Question

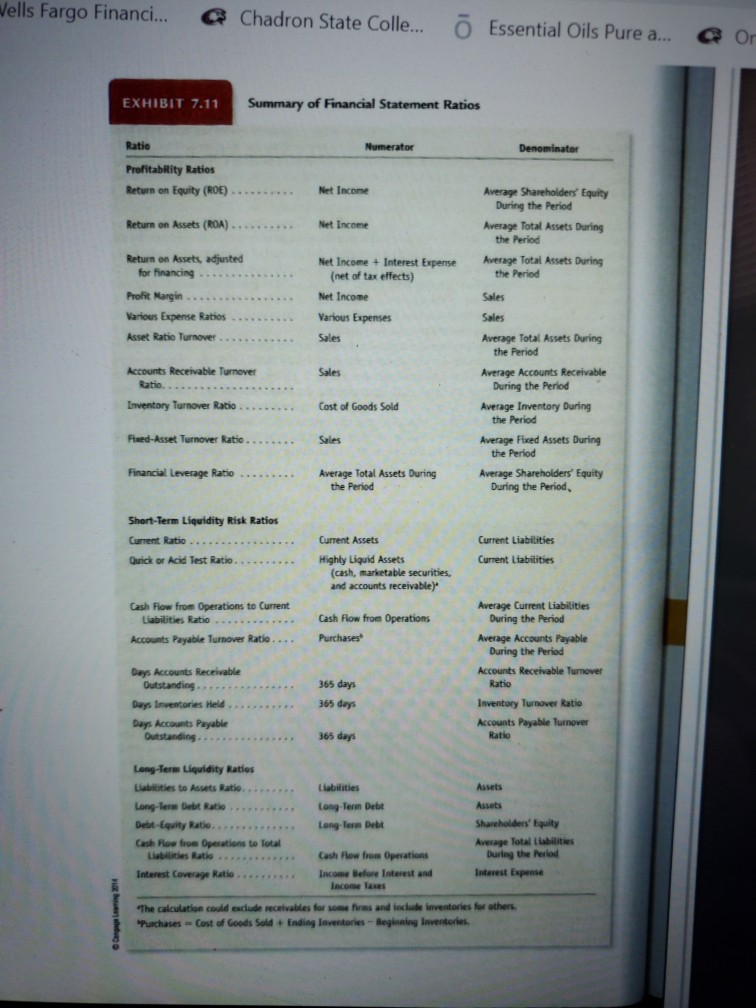

calculate ratios for the current & previous year, using the ratios described on Exhibit 7.11 on page 244 of the scanned chapter. Only 1 group

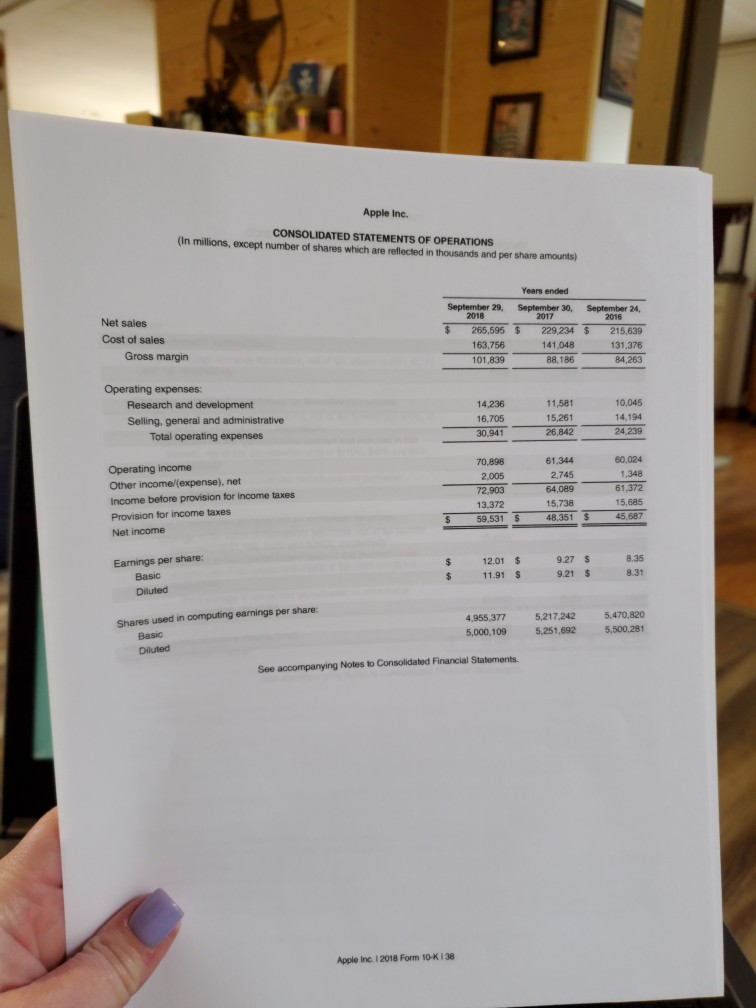

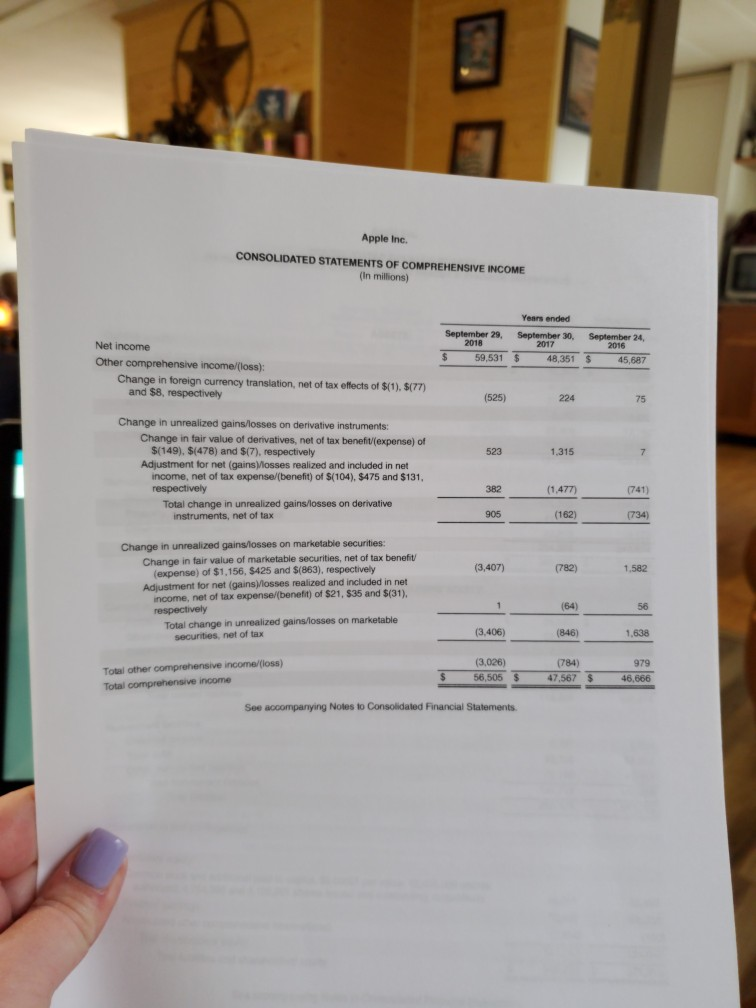

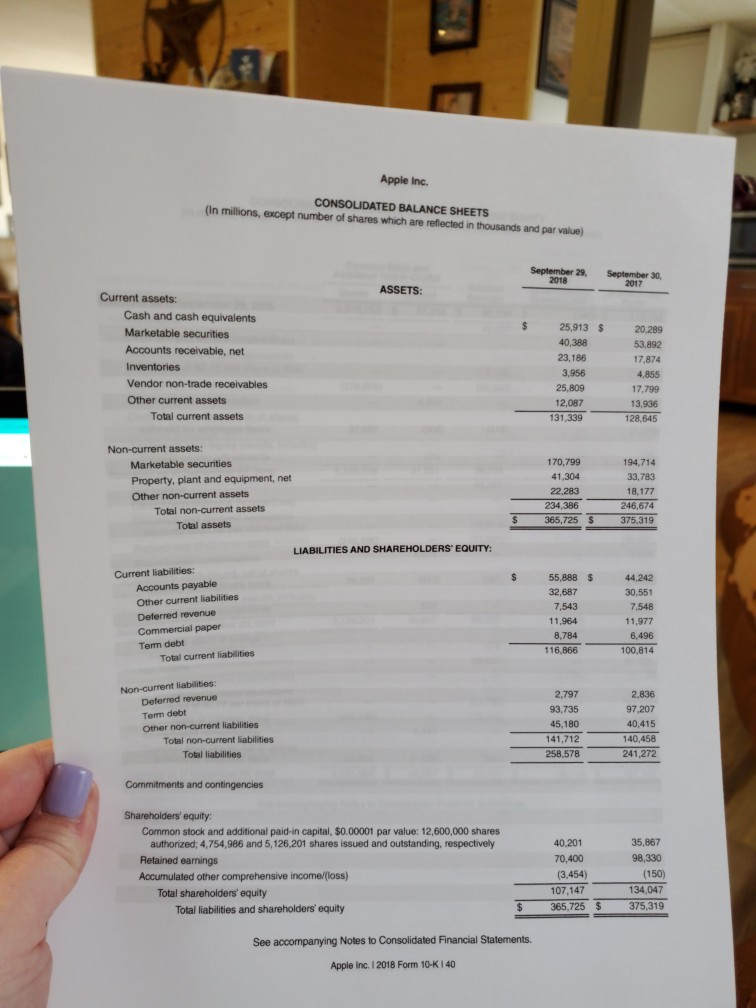

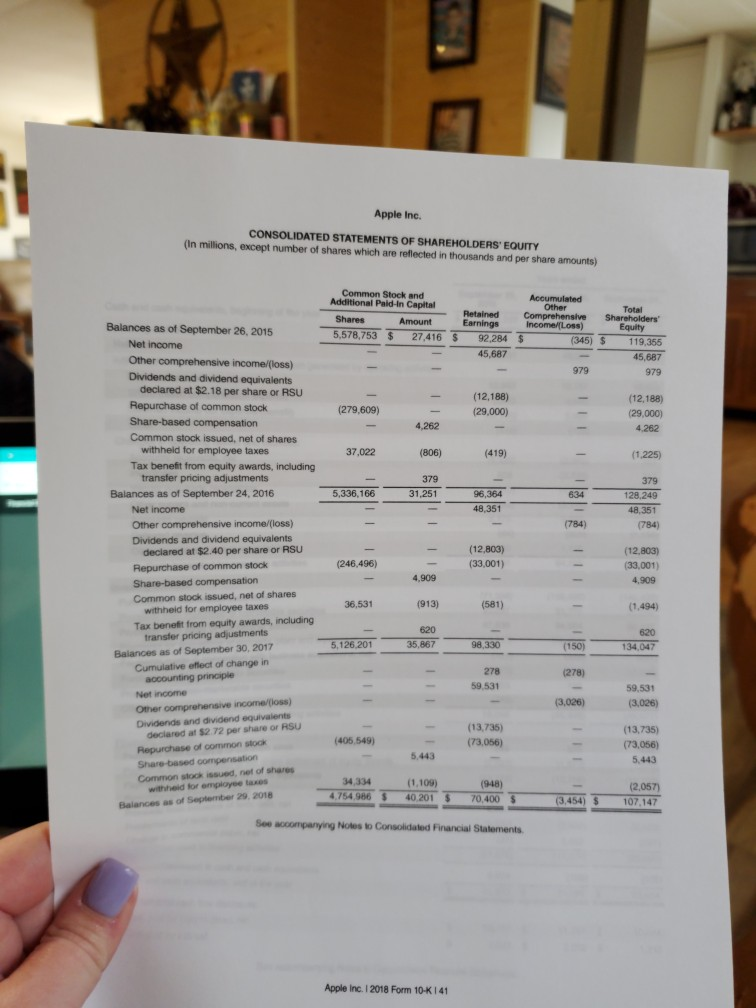

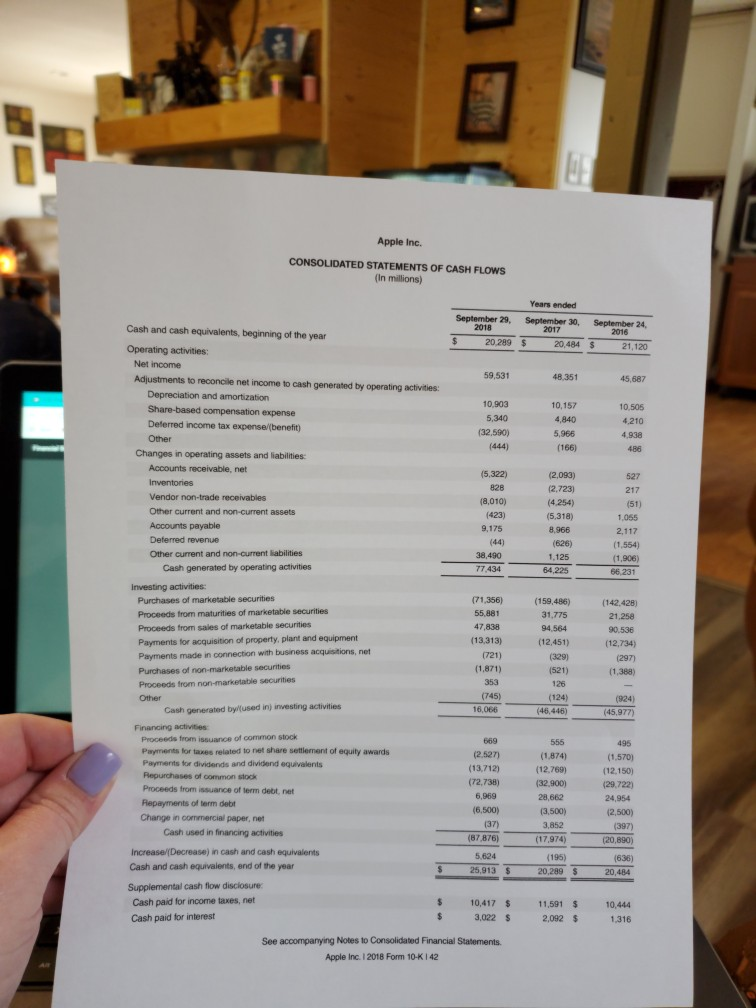

calculate ratios for the current & previous year, using the ratios described on Exhibit 7.11 on page 244 of the scanned chapter. Only 1 group member should submit the assignment. Please show you work.September 2017, and September 2018 is what we are comparing. on the 10k for Apple Inc. Asset Ratio Turnover, Accounts Receivable Turnover Ratio, Inventory Turnover Ratio, Fixed Asset Turnover Ratio, Financial Leverage Ratio. These are what I need to figure in bold from the 10K on the items I uploaded for you.

I need to calculate the asset ratio turnover, accounts receivable turnover ratio, inventory turnover ratio, fixed asset turnover ratio, financial leverage ratio for Apple Inc. I have uploaded the 10k information on the financial reports to answer these questions.

ells Fargo Financi.... Chadron State Colle... Essential Oils Pure a... Or EXHIBIT 7.11 Summary of Financial Statement Ratios Ratio Profitability Ratios Average Shareholders Equity Average Total Assets During Net Income + Interest Expense Average Total Assets During During the Period Return on Assets (ROA)...Net Income the Period Return on Assets, adjusted for financing the Period Sales Sales Average Total Assets During (net of tax effects) Various Expense Ratios....Various Expenses Asset Ratio Turnover Sales the Period Accounts Receivable Turnover Sales Average Accounts Receivable Average Inventory During Average Fixed Assets During Average Shareholders Equity Ratio. During the Period Inventory Turnover Ratio ......Cost of Goods Sold the Period Sales the Period Financial Leverage Ratio Average Total Assets During the Period During the Period Short-Term Liquidity Risk Ratios Current Ratio . . Quick or Acid Test Ratio Current Assets Current Liabilities Highly Liquid Assets Current Liabilities (cash, marketable securities, and accounts receivable) Average Current Liabilities During the Period Average Accounts Payable During the Period Cash Flow from Operations to Current Liabilities Ratio . . . . . . Cash Flow from Operations . Accounts Payable Turnover Ratio.... Purchases Days Accounts Receivable Days Inventories Held Accounts Receivable Turnover 365 days Ratio Inventory Turmover Ratio Accounts Payable Turnover A365 days Days Accounts Payable Ratio ...365 days Long-Term Liquidity Ratios Assets Shareholders Equity Avesage Total Liabilities Long-Term Debt Debt-Equity Ratio Cash Flow rom Operations to Total Long-lerm Debt Cash Flow from Operations During the Period Interest Expense Liabilities Ratio Income Before Interest and Iscome Taxes The calculation could esclude receivables for some firms and include inventories for others Purchases-Cost of Goods Sold+ Ending lnventories-Beginning Iaventories Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 29, 2018 September 30, 2017 September 24, 2016 Net sales 265,595 229234 215,639 Cost of sales 141,048 163,756 101,839 131,376 84,263 Gross margin 88.186 Operating expenses: 14,236 16,705 30,941 11,581 15,261 26,842 10,045 14.194 24,239 Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income 70,898 2,005 72,903 13.372 61,34460.024 1,348 51,372 2,745 64,089 15,738 15,685 59,531 48,351 45.687 $ 12.01 927 $ 8.35 8.31 Earnings per share: 11.91 S 9.21 $ Basic Diluted r share 4.955,377 5,217,242 5,470,820 5,251,692 n computing earnings per 5,000,109 5,500,281 Basic Diluted Notes to Consolidated Financial Statements. Apple inc. 12018 Form 10-K 138 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended Net income 2017 $ 59,53148,351$45,687 Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $(1), $(77) and $8, respectively (525) 224 75 Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(149), $(478) and $(7), respectively 523 1315 Adjustment for net (gains Mosses realized and included in net income, net of tax expense/(benefit) of S(104), $475 and $131, 382 (1.477 741) Total change in unrealized gains/losses on derivative instruments, net of tax 905 (162) (734) Change in unrealized gainsosses on marketable securities: Change in fair value of marketable securities, net of tax benefit ncome, net of tax expense/(benefit) of $21, $35 and $(31), Total change in unrealized gainslosses on marketable (3,407) (782) 1,582 (expense) of $1,156, $425 and $(863), respectively Adjustment for net (gains)Mlosses realized and included in net (64) (846) (784) 56 (3,406) 1,638 securities, net of tax (3,026) $ 56,505 47,567 S 46.666 979 Totai other comprehensive Total See accompanying Noles to Consolidaled Financial Statements Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 29, September 30, ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets $ 25,913 S 20,289 40,388 23,186 3,956 53,892 17,874 4,855 17,799 13,936 128,645 Total current assets 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets 170,799 41,304 22,283 234,386 365,725 S 194,714 33,783 18,177 246,674 375,319 Total non-current assets Total assets LIABILITIES AND SHAREHOLDERS EQUITY: Current liabilities: S Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt 32,687 7,543 11,964 8,784 116,866 55,888 $44.242 30,551 7,548 11,977 6,496 100,814 Total current liabilities Deferred revenue Term debt Other non-current liabilities 2,797 93,735 45,180 141,712 258,578 2,836 97,207 40,415 140,458 241,272 Total non-current liabilities Total liabilities Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,754,986 and 5,126,201 shares issued and outstanding, respectively Retained earnings 35,867 98,330 70,400 (3,454) 107,147 Accumulated other comprehensive income/(loss) 134,047 Total shareholders' equity Total liabilities and shareholders' equity $ 365,725 375,319 See accompanying Notes to Consolidated Financial Statements. Apple inc. I2018 Form 10-K 40 Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS Eaury (In millions, except number of shares which are reflected in thousands and per share amounts) Common Stock and Additional Paid-in Capital Total Retained Comprehensive Shareholders Balances as of September 26, 2015 5,578,753 27,416 S 92,284 S (345) 119,355 Net income Other comprehensive income/(loss) Dividends and dividend equivalents 45,687 45,687 979 declared at $2.18 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of shares (12,188) (29,000) (12,188) (29,000) (279,609) 4,262 4,262 withheld for employee taxes 37,022 (806) (419) (1,225) Tax benefit from equity awards, including transfer pricing adjustments 379 Balances as of September 24, 2016 5,336,166 96,364 634 128,249 Net income Other comprehensive income/(loss) Dividends and dividend equivaients (784) (784) declared at $2.40 per share or RSU Repurchase of common stock (12.803) (33,001) 4,909 (246,496) (33,001) 4,909 Common stock issued, net of shares 36,531 (913) (581) withheid for employee taxes Tax benefit from equity awards, including 620 134.047 transfer pricing adjustments 5,126.201 35,867 98.330 (150) Balances as of September 30, 2017 Cumulative eflect of change in 278 aocounting principle Net income Other comprehensive income/(loss) Dividends and dividend equivaients 59.531 59,531 (3,026) deciared at $2 72 per share or RSU Repurchase of common stook (13,735) (73.066) (13,735) (73,056) 5,443 (406.549) 5,443 Common slock issued, net of shares (1,109) 4.754 986 40.201 S 70,400 34,334 (948) (2,057) 3,454) $ 107,147 See accompanyrg Notes Consoloated Francia! Statements. Apple Inc. I 2018 Form 10-K 141 Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year Adjustments to reconcile net income to cash generated by operating activities Other current and non-current assets Other current and non-curent iabilities Cash generated by operating activities Proceeds from maturities of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net 16,066 Cash generated bylused in) investing activities Proceeds from issuance of common stocik Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Proceeds from issuance of term debt, net Cash used in financing activities Increase (Decrease) in cash and cash equivalents Cash and cash equivaients, end of the year See accompanying Notes to Consolidated Financial Statements Apple Inc. 12018 Form 10-K I42Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started