Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate overhead allocation rates for each of the cost drivers recommended by the management accountant, as well as the absorption allocation rate gor direct labour

calculate overhead allocation rates for each of the cost drivers recommended by the management accountant, as well as the absorption allocation rate gor direct labour hours

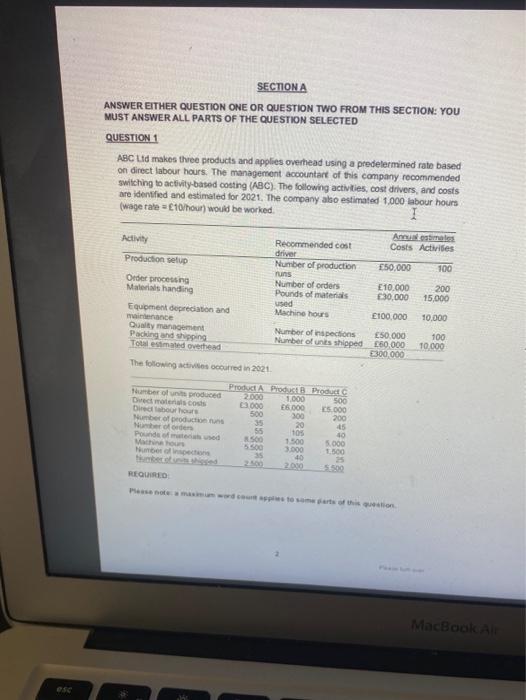

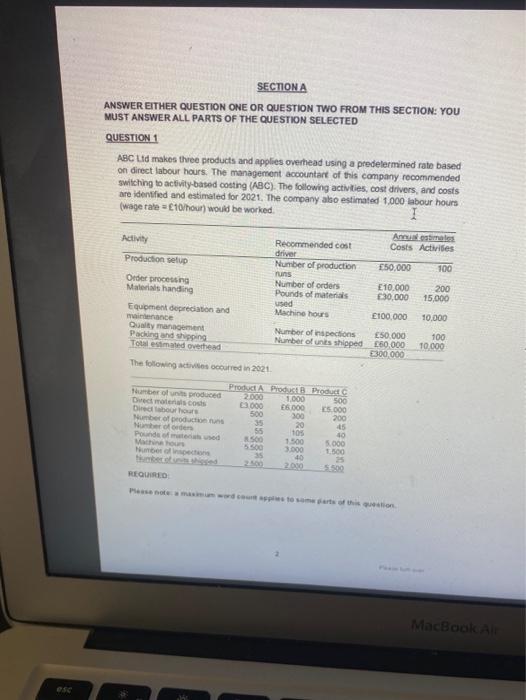

SECTIONA ANSWER EITHER QUESTION ONE OR QUESTION TWO FROM THIS SECTION: YOU MUST ANSWER ALL PARTS OF THE QUESTION SELECTED QUESTION 1 ABC Lid makes three products and applies overhead using a predetermined rate based on direct labour hours. The management accountant of this company recommended switching to activity-based costing (ABC). The following activities, cost drivers and costs are identified and estimated for 2021. The company also estimated 1.000 labour hours (wage rate= 10/hour) would be worked 1 Armuostas Adivi Recommended cost Costs Activities driver Production setup Number of production 550.000 100 runs Order procesin Number of orders 10.000 200 Material handing Pounds of materials 30.000 15,000 used Equipment depreciation and Machine hours E100.000 10.000 maintenance Quality management Number of inspections 50.000 100 Pading and shipping Number of units shipped 150.000 10.000 Total estimated overhead E300.000 The following securred in 2021 500 Product Produkt Product Number of produced 2.000 1.000 500 Divemos coss 000 5.000 Die boor hours 5.000 300 Number of productions 20 -45 Nefer 55 105 Pounded 10 500 1500 Macho 5.000 5200 3.000 Number LO 40 25 200 REQUIRED Posts of this question MacBook es

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started