Question

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of$12,600. He is single and claims 1 deduction. Before

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of$12,600. He is single and claims 1 deduction. Before his payroll,

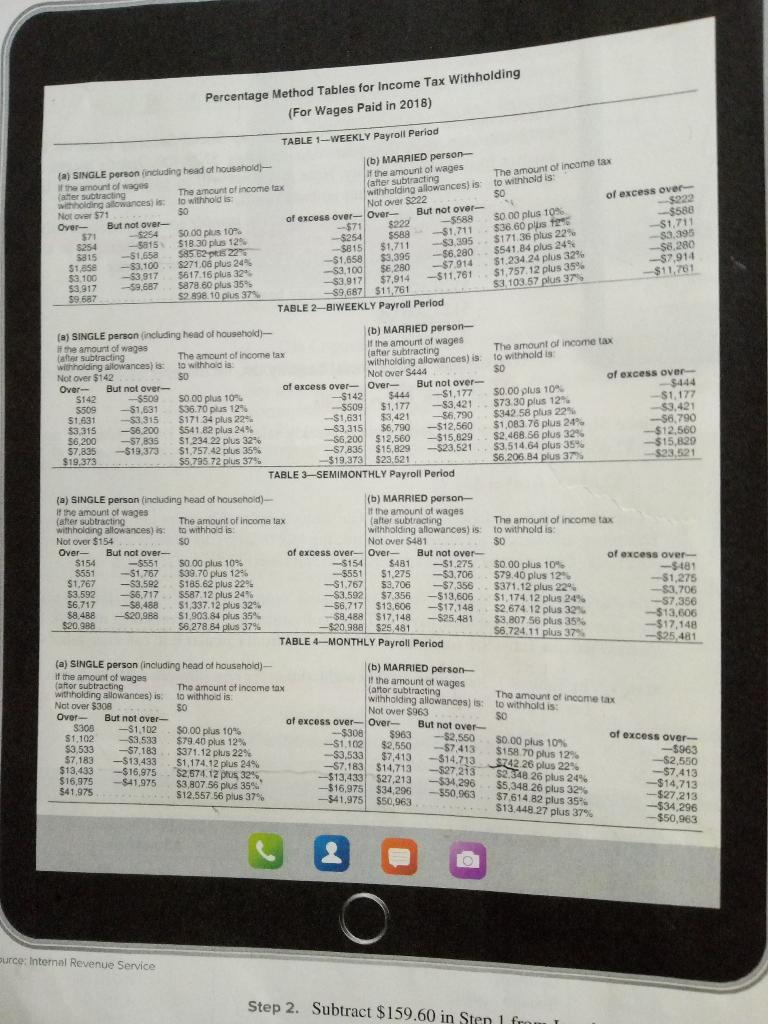

Barrett’s cumulative earnings were $128, 030. (Social Security maximum is 6.2% on. $128,400 and Medicare is 1.45%) Calculate FIT by the percentage method. (Use Table 9.1 and Table 9.2) (Round your answers to 2 decimal places).

FIT:

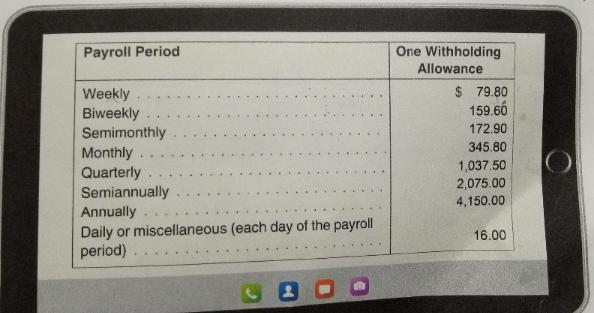

Payroll Period One Withholding Allowance $ 79.80 159.66 Weekly Biweekly Semimonthly 172.90 345.80 Monthly. Quarterly Semiannually 1,037.50 2,075.00 4,150.00 Annually Daily or miscellaneous (each day of the payroll period) 16.00

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Federal income tax withholding use percentage method table for monthly and sin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2016 Edition

Authors: Sally Jones, Shelley Rhoades Catanach

19th Edition

1259549259, 978-1259618536, 1259618536, 978-1259549250

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App