Answered step by step

Verified Expert Solution

Question

1 Approved Answer

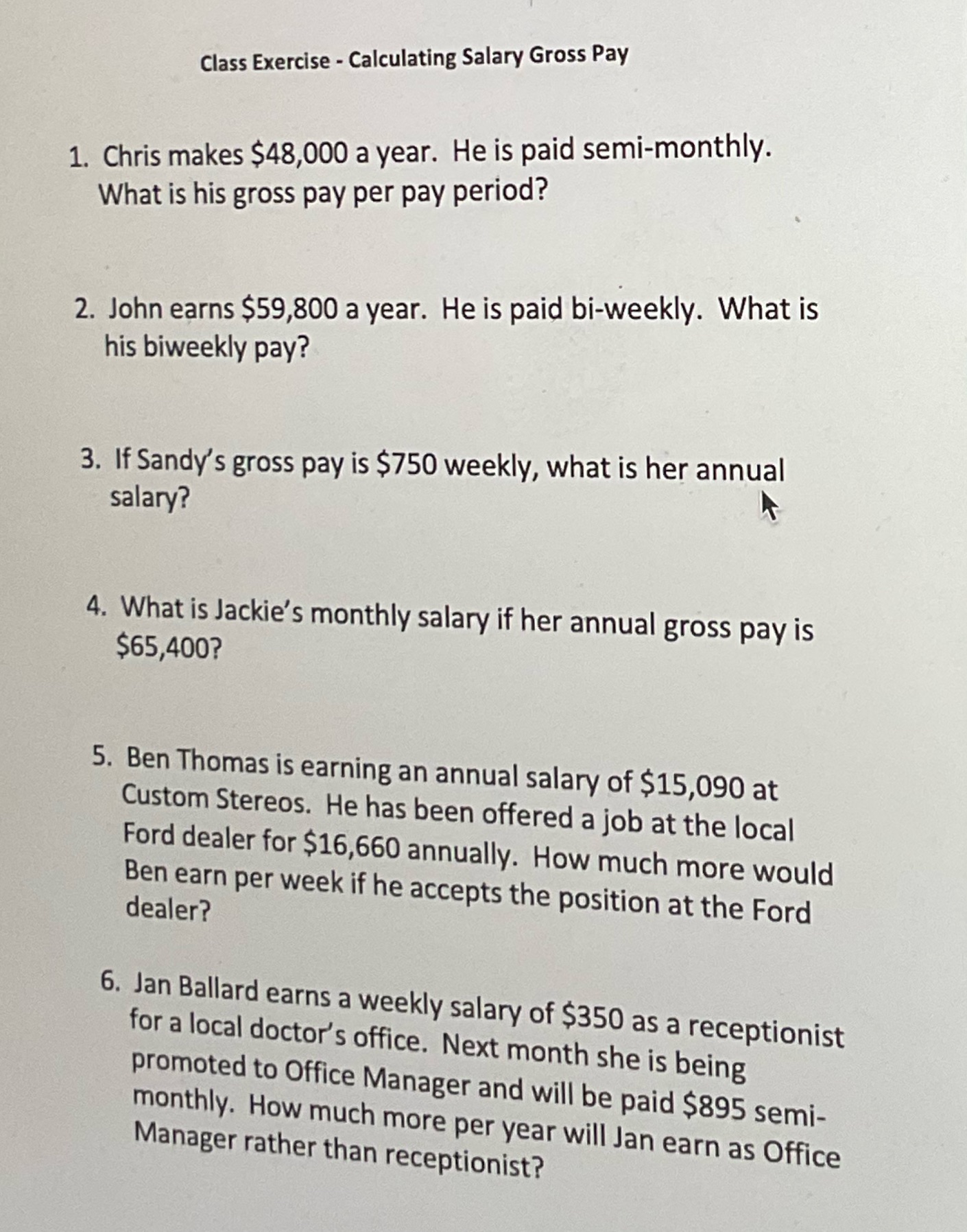

Calculate salary gross pay with the canadian claim code Class Exercise - Calculating Salary Gross Pay 1. Chris makes $48,000 a year. He is paid

Calculate salary gross pay with the canadian claim code

Class Exercise - Calculating Salary Gross Pay 1. Chris makes $48,000 a year. He is paid semi-monthly. What is his gross pay per pay period? 2. John earns $59,800 a year. He is paid bi-weekly. What is his biweekly pay? 3. If Sandy's gross pay is $750 weekly, what is her annual salary? 4. What is Jackie's monthly salary if her annual gross pay is $65,400? 5. Ben Thomas is earning an annual salary of $15,090 at Custom Stereos. He has been offered a job at the local Ford dealer for $16,660 annually. How much more would Ben earn per week if he accepts the position at the Ford dealer? 6. Jan Ballard earns a weekly salary of $350 as a receptionist for a local doctor's office. Next month she is being promoted to Office Manager and will be paid $895 semi- monthly. How much more per year will Jan earn as Office Manager rather than receptionist?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Chris SemiMonthly Gross Pay per Pay Period 48000 24 2000 2 John BiWee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started