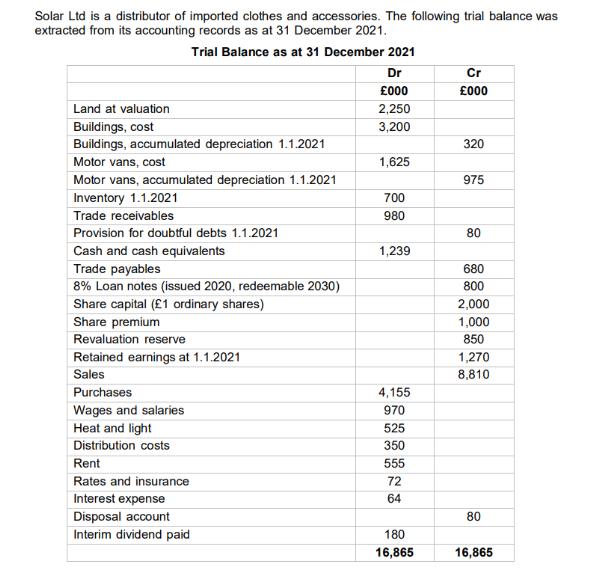

Solar Ltd is a distributor of imported clothes and accessories. The following trial balance was extracted from its accounting records as at 31 December

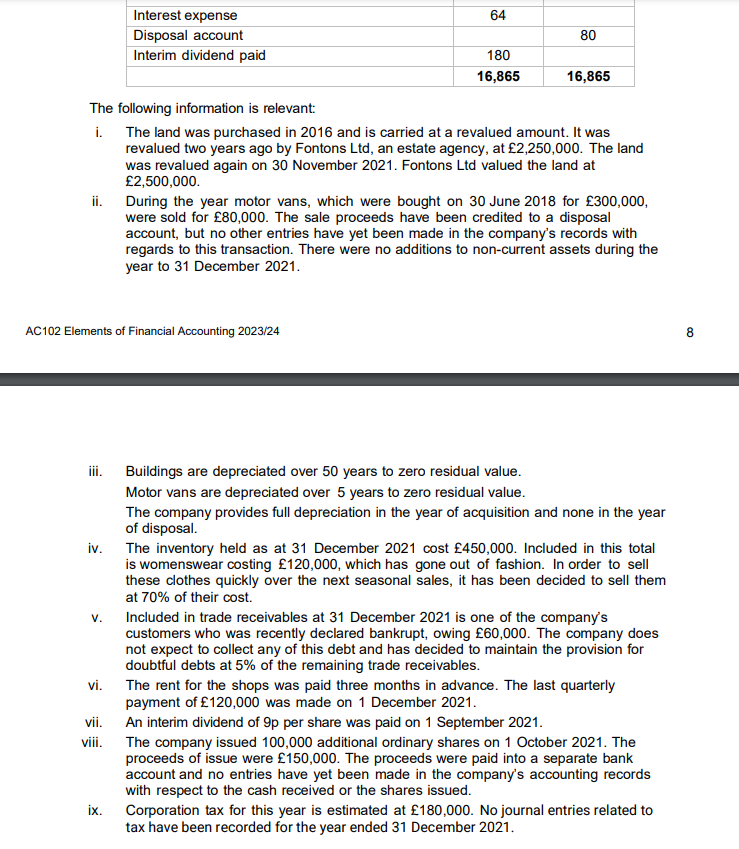

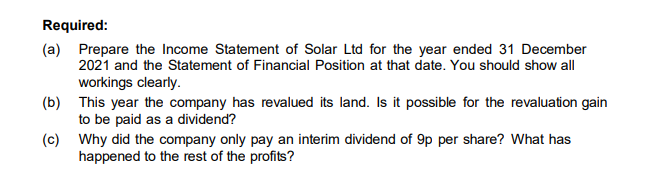

Solar Ltd is a distributor of imported clothes and accessories. The following trial balance was extracted from its accounting records as at 31 December 2021. Trial Balance as at 31 December 2021 Dr Cr 000 000 Land at valuation 2,250 Buildings, cost 3,200 Buildings, accumulated depreciation 1.1.2021 320 Motor vans, cost 1,625 Motor vans, accumulated depreciation 1.1.2021 975 Inventory 1.1.2021 700 Trade receivables 980 Provision for doubtful debts 1.1.2021 80 Cash and cash equivalents 1,239 Trade payables 8% Loan notes (issued 2020, redeemable 2030) 680 800 Share capital (1 ordinary shares) Share premium Revaluation reserve 2,000 1,000 850 Heat and light Retained earnings at 1.1.2021 Sales Purchases Wages and salaries Distribution costs 1,270 8,810 4,155 970 525 350 Rent 555 Rates and insurance 72 Interest expense 64 Disposal account 80 Interim dividend paid 180 16,865 16,865 Interest expense Disposal account Interim dividend paid 64 80 180 16,865 16,865 The following information is relevant: i. ii. The land was purchased in 2016 and is carried at a revalued amount. It was revalued two years ago by Fontons Ltd, an estate agency, at 2,250,000. The land was revalued again on 30 November 2021. Fontons Ltd valued the land at 2,500,000. During the year motor vans, which were bought on 30 June 2018 for 300,000, were sold for 80,000. The sale proceeds have been credited to a disposal account, but no other entries have yet been made in the company's records with regards to this transaction. There were no additions to non-current assets during the year to 31 December 2021. AC102 Elements of Financial Accounting 2023/24 iii. iv. v. vi. vii. viii. ix. Buildings are depreciated over 50 years to zero residual value. Motor vans are depreciated over 5 years to zero residual value. The company provides full depreciation in the year of acquisition and none in the year of disposal. The inventory held as at 31 December 2021 cost 450,000. Included in this total is womenswear costing 120,000, which has gone out of fashion. In order to sell these clothes quickly over the next seasonal sales, it has been decided to sell them at 70% of their cost. Included in trade receivables at 31 December 2021 is one of the company's customers who was recently declared bankrupt, owing 60,000. The company does not expect to collect any of this debt and has decided to maintain the provision for doubtful debts at 5% of the remaining trade receivables. The rent for the shops was paid three months in advance. The last quarterly payment of 120,000 was made on 1 December 2021. An interim dividend of 9p per share was paid on 1 September 2021. The company issued 100,000 additional ordinary shares on 1 October 2021. The proceeds of issue were 150,000. The proceeds were paid into a separate bank account and no entries have yet been made in the company's accounting records with respect to the cash received or the shares issued. Corporation tax for this year is estimated at 180,000. No journal entries related to tax have been recorded for the year ended 31 December 2021. 8 Required: (a) Prepare the Income Statement of Solar Ltd for the year ended 31 December 2021 and the Statement of Financial Position at that date. You should show all workings clearly. (b) This year the company has revalued its land. Is it possible for the revaluation gain to be paid as a dividend? (c) Why did the company only pay an interim dividend of 9p per share? What has happened to the rest of the profits?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer working Cost of Goods Sold COGS Cost of Goods Sold Sales Gross Profit 8810 5480 3330 Deprecia...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started