have paid 5 percent interest on a similar loan from the bank eired by hi emloyer for all of his moving costs. As a consequence, he has no deductible finance the new house, ModFam Company lent Phil $500,000 on April 1 at 1 percent rovides Phil with a company car. While he was at the Toronto office, he had a odra ihlander that the company leased for $875 per month ($50 of which was for insur pany paid $1,600 for the Highlander's other operating costs from January 1 to 0 1 During that period, Phil drove the car 9,000 kilometers of which 6,000 kilometers were employment related On April 1, the Vancouver office gave Phil the keys to a Toyota Camry Hybrid that wa ased for $31,300. The company paid $4,500 for the Camry's operating costs from April pu 1 to December 31. During that period, Phil drove the car 24,000 kilometers of which 10,000 ilometers were employment related During 2018, the following amounts were deducted from Phil's pay: Federal Income Tax CPP EI Group Life Insurance Premiums Registered Pension Plan United Way Donations $8,500 2,594 858 600 1,200 1,500 The company matched the life insurance and RPP amounts During 2018, Phil paid the following amounts of eligible medical expenses $ 650 1,940 860 1,250 480 990 Himself Haley Manny Cameror ay ation to Phil paid $900 h their church during 2018 for his 2018 professional association dues. Claire made a $500 don that the prescribed interest rates for 2018 were 2 percent for the first and fourth and 3 percent for the second and third quarter me t quarter red: For the 2018 taxation year, calculate Mr. Cousteau's minimum: 1. Net Income For Tax Purposes Taxable Income . Federal Tax Owing. ining these amounts, ignore GST, PST and HST considerations Assignment Problem Four - 6 (Comprehensive Tax Payable) Phil Cousteau is an accountant. Phil is 47 years old and is married to Claire who is 45 yearsolh and blind. She has Net Income For Tax Purposes in 2018 of $9,000, all of which is intereste Is interest on investments she inherited from her mother Phil and Claire have two children, a 15 year old daughter, Haley, and a 19 year old son, Many Both Haley and Manny live at home. Haley earned $800 during 2018 baby-sitting. Manny has a disability that is not severe enough for his doctor to sign off on the T2201 form. Manny inherited investments from his grandmother and received $15,000 in interest income from them during 2018. Phil's brother, Cameron, lives in the basement of Phil's Toronto home. Cameron is 50 years old and his only income for 2018 was El benefit payments totaling $3,000. Phil also supports his 85 year old father, Jay, who is physically infirm and lives in a retirement home. Jay had Net u Tax Payable For Individuals Assignment Problems 189 Tax Purposes of $9,000 for d payments trom a registered pension plan of $1,000 r 2018. His income consisted of OAS, investment incos for ModFam Company and was paid a salary of $70,000 in 2018. He also earned a works.000 in 2018, with one-fifth of the bonus to be paid each year from 2018 to 2022 he received a briefcase worth $800 as an award for being the "employee of the tmas basket from the company worth $600. All of the Company's employees ferred Phil from their Toronto office to their Vancouver office in 2018. On Apri se in Vancouver that cost $800,000. Although Jay was to stay at th ved a similar basket ily out of the house they had rented in Toronto for the last 10 years a Mo 1, Phil moved his family into a Drat home in Toronto, Cameron moved with the family to Vancouver. Phil was reirm brand new house Vanc moving costs To he phil would have paid 5 percent interest on a similar loan from the bank eired by hi emloyer for all of his moving costs. As a consequence, he has no deductible finance the new house, ModFam Company lent Phil $500,000 on April 1 at 1 percent rovides Phil with a company car. While he was at the Toronto office, he had a odra ihlander that the company leased for $875 per month ($50 of which was for insur pany paid $1,600 for the Highlander's other operating costs from January 1 to 0 1 During that period, Phil drove the car 9,000 kilometers of which 6,000 kilometers were employment related On April 1, the Vancouver office gave Phil the keys to a Toyota Camry Hybrid that wa ased for $31,300. The company paid $4,500 for the Camry's operating costs from April pu 1 to December 31. During that period, Phil drove the car 24,000 kilometers of which 10,000 ilometers were employment related During 2018, the following amounts were deducted from Phil's pay: Federal Income Tax CPP EI Group Life Insurance Premiums Registered Pension Plan United Way Donations $8,500 2,594 858 600 1,200 1,500 The company matched the life insurance and RPP amounts During 2018, Phil paid the following amounts of eligible medical expenses $ 650 1,940 860 1,250 480 990 Himself Haley Manny Cameror ay ation to Phil paid $900 h their church during 2018 for his 2018 professional association dues. Claire made a $500 don that the prescribed interest rates for 2018 were 2 percent for the first and fourth and 3 percent for the second and third quarter me t quarter red: For the 2018 taxation year, calculate Mr. Cousteau's minimum: 1. Net Income For Tax Purposes Taxable Income . Federal Tax Owing. ining these amounts, ignore GST, PST and HST considerationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started