Question

Calculate Net Present Value of refunding the 1991 issue if the firms refunds on January 1, 1996. Use Table 1 or Table 2 as a

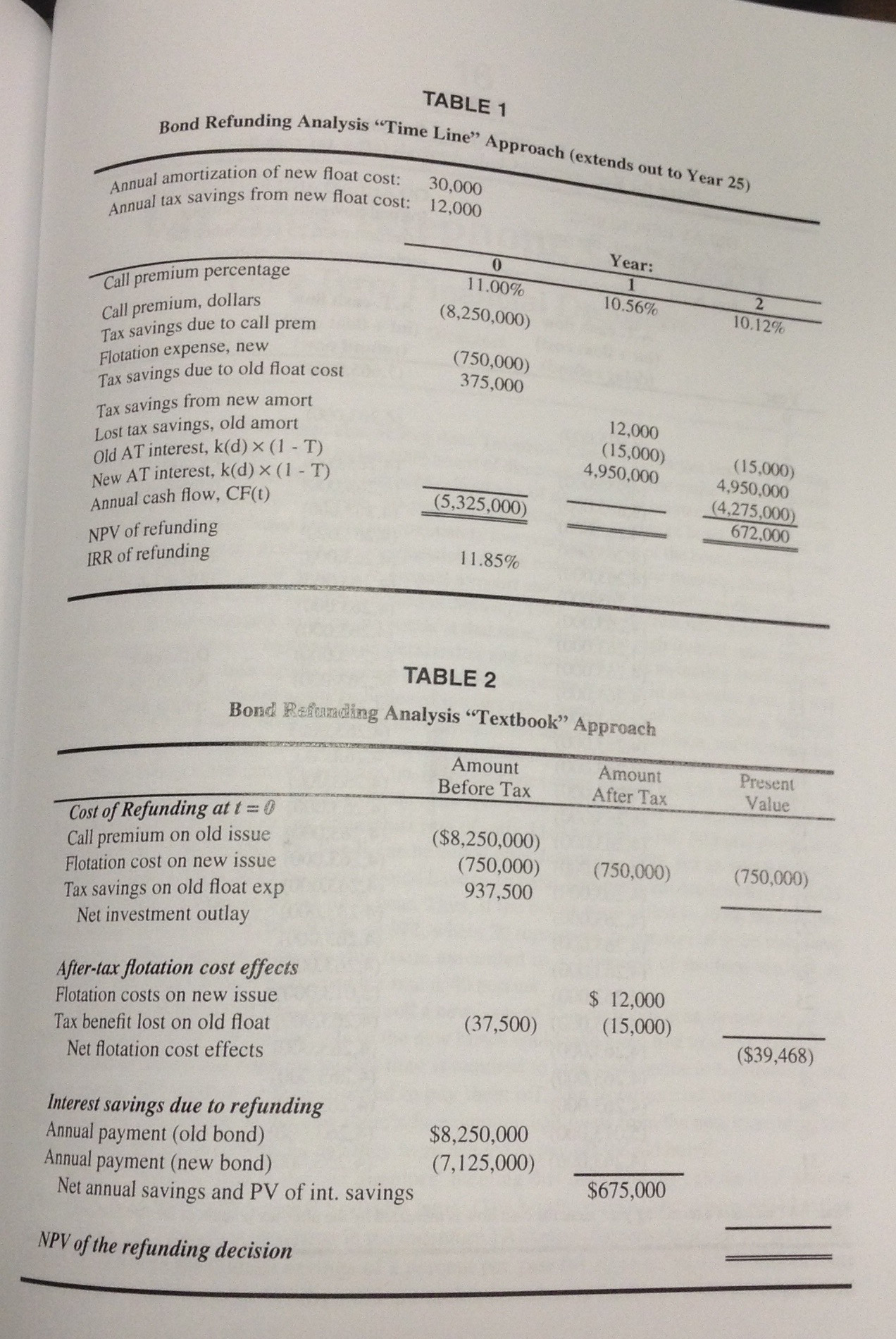

Calculate Net Present Value of refunding the 1991 issue if the firms refunds on January 1, 1996. Use Table 1 or Table 2 as a guide for your analysis. -The 1991 bond is a 5 year callable bond. 11% coupon, 30 year, 75M (75,000 units of $1,000 par value bonds). The company can reissue new bonds at a coupon rate of 9.5%. This is a callable bond - had the bond not been callable the interest rate would have been 10.5% instead of 11%. If the bond is called on January 1, 1996 then an inital call premium of 11% or $110 per bond would have to be paid. However, the premium declines by 11%/25 = 0.44 percentage point, or $4.40, each year thereafter. Thus, if the bonds were called in 2001, the call premium would be (0.11/25)(20) = 8.8% or $88, where 20 represents the number of years remaining to maturity. Floatation costs on the 1991 issue totaled 1.5% of the face amount, or $1,125,000. The firm's federal-plus-state tax rate is 40%. You think you can issue new 25 year bonds at an interest rate of 9.5%. The floatation cost on the refunding issue would be 1% of the new issues face amount. Calculate the Net Present Value of refunding the 1991 issue. Table for guidance are below. Please show steps.

TABLE 1 Bond Refunding Analysis alysis "Time Line" Approach (extends out to Year 25) Inual amortization of new float cost: 30.0 Annual tax savings from new float cost: 2,000 Year: Call premium percentage Call premium, dollars Tax savings due to call prem Flotation expense, new Tax savings to float due old cost Tax savings from new amort Lost tax savings, old amort old at interest, k(d) x IT New AT interest, K(d) x (1- T) Annual cash flow, CFO NPV of refunding IRR of refunding 11.00% (8,250,000) 10.56% 0.12% (750,000) 375,000 4,950,000 12,000 (15,000) 4,950,000 (4275000) 672,000 (15,000) (5,325,000) 85% TABLE 2 Bond Reica Rading Analysis Textbook Approach Amount Before Tax Cost of Refunding at t = 0 Call premium on old issue Flotation cost on new issue Tax savings on old float exp Net investment outlay Amount After Tax Present Value ($8,250,000) (750,000) 937,500 (750,000) (750,000) After-tax flotation cost effects Flotation costs on new issue Tax benefit lost on old float Net flotation cost effects (37500) $ 12,000 (15,000) ($39,468) Interest savings due to refunding Annual payment (old bond) $8,250,000 Annual payment (new bond) (7,125,000) Net annual savings and PV of int, savings $675,000 NPV of the refunding decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started