Question

Calculate the 5-year net sales, operating expenses, operating income, and net income of Jiranna Healthcare. Once calculations are complete, interpret the resulting data and explain

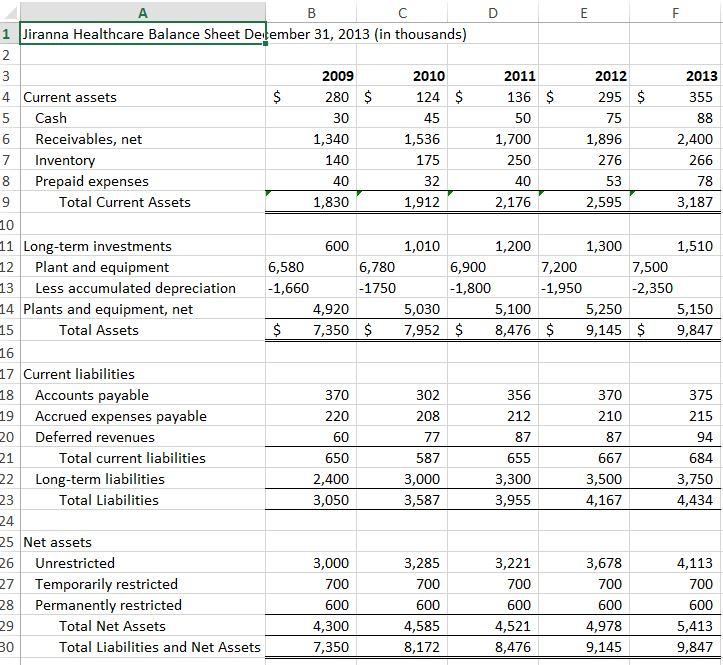

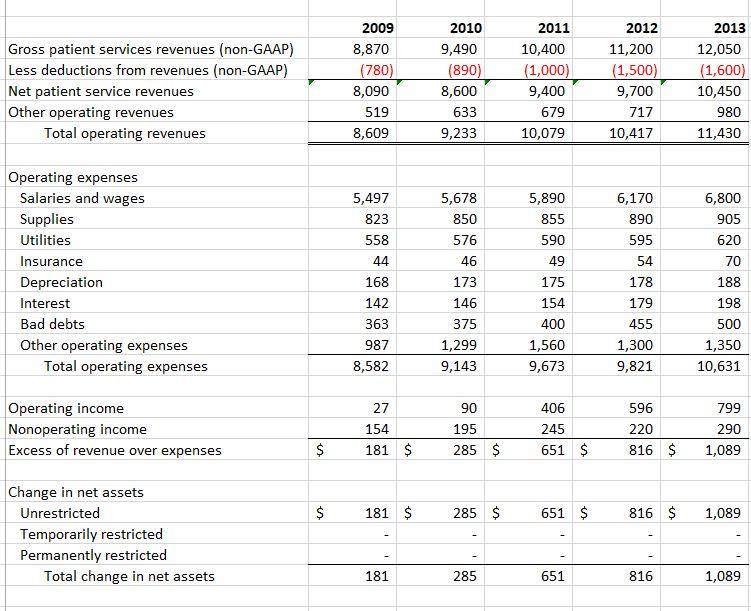

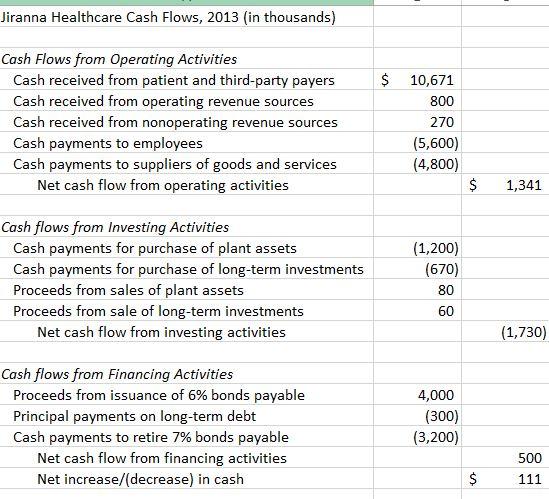

Calculate the 5-year net sales, operating expenses, operating income, and net income of Jiranna Healthcare. Once calculations are complete, interpret the resulting data and explain the significance of the trend results.

Calculate the 5-year total profit margin, asset turnover, return on assets, and return on net worth. Once calculations are complete, interpret the resulting data and determine the company’s profitability.

Calculate the 5-year current ratio, day’s cash on hand, and working capital. Once calculations are complete, interpret the resulting data and assess the company’s liquidity.

Calculate the 5-year debt ratio and times interest earned ratio. Once calculations are complete, interpret the resulting data and explain the company’s long term solvency.

Complete a DuPont analysis for each of the five most recent years. Once calculations are complete, interpret the resulting data and determine the company’s individual DuPont characteristics.

B 1 Jiranna Healthcare Balance Sheet December 31, 2013 (in thousands) 2 3 4 Current assets Cash 567 6 7 8 9 A Receivables, net Inventory Prepaid expenses Total Current Assets 10 11 Long-term investments 12 Plant and equipment 13 14 Plants and equipment, net Total Assets 15 Less accumulated depreciation 16 17 Current liabilities 18 Accounts payable 19 Accrued expenses payable 20 Deferred revenues 21 Total current liabilities Long-term liabilities Total Liabilities 22 23 24 25 Net assets 26 Unrestricted 27 Temporarily restricted 28 Permanently restricted 29 Total Net Assets 30 Total Liabilities and Net Assets $ 6,580 -1,660 $ 2009 280 $ 30 1,340 140 40 1,830 600 4,920 7,350 $ 370 220 60 650 2,400 3,050 3,000 700 600 6,780 -1750 4,300 7,350 2010 124 $ 45 1,536 175 32 1,912 1,010 5,030 7,952 $ 302 208 77 587 3,000 3,587 3,285 700 600 4,585 8,172 D 6,900 -1,800 2011 136 $ 50 1,700 250 40 2,176 1,200 356 212 87 655 3,300 3,955 E 3,221 700 600 4,521 8,476 7,200 -1,950 2012 295 $ 75 1,896 276 53 2,595 5,100 5,250 8,476 $ 9,145 $ 1,300 370 210 87 667 3,500 4,167 3,678 700 600 4,978 9,145 F 7,500 -2,350 2013 355 88 2,400 266 78 3,187 1,510 5,150 9,847 375 215 94 684 3,750 4,434 4,113 700 600 5,413 9,847

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started