Answered step by step

Verified Expert Solution

Question

1 Approved Answer

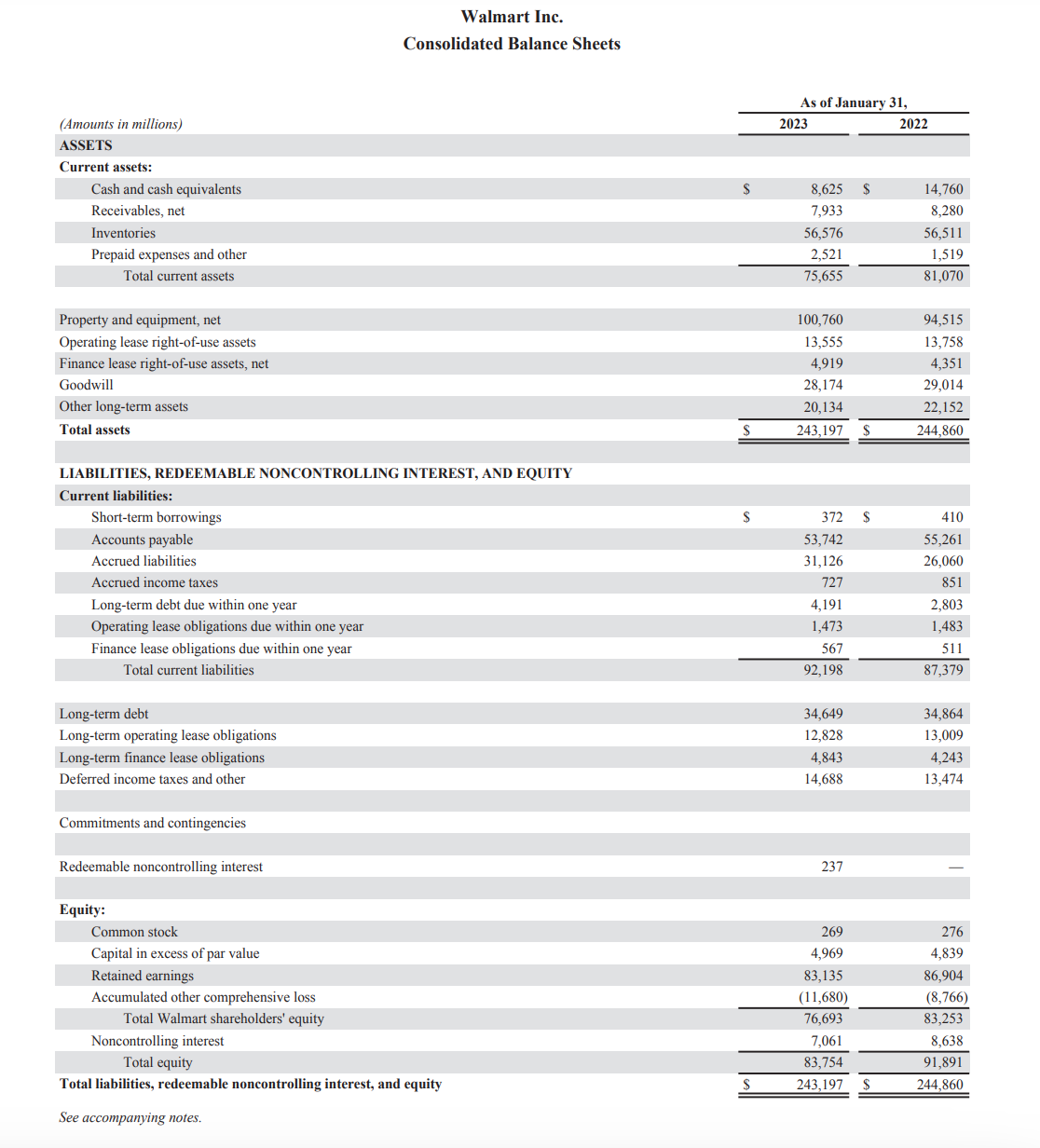

Calculate Quick Ratio and Current Ratio and apply them to Walmart's financial statements. (Amounts in millions) ASSETS Current assets: Walmart Inc. Consolidated Balance Sheets Cash

Calculate Quick Ratio and Current Ratio and apply them to Walmart's financial statements.

(Amounts in millions) ASSETS Current assets: Walmart Inc. Consolidated Balance Sheets Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets Property and equipment, net Operating lease right-of-use assets Finance lease right-of-use assets, net Goodwill Other long-term assets Total assets LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities Long-term debt Long-term operating lease obligations Long-term finance lease obligations Deferred income taxes and other Commitments and contingencies Redeemable noncontrolling interest Equity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Noncontrolling interest Total equity Total liabilities, redeemable noncontrolling interest, and equity See accompanying notes. As of January 31, 2023 2022 $ 8,625 $ 14,760 7,933 8,280 56,576 56,511 2,521 1,519 75,655 81,070 100,760 94,515 13,555 13,758 4,919 4,351 28,174 29,014 20,134 22,152 S 243,197 $ 244,860 $ 372 $ 410 53,742 55,261 31,126 26,060 727 851 4,191 2,803 1,473 1,483 567 511 92,198 87,379 34,649 34,864 12,828 13,009 4,843 4,243 14,688 13,474 237 269 276 4,969 4,839 83,135 86,904 (11,680) (8,766) 76,693 83,253 7,061 8,638 83,754 91,891 S 243,197 $ 244,860

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started