Answered step by step

Verified Expert Solution

Question

1 Approved Answer

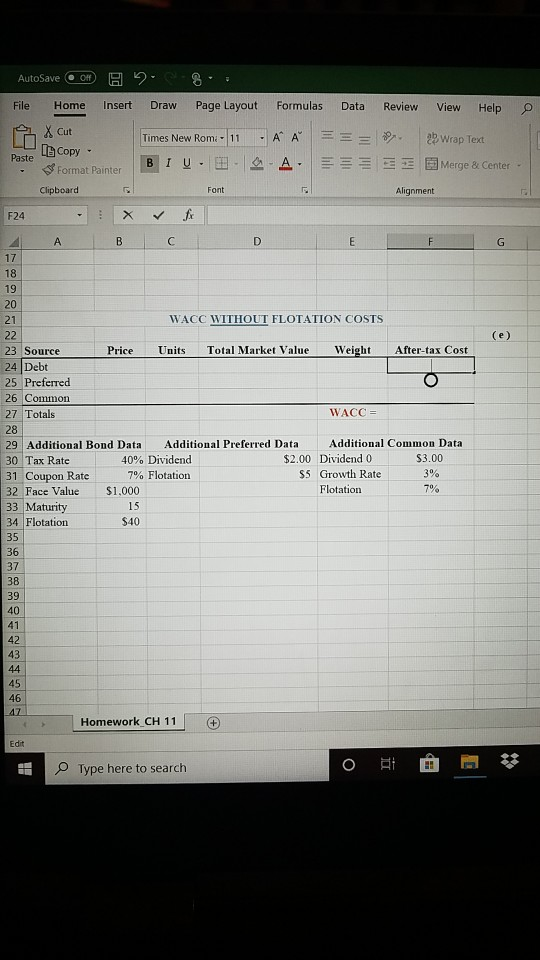

calculate problem E. only showing how to use WACC without flotation costs in attached excel. calculate dept, preferred and common in excel. Homework for Chapter

calculate problem E. only showing how to use WACC without flotation costs in attached excel. calculate dept, preferred and common in excel.

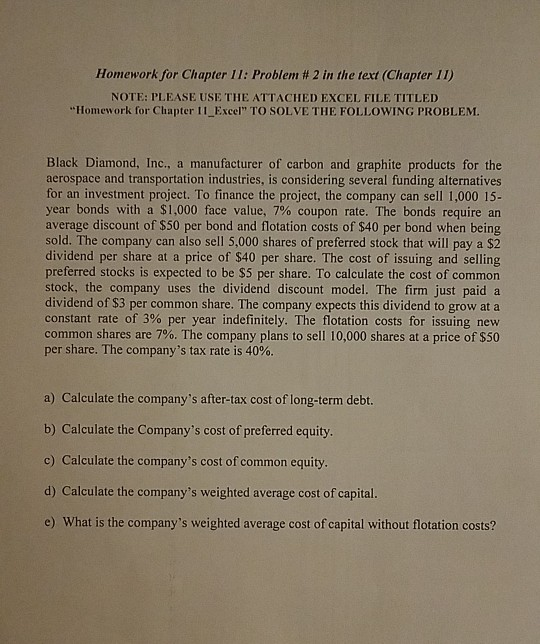

Homework for Chapter 11: Problem #2 in the text (Chapter 11) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED "Homework for Chapter 11_Excel" TO SOLVE THE FOLLOWING PROBLEM. Black Diamond, Inc., a manufacturer of carbon and graphite products for the aerospace and transportation industries, is considering several funding alternatives for an investment project. To finance the project, the company can sell 1,000 15- year bonds with a $1,000 face value, 7% coupon rate. The bonds require an average discount of $50 per bond and flotation costs of $40 per bond when being sold. The company can also sell 5,000 shares of preferred stock that will pay a $2 dividend per share at a price of $40 per share. The cost of issuing and selling preferred stocks is expected to be $5 per share. To calculate the cost of common stock, the company uses the dividend discount model. The firm just paid a dividend of $3 per common share. The company expects this dividend to grow at a constant rate of 3% per year indefinitely. The flotation costs for issuing new common shares are 7%. The company plans to sell 10,000 shares at a price of $50 per share. The company's tax rate is 40%. a) Calculate the company's after-tax cost of long-term debt. b) Calculate the Company's cost of preferred equity. c) Calculate the company's cost of common equity. d) Calculate the company's weighted average cost of capital. e) What is the company's weighted average cost of capital without flotation costs? AutoSave File Home o x cut 2 Insert 8 .. Draw Page Layout Times New Rom-11 -A B IU. Formulas Data A = = = A E Review . View Help ab Wrap Text Merge & Center LU la Copy PY Paste - 8 Format Painter Clipboard Font Alignment F24 A B C E F G 20 WACC WITHOUT FLOTATION COSTS (e) Price Units Total Market Value Weight After-tax Cost 23 Source 24 Debt 25 Preferred 26 Common 27 Totals WACC = 29 Additional Bond Data Additional Preferred Data Additional Common Data 30 Tax Rate 40% Dividend $2.00 Dividend 0 $3.00 31 Coupon Rate 7% Flotation $5 Growth Rate 3% 32 Face Value $1,000 Flotation 33 Maturity 34 Flotation $40 79 15 Homework CH 11 Edit Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started