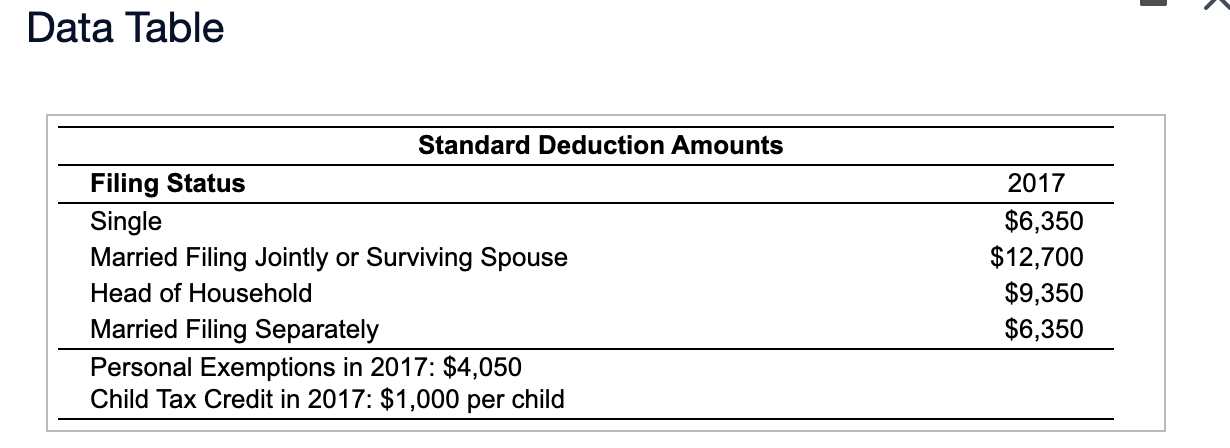

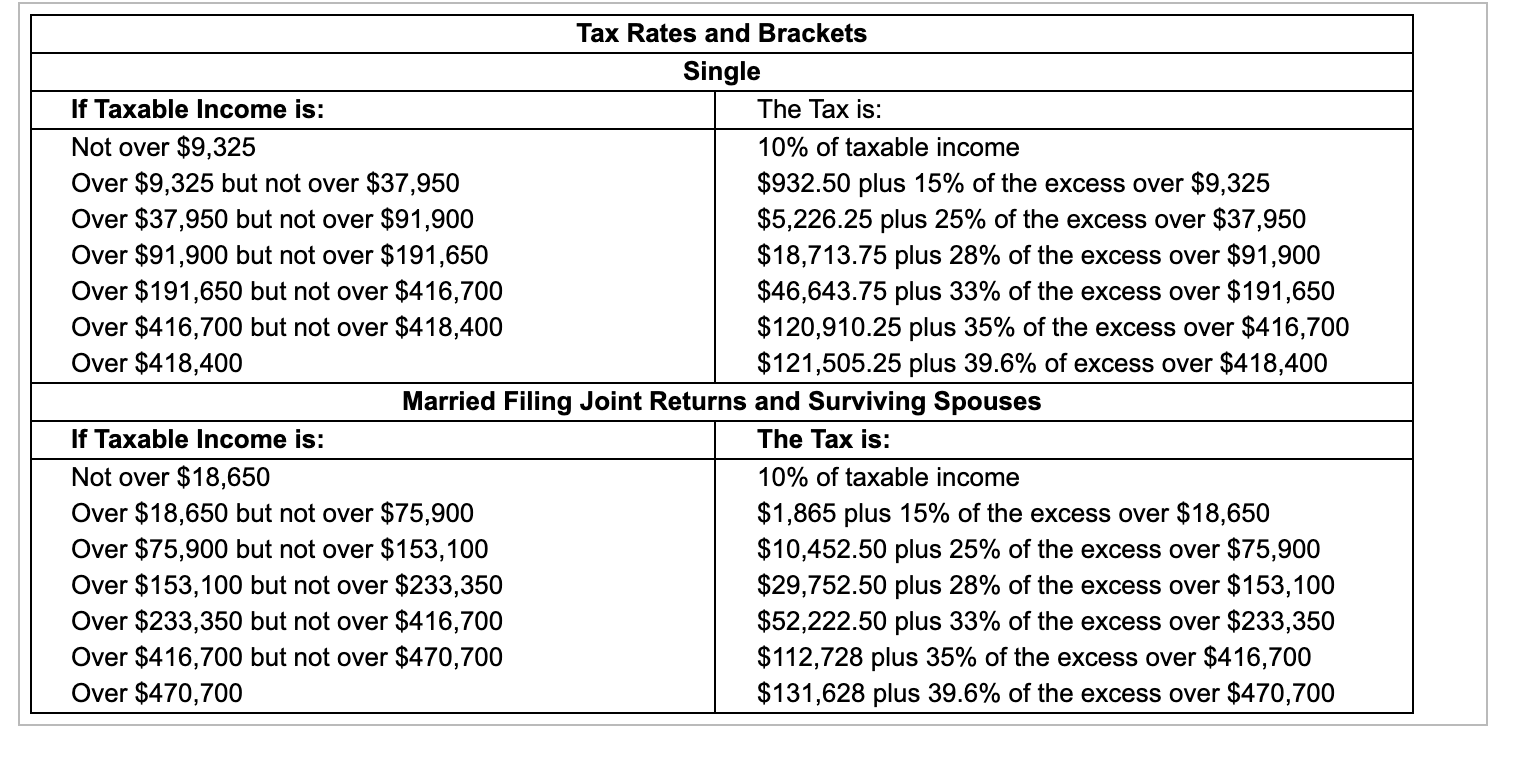

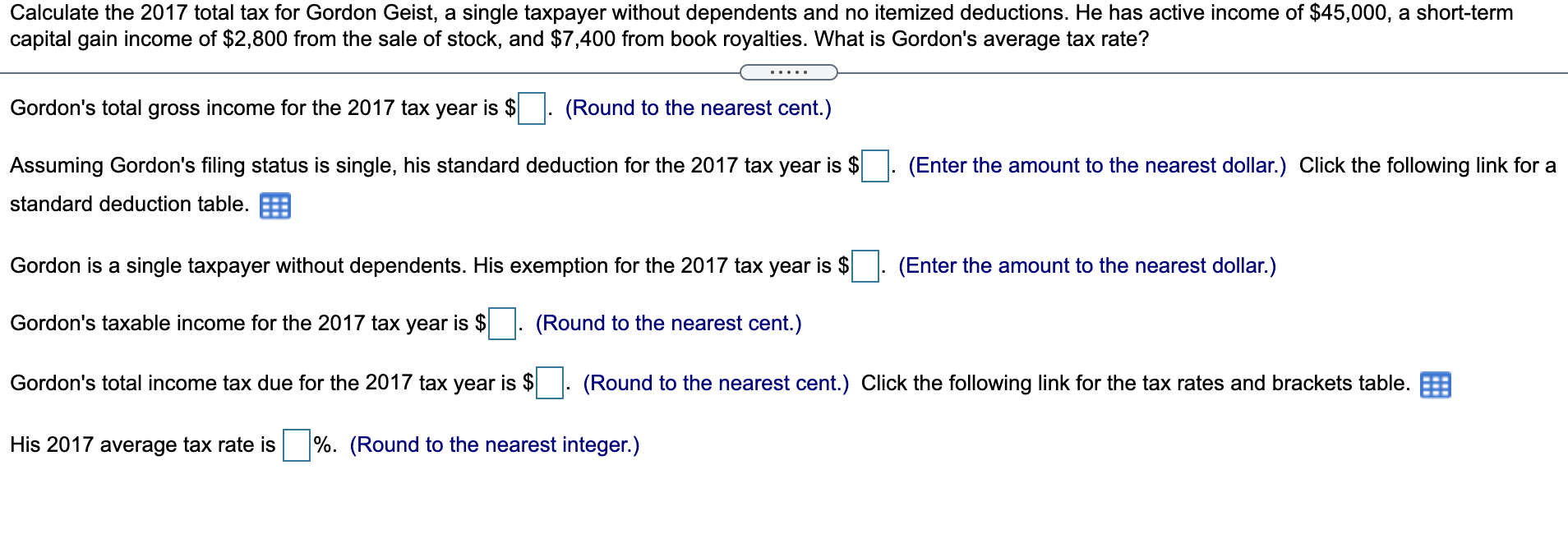

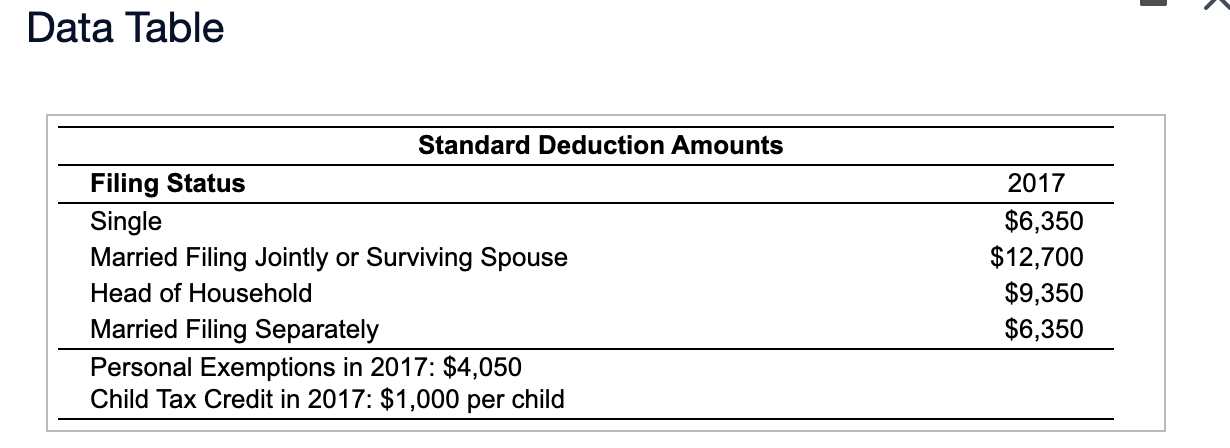

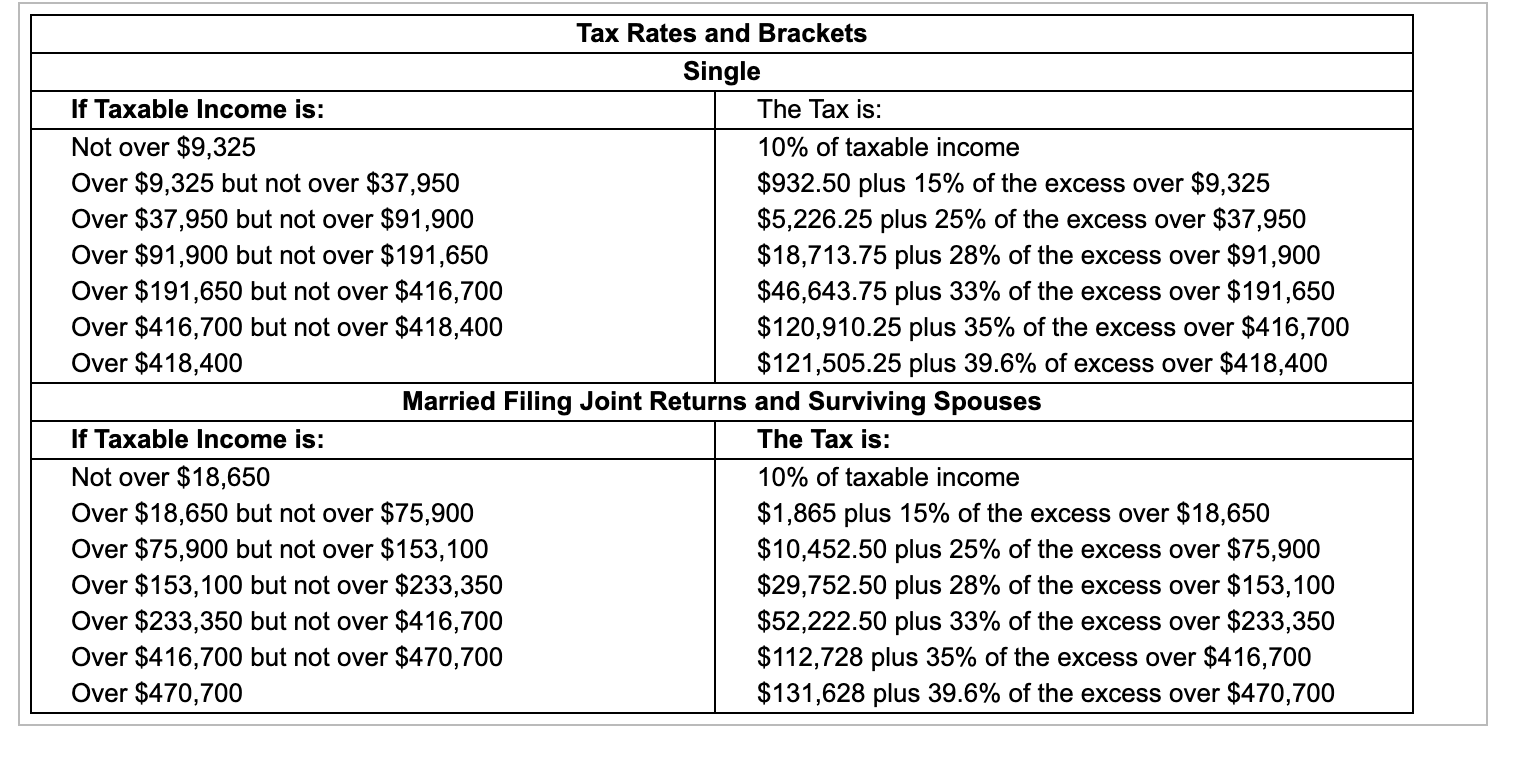

Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemized deductions. He has active income of $45,000, a short-term capital gain income of $2,800 from the sale of stock, and $7,400 from book royalties. What is Gordon's average tax rate? Gordon's total gross income for the 2017 tax year is $ (Round to the nearest cent.) (Enter the amount to the nearest dollar.) Click the following link for a Assuming Gordon's filing status is single, his standard deduction for the 2017 tax year is $ standard deduction table. E Gordon is a single taxpayer without dependents. His exemption for the 2017 tax year is $ (Enter the amount to the nearest dollar.) Gordon's taxable income for the 2017 tax year is $ (Round to the nearest cent.) Gordon's total income tax due for the 2017 tax year is $ (Round to the nearest cent.) Click the following link for the tax rates and brackets table. His 2017 average tax rate is %. (Round to the nearest integer.) Data Table Standard Deduction Amounts Filing Status Single Married Filing Jointly or Surviving Spouse Head of Household Married Filing Separately Personal Exemptions in 2017: $4,050 Child Tax Credit in 2017: $1,000 per child 2017 $6,350 $12,700 $9,350 $6,350 Tax Rates and Brackets Single If Taxable income is: The Tax is: Not over $9,325 10% of taxable income Over $9,325 but not over $37,950 $932.50 plus 15% of the excess over $9,325 Over $37,950 but not over $91,900 $5,226.25 plus 25% of the excess over $37,950 Over $91,900 but not over $191,650 $18,713.75 plus 28% of the excess over $91,900 Over $191,650 but not over $416,700 $46,643.75 plus 33% of the excess over $191,650 Over $416,700 but not over $418,400 $120,910.25 plus 35% of the excess over $416,700 Over $418,400 $121,505.25 plus 39.6% of excess over $418,400 Married Filing Joint Returns and Surviving Spouses If Taxable income is: The Tax is: Not over $18,650 10% of taxable income Over $18,650 but not over $75,900 $1,865 plus 15% of the excess over $18,650 Over $75,900 but not over $153,100 $10,452.50 plus 25% of the excess over $75,900 Over $153,100 but not over $233,350 $29,752.50 plus 28% of the excess over $153,100 Over $233,350 but not over $416,700 $52,222.50 plus 33% of the excess over $233,350 Over $416,700 but not over $470,700 $112,728 plus 35% of the excess over $416,700 Over $470,700 $131,628 plus 39.6% of the excess over $470,700