calculate ten financial ratios for the years attached

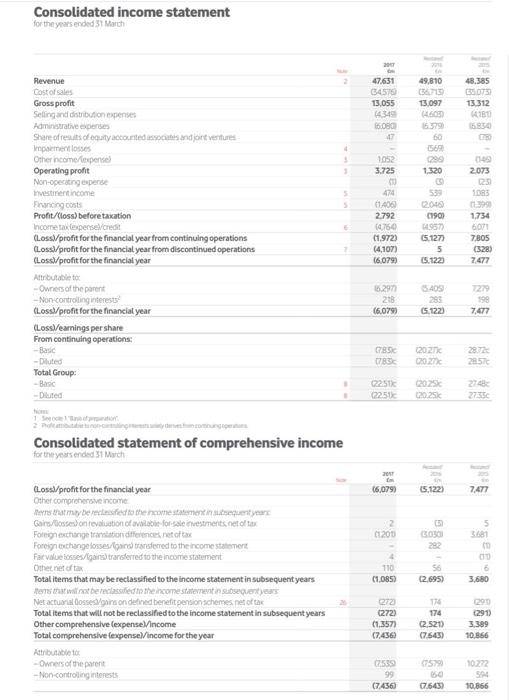

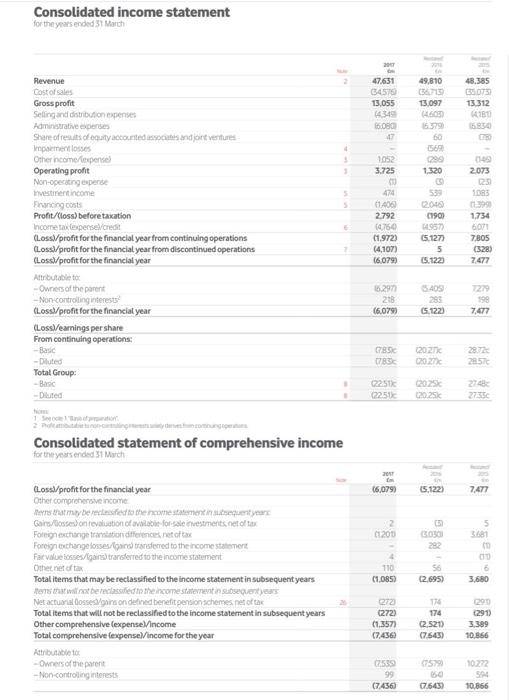

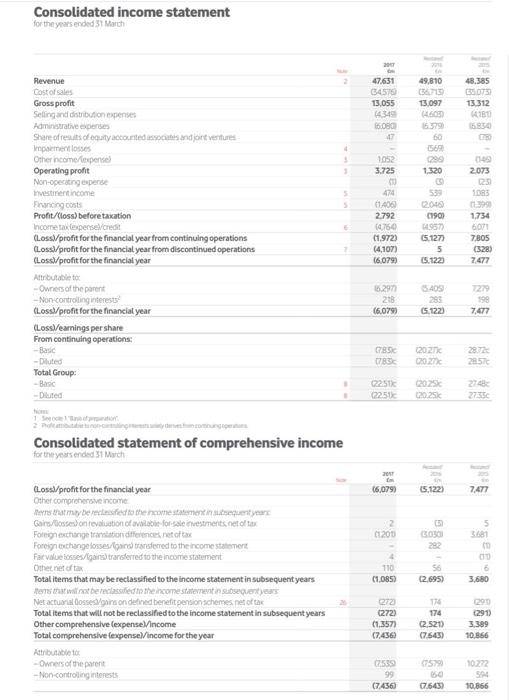

Consolidated income statement for the years ended 31 March 49,810 47.631 034570 13.055 4349 16.080 1 48.385 3507 13.312 13.097 60 299 1.320 3.725 2073 Revenue Cost of sales Gross profit Selingand distribution expenses Administrative expenses Share of results of coaty accounts and joint ventures Impamentos Other income/expenses Operating profit Non-operating expense vestment income Francing costs Profit/loss) before taxation Income tax expense/credit (Lossl/profit for the financial year from continuing operations (Loss/profit for the financial year from discontinued operations Lossl/profit for the financial year Attributable to - Owners of the parent -Non-controlling interests (Lossl/profit for the financial year (Loss/earnings per share From continuing operations -Basic -Duted Total Group: - Basic -Diluted 474 1.400 2.792 14750 (1972) (4,107) (6079) 538 2015 6190 4957 (5.127) 5 15.1223 1,734 6071 7.805 (328) 7477 5297 218 (6.079) 5409 23 29 198 7,477 65.122) 0785 7 (202) 00 2872 2857 2251 2250 2025 0202 2735 Consolidated statement of comprehensive income for the years ended 31 March 16,0799 65,122) 7,477 2 (1200 co 5 361 00 Loss/profit for the financial year Other comprehensive income terrestat may be rectified to the western steuery Gains/Bosses on evaluation of ville for sale investments.net Foreign exchange ratindifferences of tax Foreign change losses/land transferred to the income statement Farve bosses/gain transferred to the income statement Othet niet of tax Total items that may be reclassified to the income statement in subsequent years entire recited to the income statement in subsequentes Net actuaria ossegins on defined benefit pension schemes.net of tax Total items that will not be reclassified to the income statement in subsequent years Other comprehensive expense/income Total comprehensive expensel/income for the year Attributable to - Owners of the parent -Non controlling interests 110 (1.085) 56 (2.695) 6 3.680 272 (272) (1.357) (7.436 174 (2.520 (7.5431 (291) 3.389 10.866 0579 CASES 99 (7.4560 10272 504 10,866 7.643) Consolidated income statement for the years ended 31 March 49,810 47.631 034570 13.055 4349 16.080 1 48.385 3507 13.312 13.097 60 299 1.320 3.725 2073 Revenue Cost of sales Gross profit Selingand distribution expenses Administrative expenses Share of results of coaty accounts and joint ventures Impamentos Other income/expenses Operating profit Non-operating expense vestment income Francing costs Profit/loss) before taxation Income tax expense/credit (Lossl/profit for the financial year from continuing operations (Loss/profit for the financial year from discontinued operations Lossl/profit for the financial year Attributable to - Owners of the parent -Non-controlling interests (Lossl/profit for the financial year (Loss/earnings per share From continuing operations -Basic -Duted Total Group: - Basic -Diluted 474 1.400 2.792 14750 (1972) (4,107) (6079) 538 2015 6190 4957 (5.127) 5 15.1223 1,734 6071 7.805 (328) 7477 5297 218 (6.079) 5409 23 29 198 7,477 65.122) 0785 7 (202) 00 2872 2857 2251 2250 2025 0202 2735 Consolidated statement of comprehensive income for the years ended 31 March 16,0799 65,122) 7,477 2 (1200 co 5 361 00 Loss/profit for the financial year Other comprehensive income terrestat may be rectified to the western steuery Gains/Bosses on evaluation of ville for sale investments.net Foreign exchange ratindifferences of tax Foreign change losses/land transferred to the income statement Farve bosses/gain transferred to the income statement Othet niet of tax Total items that may be reclassified to the income statement in subsequent years entire recited to the income statement in subsequentes Net actuaria ossegins on defined benefit pension schemes.net of tax Total items that will not be reclassified to the income statement in subsequent years Other comprehensive expense/income Total comprehensive expensel/income for the year Attributable to - Owners of the parent -Non controlling interests 110 (1.085) 56 (2.695) 6 3.680 272 (272) (1.357) (7.436 174 (2.520 (7.5431 (291) 3.389 10.866 0579 CASES 99 (7.4560 10272 504 10,866 7.643)