Answered step by step

Verified Expert Solution

Question

1 Approved Answer

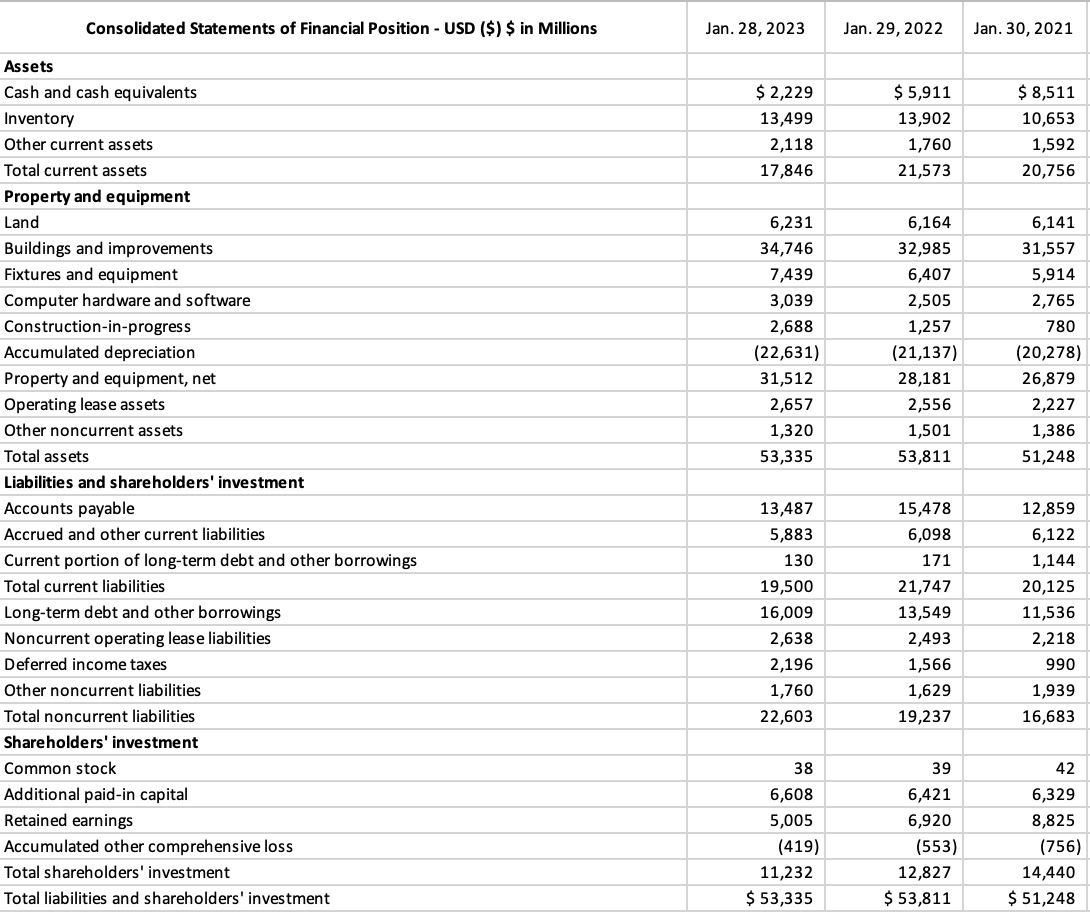

Calculate Net Operating Assets (NOA), Net Non-operating Obligations (NNO), and Common Shareholders' Equity (CSE) for Fiscal Year 2021 Consolidated Statements of Financial Position - USD

Calculate Net Operating Assets (NOA), Net Non-operating Obligations (NNO), and Common Shareholders' Equity (CSE) for Fiscal Year 2021

Consolidated Statements of Financial Position - USD ($) $ in Millions Jan. 28, 2023 Jan. 29, 2022 Jan. 30, 2021 Assets Cash and cash equivalents Inventory Other current assets Total current assets $2,229 $5,911 $ 8,511 13,499 13,902 10,653 2,118 1,760 1,592 17,846 21,573 20,756 Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets 6,231 6,164 6,141 34,746 32,985 31,557 7,439 6,407 5,914 3,039 2,505 2,765 2,688 1,257 780 (22,631) (21,137) (20,278) 31,512 28,181 26,879 2,657 2,556 2,227 1,320 1,501 1,386 53,335 53,811 51,248 Liabilities and shareholders' investment Accounts payable 13,487 15,478 12,859 Accrued and other current liabilities 5,883 6,098 6,122 Current portion of long-term debt and other borrowings 130 171 1,144 Total current liabilities 19,500 21,747 20,125 Long-term debt and other borrowings 16,009 13,549 11,536 Noncurrent operating lease liabilities 2,638 2,493 2,218 Deferred income taxes 2,196 1,566 990 Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment 1,760 1,629 1,939 22,603 19,237 16,683 Common stock 38 39 42 Additional paid-in capital Retained earnings 6,608 6,421 6,329 5,005 6,920 8,825 Accumulated other comprehensive loss (419) (553) (756) Total shareholders' investment 11,232 12,827 14,440 Total liabilities and shareholders' investment $53,335 $ 53,811 $51,248

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started