Answered step by step

Verified Expert Solution

Question

1 Approved Answer

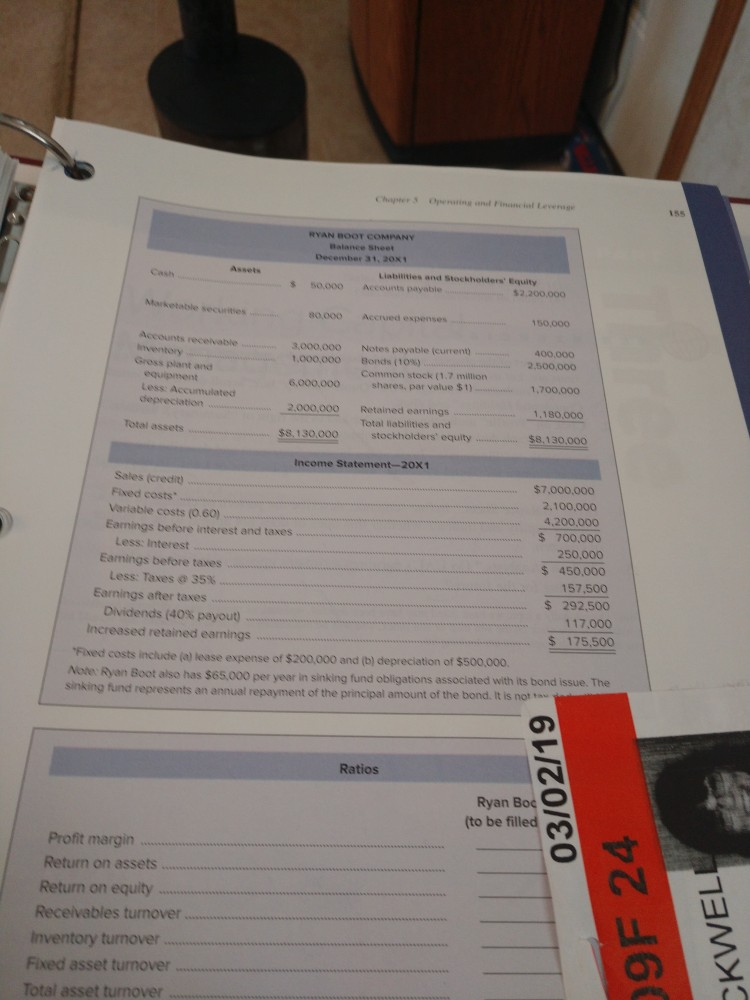

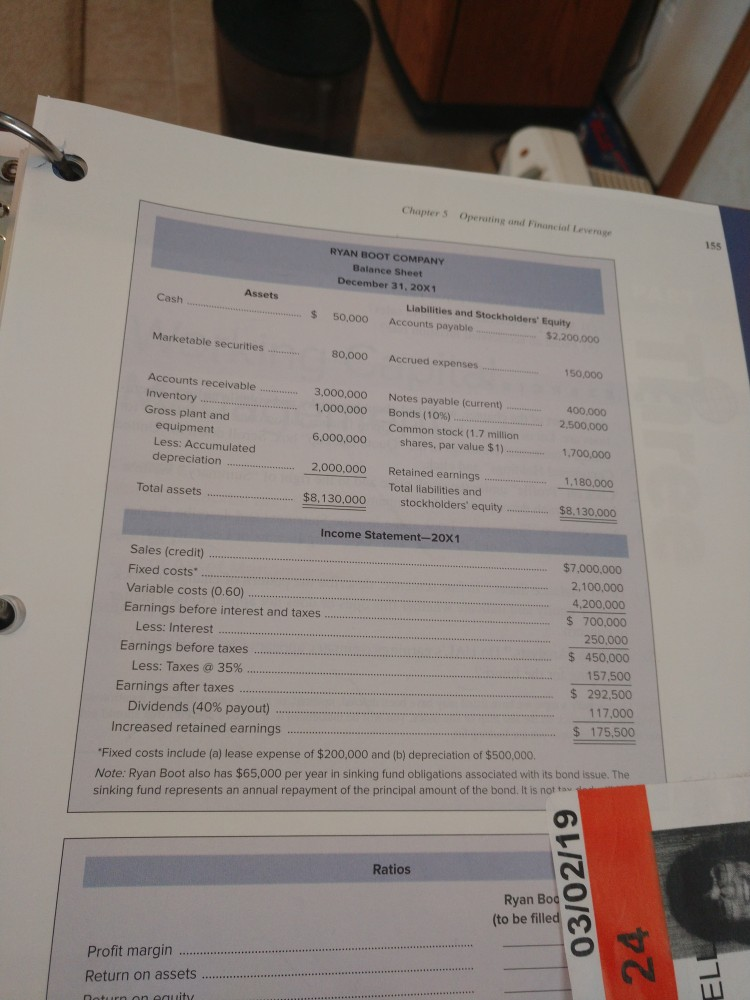

calculate Ryan's break-even points in units. find Ryan's degree of financial leverage. use your answer to part b to predict Ryan CPS if ebit is

calculate Ryan's break-even points in units. find Ryan's degree of financial leverage. use your answer to part b to predict Ryan CPS if ebit is forecast to rise by 20%

155 RYAN BOOT COMPANY Balance Sheet ber 31, 2oxt s s0,000 Accounts payable 80.000 Accued espenses 150,000 3,000.000 Notes payable (current 400.00O 1.000.000 6,000.0oo 2.000.000 Bonds ( 10%) Common stock (1.7 million 2.500,000 Gress plant and equipment 1,700,000 1.180,00o $8.130,000 shares, par value $ 1) Retained earnings Total iabilities and Total assets $8 130.000 Income Statement-20x1 Sales (credit) Fixed costs Variable costs (0.60) Earnings before interest and taxes $7,000,000 2.100,000 4,200,000 $ 700,000 Less: Interest Eamings before taxes 250,000 $ 450,000 mm4 157.500 s 292.500 117.000 mmmsm$ 175,500 Less: Taxes @ 35% Earnings after taxes Dividends (40% payout) Increased retained earnings .. Fived costs include (o) kease expense of $200.000 and (b) depreciation of $500,000. Note: Ryan Boot also has $65,000 per year in sinking fund obligations sinking fund represents an annual repayment of the principal amount of associated with its bond issue. The the bond.It is not u Ratios Ryan Boc (to be filled Profit margin Return on assets Return on equity Receivables turnover inventory turnover Fixed asset turnover Total asset turnover Chapter 5 Operating and Financial Levernge 155 RYAN BOOT COMPANY Balance Sheet December 31, 20X1 Assets Cash Liabilities and Stockholders' Equity $ 50,000 Accounts payable $2,200,000 Marketable securities 80,000 Accrued expenses 50,000 Accounts receivable Inventory Gross plant and 3,000,000 1,000.000 6,000,000 Notes payable (current) Bonds (10%) Common stock (1.7 million 400.000 2,500,000 equipment Less: Accumulated depreciation shares, par value $1 1,700,000 2000,000 Retained earnings Total liabilities and 1,180,000 Total assets .$8,130,000 stockholders' equity.. $8.130,000 Income Statement-20X1 Sales (credit) Fixed costs Variable costs (0.60 Earnings before interest and taxes $7,000,000 2,100,000 4,200,000 $ 700,000 250,000 $ 450,000 157,500 $ 292,500 term.ne mor.. Less: Interest Earnings before taxes. Less: Taxes @ 35% Earnings after taxes 117,000 Dividends (40% payout) $ 175,500 Increased retained earnings Fixed costs include (a) lease expense of $200,000 and (b) depreciation of $500,000. Note: Ryan Boot also has $65,000 per year in sinking fund obligations associated with its bond issue. The sinking fund represents an annual repayment of the principal amount of the bond. It is not taw Ratios Ryan Bod to be fille Profit margin Return on assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started