calculate probate estate

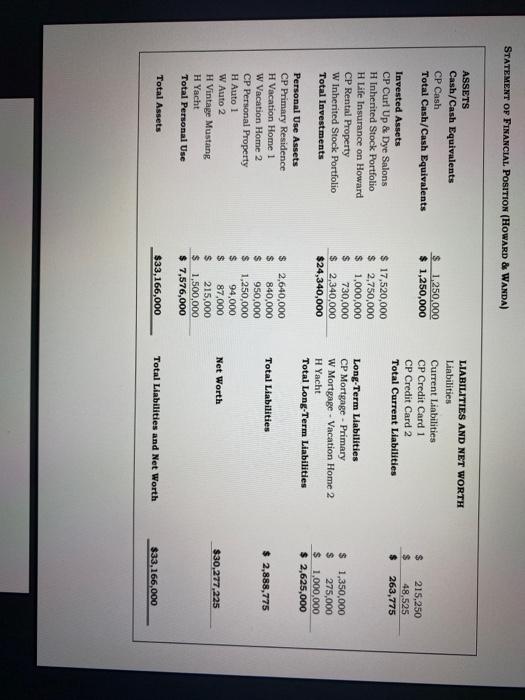

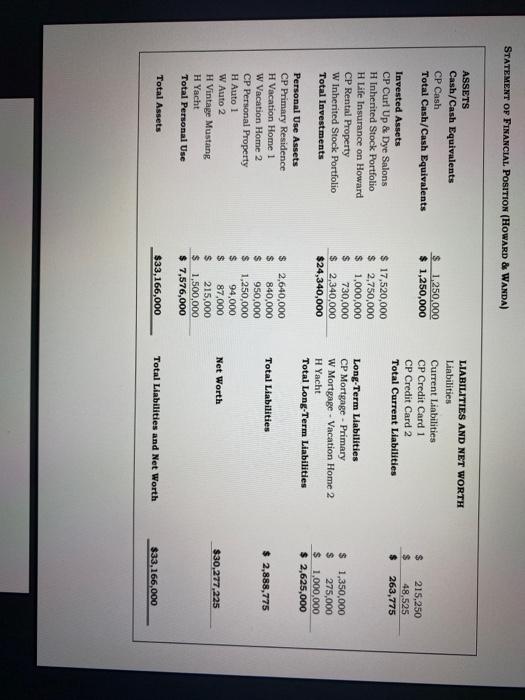

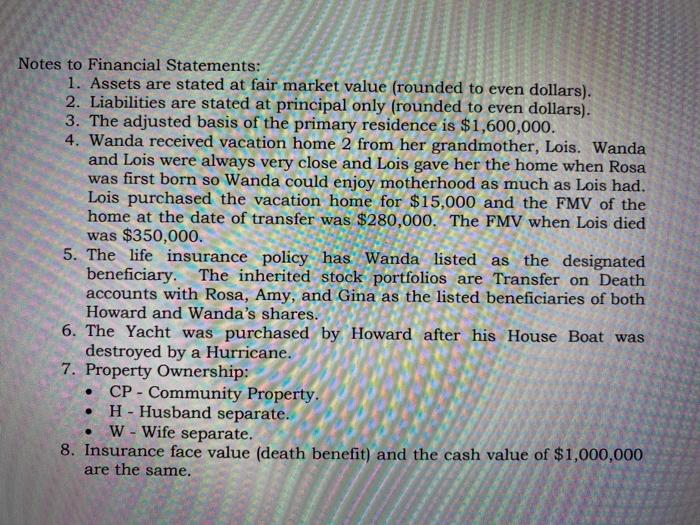

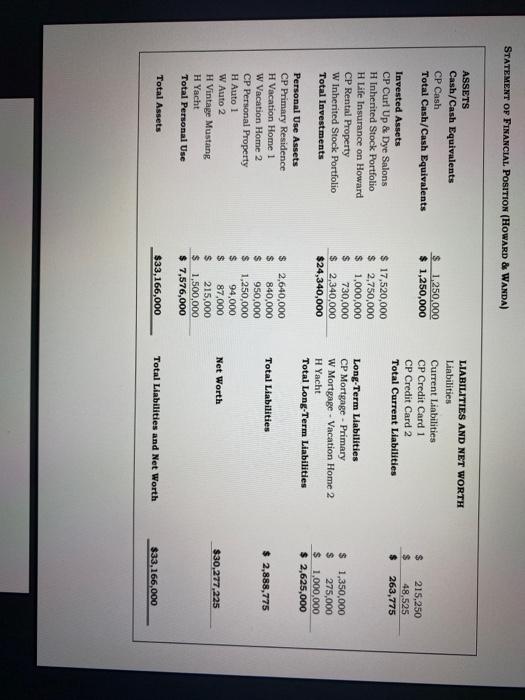

STATEMENT OF FINANCIAL POSITION (HOWARD & WANDA) ASSETS Cash/Cash Equivalents CP Cash Total Cash/Cash Equivalents $1,250,000 $ 1,250,000 LIABILITIES AND NET WORTH Liabilities Current Liabilities CP Credit Card 1 CP Credit Card 2 Total Current Liabilities $ $ $ 215,250 48,525 263,775 Invested Assets CP Curl Up & Dye Salons H Inherited Stock Portfolio H Life Insurance on Howard CP Rental Property W Inherited Stock Portfolio Total Investments $ 17,520,000 $ 2,750,000 $ 1,000,000 $ 730,000 $ 2,340,000 $24,340,000 Long-Term Liabilities CP Mortgage - Primary W Mortgage - Vacation Home 2 H Yacht Total Long-Term Liabilities $ 1,350,000 $ 275,000 $ 1,000,000 $ 2,625,000 Total Liabilities $ 2,888,775 Personal Use Assets CP Primary Residence H Vacation Home 1 W Vacation Home 2 CP Personal Property H Auto 1 W Auto 2 H Vintage Mustang H Yacht Total Personal Use $ 2,640,000 $ 840,000 $ 950,000 $ 1,250,000 $ 94,000 $ 87,000 $ 215,000 $ 1,500,000 $ 7,576,000 Net Worth $30,277,225 Total Assets $33,166,000 Total Liabilities and Net Worth $33,166,000 Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The adjusted basis of the primary residence is $1,600,000. 4. Wanda received vacation home 2 from her grandmother, Lois. Wanda and Lois were always very close and Lois gave her the home when Rosa was first born so Wanda could enjoy motherhood as much as Lois had. Lois purchased the vacation home for $15,000 and the FMV of the home at the date of transfer was $280,000. The FMV when Lois died was $350,000. 5. The life insurance policy has. Wanda listed as the designated beneficiary. The inherited stock portfolios are Transfer on Death accounts with Rosa, Amy, and Gina as the listed beneficiaries of both Howard and Wanda's shares. 6. The Yacht was purchased by Howard after his House Boat was destroyed by a Hurricane. 7. Property Ownership: CP - Community Property. H - Husband separate. W - Wife separate. 8. Insurance face value (death benefit) and the cash value of $1,000,000 are the same. . STATEMENT OF FINANCIAL POSITION (HOWARD & WANDA) ASSETS Cash/Cash Equivalents CP Cash Total Cash/Cash Equivalents $1,250,000 $ 1,250,000 LIABILITIES AND NET WORTH Liabilities Current Liabilities CP Credit Card 1 CP Credit Card 2 Total Current Liabilities $ $ $ 215,250 48,525 263,775 Invested Assets CP Curl Up & Dye Salons H Inherited Stock Portfolio H Life Insurance on Howard CP Rental Property W Inherited Stock Portfolio Total Investments $ 17,520,000 $ 2,750,000 $ 1,000,000 $ 730,000 $ 2,340,000 $24,340,000 Long-Term Liabilities CP Mortgage - Primary W Mortgage - Vacation Home 2 H Yacht Total Long-Term Liabilities $ 1,350,000 $ 275,000 $ 1,000,000 $ 2,625,000 Total Liabilities $ 2,888,775 Personal Use Assets CP Primary Residence H Vacation Home 1 W Vacation Home 2 CP Personal Property H Auto 1 W Auto 2 H Vintage Mustang H Yacht Total Personal Use $ 2,640,000 $ 840,000 $ 950,000 $ 1,250,000 $ 94,000 $ 87,000 $ 215,000 $ 1,500,000 $ 7,576,000 Net Worth $30,277,225 Total Assets $33,166,000 Total Liabilities and Net Worth $33,166,000 Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The adjusted basis of the primary residence is $1,600,000. 4. Wanda received vacation home 2 from her grandmother, Lois. Wanda and Lois were always very close and Lois gave her the home when Rosa was first born so Wanda could enjoy motherhood as much as Lois had. Lois purchased the vacation home for $15,000 and the FMV of the home at the date of transfer was $280,000. The FMV when Lois died was $350,000. 5. The life insurance policy has. Wanda listed as the designated beneficiary. The inherited stock portfolios are Transfer on Death accounts with Rosa, Amy, and Gina as the listed beneficiaries of both Howard and Wanda's shares. 6. The Yacht was purchased by Howard after his House Boat was destroyed by a Hurricane. 7. Property Ownership: CP - Community Property. H - Husband separate. W - Wife separate. 8. Insurance face value (death benefit) and the cash value of $1,000,000 are the same