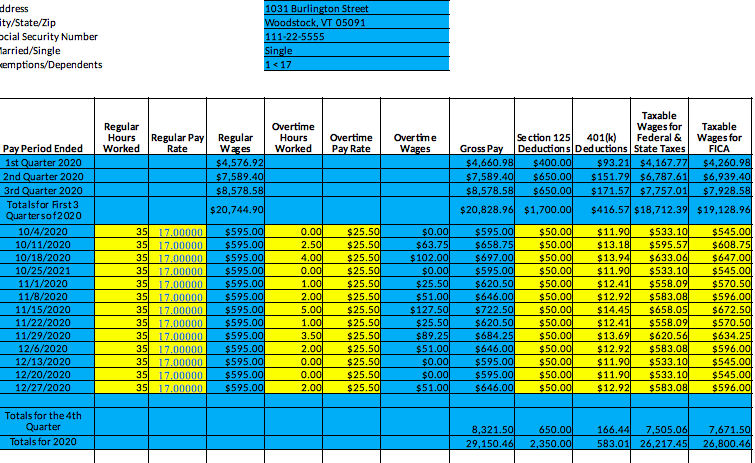

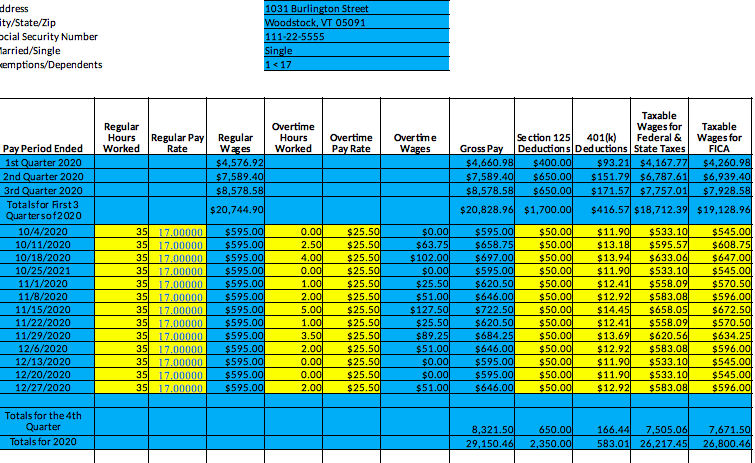

Calculate payroll for employee that is single

2020 W-4 Sections 2&4 are blank with dependents that are 1

Calculate taxable wages for federal and state taxes, Social security, and medicare. State taxes are 5%

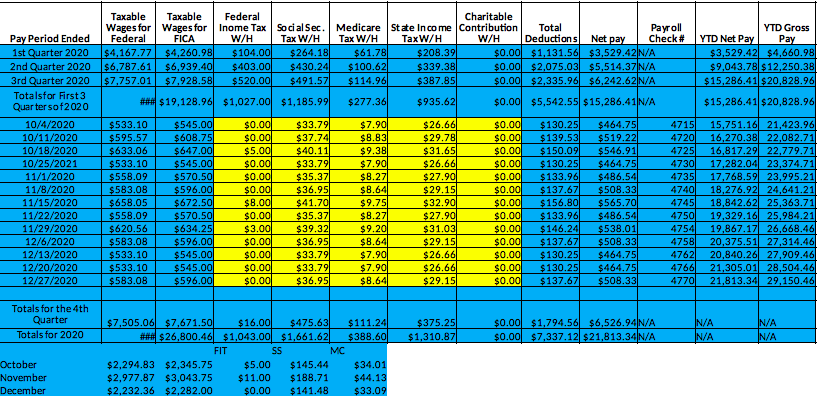

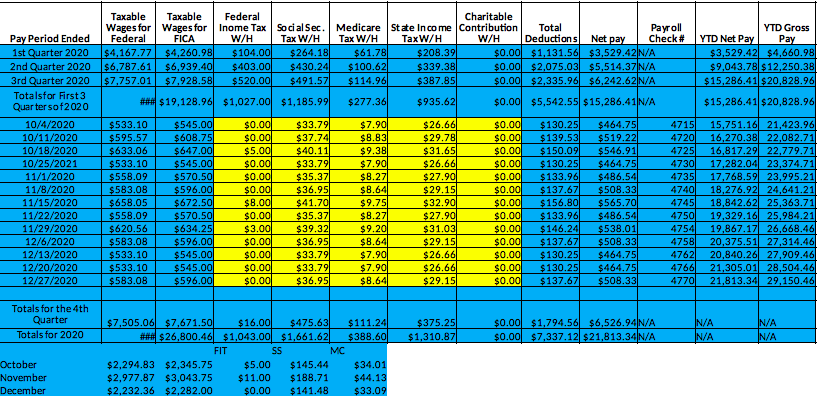

Net pay Taxable Taxable Wages for Wages for Federal FICA $4,167.77 $4,260.98 $6,787.61 $6,939.40 $7,757.01 $7.928.58 Federal Charitable Inome Tax Social Sec. Medicare State Income Contribution Total Payroll W/H Tax W/H Tax W/H TaxW/H W/H Deductions Check # $ 104.00 $264.18 $61.78) $208.39 $0.00 $1,131.56 $3,529.42N/A $403.00 $430.24 $ 100.62 $339.38 $0.00 $2,075.03 $5,514.37N/A $520.00 $491.57 $ 114.96 $387.85 $0.00 $2.335.96 $6,242.62 N/A YTD Gross YTD Net Pay Pay $3,529.42 $4,660.98 $9,043.78 $ 12,250.38 $ 15,286.41 $ 20,828.96 ### $19,128.96 $1,027.00 $1,185.99 $277.36 $935.62 $0.00 $5,542.55 $15,286.41N/A $15,286.41 $20,828.96 Pay Period Ended 1st Quarter 2020 2nd Quarter 2020 3rd Quarter 2020 Totalsfor First 3 Quartersof2020 10/4/2020 10/11/2020 10/18/2020 10/25/2021 11/1/2020 11/8/2020 11/15/2020 11/22/2020 11/29/2020 12/6/2020 12/13/2020 12/20/2020 12/27/2020 $533.10 $595.57 $633.06 $533.10 $558.09 $583.08 $658.05 $558.09 $620.56 $583.08 $533.10 $533.10 $583.08 $545.00 $608.75 $647.00 $545.00 $570.50 $596.00 $672.50 $570.50 $634.25 $596.00 $545.00 $545.00 $596.00 $0.00 $0.00 $5.00 $0.00 $0.00 $0.00 $8.00 $0.00 $3.000 $0.00 $0.00 $0.00 $0.00 $33.79 $37.74 $40.11 $33.791 $35.37 $36.95 $41.70 $35.37 $39.32 $36.95 $33.791 $33.791 $36.95 $7.901 $8.831 $9.38 $7.90 $8.27 $8.64 $9.75 $8.27 $9.20 $8.64 $7.90 $7.90 $8.64 $26.66 $29.781 $31.651 $26.66 $27.901 $29.15 $32.90 $27.90 $31.03 $29.15 $26.66 $26.66 $29.15 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $130.25 $ 139.53 $ 150.09 $130.25 $133.96 $137.67 $ 156.80 $133.96 $146.24 $137.67 $130.25 $ 130.25 $137.67 $464.75 $519.22 $546.91 $464.75 $486.54 $508.33 $565.70 $486.54 $538.01 $508.33 $464.75 $464.75 $508.33 4715 4720 4725 4730 4735 47401 4745 4750 4754 4758 4762) 4766 4770 15,751.16 21,423.96 16,270.38 22,082.71 16,817.29 22,779.71 17,282.04 23,374.71 17.768.59 23.995.21 18.276.92 24,641.21 18,842.62 25,363.71 19,329.16 25,984.21 19,867.17 26,668.46 20,375.51 27,314.46 20,840.26 27,909.46 21,305.01 28,504.46 21,813.34 29.150.46 Totals for the 4th Quarter Totals for 2020 N/A $375.25 $1.310.87 $0.00 $1,794.56 $6,526.94N/A $0.00 $7,337.12 $21,813.34N/A N/A N/A IN/A FIT $7,505.06 $7,671.50 $ 16.00 $475.63 $111.24 ### $26,800.46 $1,043.00 $1,661.62 $388.60 SS MC $2,294.83 $2,345.75 $5.00 $145.44 $34.01 $2,977.87 $3,043.75 $11.00 $188.71 $44.13 $2,232.36 $2,282.00 $0.00 $141.48 $33.09 October November December ddress ity/State/Zip ocial Security Number Harried/Single xemptions/Dependents 1031 Burlington Street Woodstock, VT 05091 111-22-5555 Single 1