Answered step by step

Verified Expert Solution

Question

1 Approved Answer

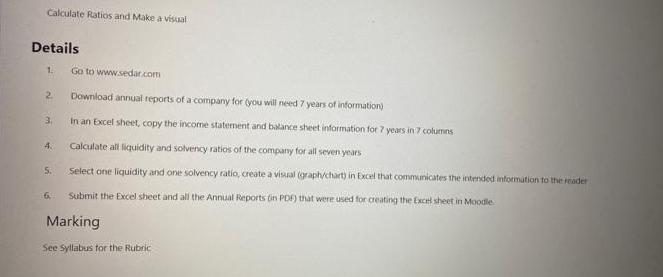

Calculate Ratios and Make a vistal Details 1. Go to www.sedar.com 2. Download annual reports of a company for you will need 7 years

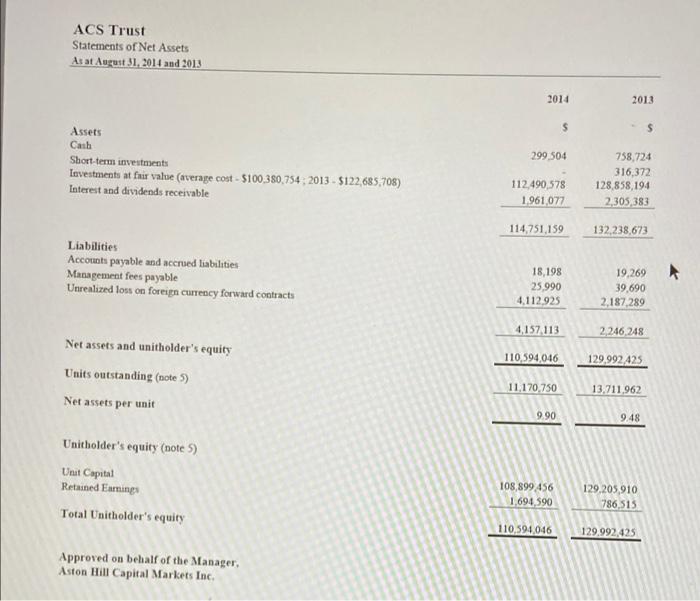

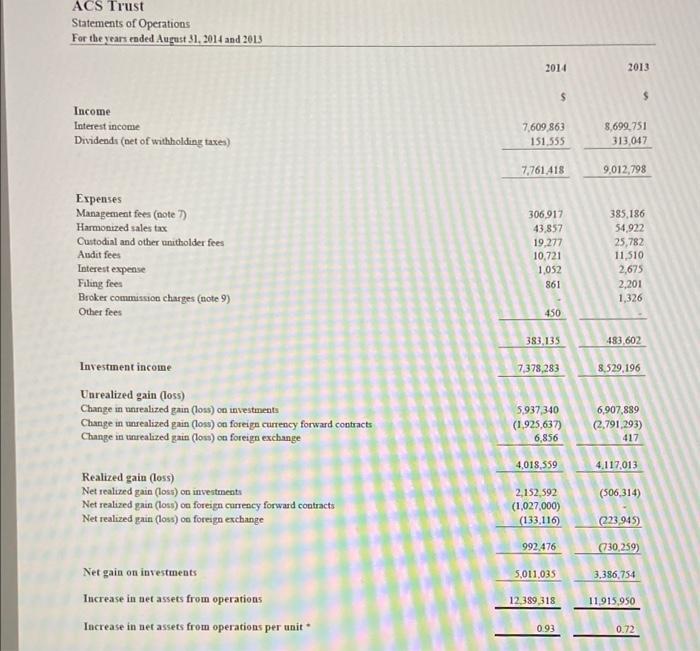

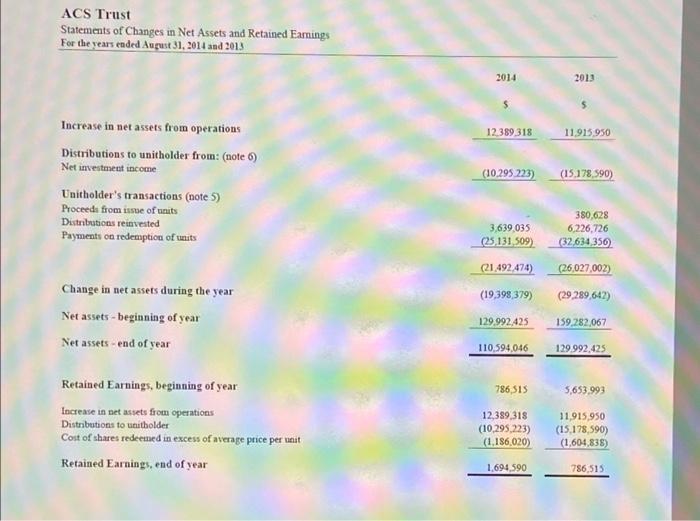

Calculate Ratios and Make a vistal Details 1. Go to www.sedar.com 2. Download annual reports of a company for you will need 7 years of information) 3. In an Excel sheet, copy the income statement and balance sheet information for 7 years in 7 columns Calculate all liquidity and solvency ratios of the company for all seven years 4. 5. Select one liquidity and one solvency ratio, create a visual (graphychart) in Excel that communicates the intended information to the reader 6 Submit the Excel sheet and all the Annual Reports in PDF) that were used for creating the Excel sheet in Moodle Marking See Syllabus for the Rubric ACS Trust Statements of Net Assets As at August 31, 2014 and 2013 2014 2013 Assets Cash 299 504 758,724 Short-term investments Investments at fair value (average cost - $100 380,754 2013 - $122,685,708) 316,372 112,490,578 128,858,194 Interest and dividends receivable 1,961,077 2,305,383 114,751,159 132,238,673 Liabilities Accounts payable and accrued liabilities Management fees payable Unrealized loss on foreign currency forwar 18,198 25,990 4,112,925 19,269 39,690 2,187,289 d contracts 4,157,113 2,246,248 Net assets and unitholder's equity 110,594,046 129,992,425 Units outstanding (note 5) 11,170,750 13,711,962 Net assets per unit 9.90 948 Unitholder's equity (note 5) Unit Capital Retained Earnings 108,899 456 1.694 590 129.205,910 786,515 Total Unitholder's equity 110,594,046 129.992,425 Approved on behalf of the Manager, Aston Hill Capital Markets Inc. ACS Trust Statements of Operations For the years ended August 31, 2014 and 2013 2014 2013 4. Income Interest income Dividends (net of withholding taxes) 7,609 863 8,699,751 151,555 313,047 7,761418 9,012,798 xpenses Management fees (note 7) Harmonized sales tax 306,917 385,186 43,857 54,922 Custodial and other unitholder fees Audit fees 25,782 11,510 19,277 10,721 Interest expense Filing fees Broker commission charges (note 9) Other fees 1,052 2,675 861 2,201 1,326 450 383,135 483,602 Investment income 7,378,283 8,529,196 Unrealized gain (loss) Change in unrealized gain (loss) on investments Change in unrealized gain (loss) on foreign currency forward contracts Change in unrealized gain (los) on foreign exchange 5,937,340 6,907,889 (2,791,293) (1,925,637) 6,856 417 4,018,559 4.117,013 Realized gain (loss) Net realized gain (loss) on investments Net realized gain (loss) on foreign currency forward contracts Net realized gain (los) on foreign exchange 2,152,592 (506,314) (1,027,000) (133.116) 223,945) 992.476 730,259) Net gain on investments 5,011,035 3.386.754 Increase in net assets from operations 12,389,318 11.915,950 Increase in net assets from operations per unit 093 0.72 ACS Trust Statements of Changes in Net Assets and Retained Earnings For the years ended August 31, 2014 and 2013 2014 2013 Increase in net assets from operations 12,389 318 11,915 950 Distributions to unitholder from: (note 6) Net investment income (10.295 223) (15.178,590) Unitholder's transactions (note 5) Proceeds from issue of units Distributions reinvested Payments on redemption of units 380,628 6,226,726 3,639,035 (25.131,509) (32,634,356) (21.492,474) (26,027,002) Change in net assets during the year (19,398,379) (29289,642) Net assets - beginning of year 129,992,425 159,282.067 Net assets - end of year 110,594,046 129.992,425 Retained Earnings, beginning of year 786,515 5,653,993 Increase in net assets from operations Distrabutions to unitholder 12,389,318 11,915,950 (10,295,223) (1,186,020) (15,178,590) (1,604,838) Cost of shares redeemed in excess of average price per unit Retained Earnings, end of year 1,694,590 786,515

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

2015 2014 2013 2012 2011 Assets Current assets Cash 2304974 299504 758724 699052 1193484 Shortterm investments 316372 Financial assets at fair value through profit or loss 100466340 112490578 12885819...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6285e89f4d027_Book2456.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started