Saji and Henry Lozano are married for all of 2022 and have an AGI of $130,000, taxable income of $120,000 and calculated income tax

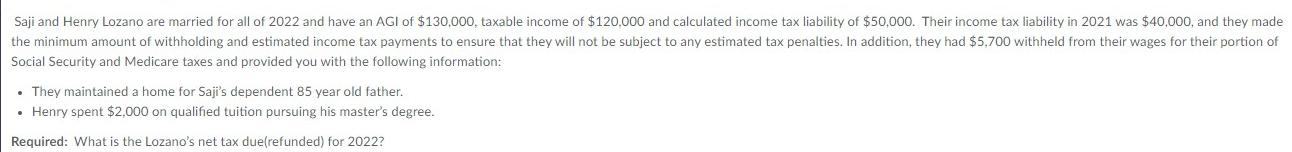

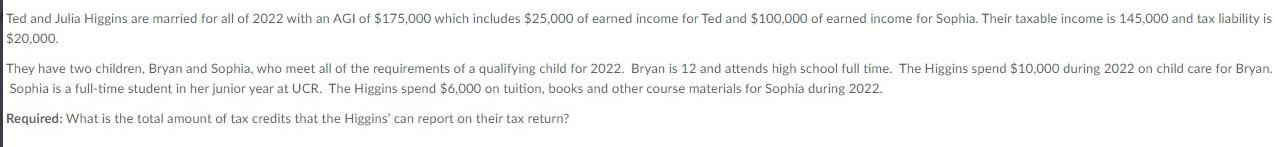

Saji and Henry Lozano are married for all of 2022 and have an AGI of $130,000, taxable income of $120,000 and calculated income tax liability of $50,000. Their income tax liability in 2021 was $40,000, and they made the minimum amount of withholding and estimated income tax payments to ensure that they will not be subject to any estimated tax penalties. In addition, they had $5,700 withheld from their wages for their portion of Social Security and Medicare taxes and provided you with the following information: They maintained a home for Saji's dependent 85 year old father. Henry spent $2,000 on qualified tuition pursuing his master's degree. Required: What is the Lozano's net tax due(refunded) for 2022? Ted and Julia Higgins are married for all of 2022 with an AGI of $175,000 which includes $25,000 of earned income for Ted and $100,000 of earned income for Sophia. Their taxable income is 145,000 and tax liability is $20,000. They have two children, Bryan and Sophia, who meet all of the requirements of a qualifying child for 2022. Bryan is 12 and attends high school full time. The Higgins spend $10,000 during 2022 on child care for Bryan. Sophia is a full-time student in her junior year at UCR. The Higgins spend $6,000 on tuition, books and other course materials for Sophia during 2022. Required: What is the total amount of tax credits that the Higgins' can report on their tax return?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 The Lozanos net tax due or refund for 2022 is as follows Income Tax Liability 50000 Withholding an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started