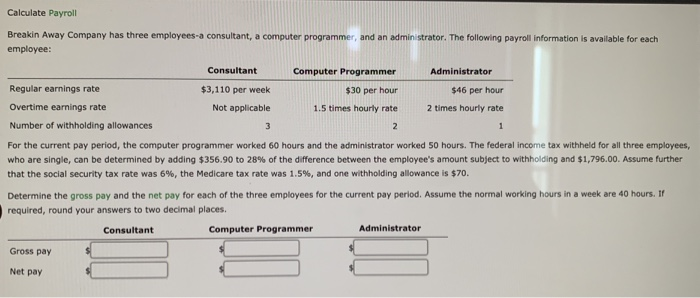

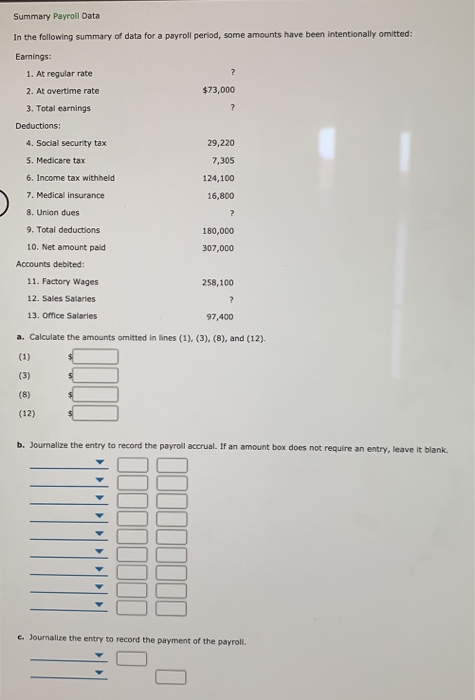

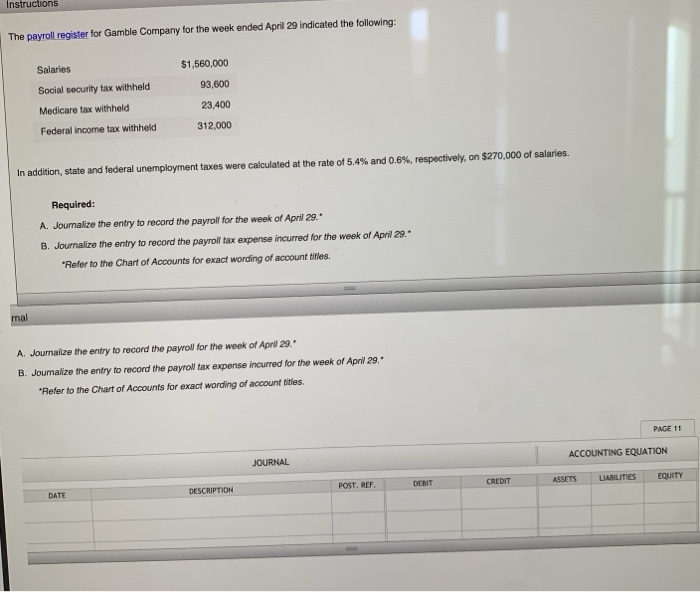

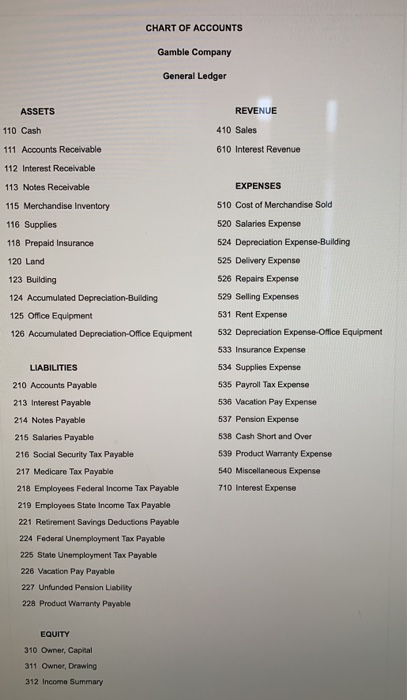

Calculate Payroll Breakin Away Company has three employees a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $3,110 per week $30 per hour $46 per hour Overtime earnings rate Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places Consultant Computer Programmer Administrator Gross pay $ Net pay Summary Payroll Data In the following summary of data for a payroll period, some amounts have been intentionally omitted: $73,000 Earnings: 1. At regular rate 2. At overtime rate 3. Total earnings Deductions: 4. Social security tax 5. Medicare tax 29,220 7,305 124,100 16,800 6. Income tax withheld 7. Medical insurance 8. Union dues 180,000 307,000 9. Total deductions 10. Net amount paid Accounts debited: 11. Factory Wages 12. Sales Salaries 13. Office Salaries 258,100 97,400 a. Calculate the amounts omitted in lines (1), (3), (8), and (12). (12) b. Journalize the entry to record the payroll accrual. If an amount box does not require an entry, leave it blank. UUUUUU W111) e. Journalize the entry to record the payment of the payroll. The payroll register for Gamble Company for the week ended April 29 indicated the following: Salaries Social security tax withheld Medicare tax withheld Federal income tax withheld $1,560,000 93,600 23,400 312,000 In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.6%, respectively, on $270,000 of salaries. Required: A. Joumalize the entry to record the payroll for the week of April 29. B. Journalize the entry to record the payroll tax expense incurred for the week of April 29." *Refer to the Chart of Accounts for exact wording of account bites mal A Journalize the entry to record the payroll for the week of April 29." B. Joumalize the entry to record the payroll tax expense incurred for the week of April 29. "Refer to the Chart of Accounts for exact wording of account titles PAGE 11 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY CHART OF ACCOUNTS Gamble Company General Ledger REVENUE 410 Sales 610 Interest Revenue EXPENSES ASSETS 110 Cash 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Merchandise Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment 126 Accumulated Depreciation Office Equipment 510 Cost of Merchandise Sold 520 Salaries Expense 524 Depreciation Expense-Building 525 Delivery Expense 526 Repairs Expense 529 Selling Expenses 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Supplies Expense 535 Payroll Tax Expense 536 Vacation Pay Expense 537 Pension Expense 538 Cash Short and Over 539 Product Warranty Expense 540 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Salaries Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees Federal Income Tax Payable 219 Employees State Income Tax Payable 221 Retirement Savings Deductions Payable 224 Federal Unemployment Tax Payable 225 State Unemployment Tax Payable 226 Vacation Pay Payable 227 Unfunded Pension Liability 228 Product Warranty Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary