Answered step by step

Verified Expert Solution

Question

1 Approved Answer

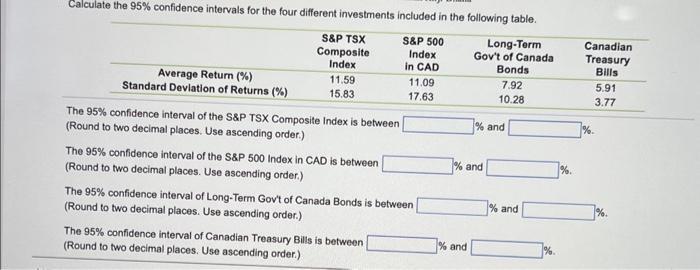

Calculate the 95% confidence intervals for the four different investments included in the following table. S&P 500 Index in CAD Long-Term Gov't of Canada

Calculate the 95% confidence intervals for the four different investments included in the following table. S&P 500 Index in CAD Long-Term Gov't of Canada Bonds 7.92 10.28 Average Return (%) Standard Deviation of Returns (%) S&P TSX Composite Index 11.59 15.83 The 95% confidence interval of the S&P TSX Composite Index is between (Round to two decimal places. Use ascending order.) The 95% confidence interval of the S&P 500 Index in CAD is between (Round to two decimal places. Use ascending order.) 11.09 17.63 The 95% confidence interval of Long-Term Govt of Canada Bonds is between (Round to two decimal places. Use ascending order.) The 95% confidence interval of Canadian Treasury Bills is between (Round to two decimal places. Use ascending order.) % and % and % and % and %. Canadian Treasury Bills 5.91 3.77 %.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

9 1159 196 1583 b 1109 1961763 c 792 39234 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started