Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CALCULATE NPV OF THESE PROJECTS IN DETAILS Al Gharafa is a Qatari company, based in Doha, engaged in house-building. The company is currently considering whether

CALCULATE NPV OF THESE PROJECTS IN DETAILS

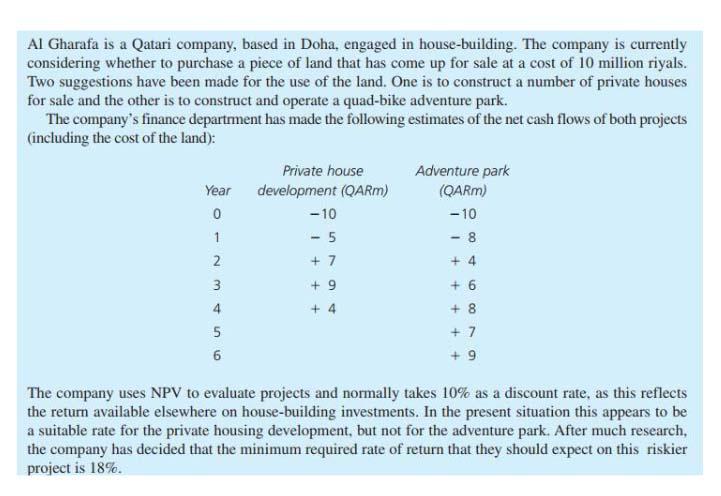

Al Gharafa is a Qatari company, based in Doha, engaged in house-building. The company is currently considering whether to purchase a piece of land that has come up for sale at a cost of 10 million riyals. Two suggestions have been made for the use of the land. One is to construct a number of private houses for sale and the other is to construct and operate a quad-bike adventure park. The company's finance department has made the following estimates of the net cash flows of both projects (including the cost of the land): Adventure park (QAR) -10 - 8 Private house Year development (QARm) 0 -10 1 - 5 2 + 7 3 + 9 4 + 4 5 6 + 4 + 6 min + 8 +7 + 9 The company uses NPV to evaluate projects and normally takes 10% as a discount rate, as this reflects the return available elsewhere on house-building investments. In the present situation this appears to be a suitable rate for the private housing development, but not for the adventure park. After much research, the company has decided that the minimum required rate of return that they should expect on this riskier project is 18%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started