Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the actuarially fair premium in the high deductible plan for the careless driver. (Hint: you have to think as if you were the

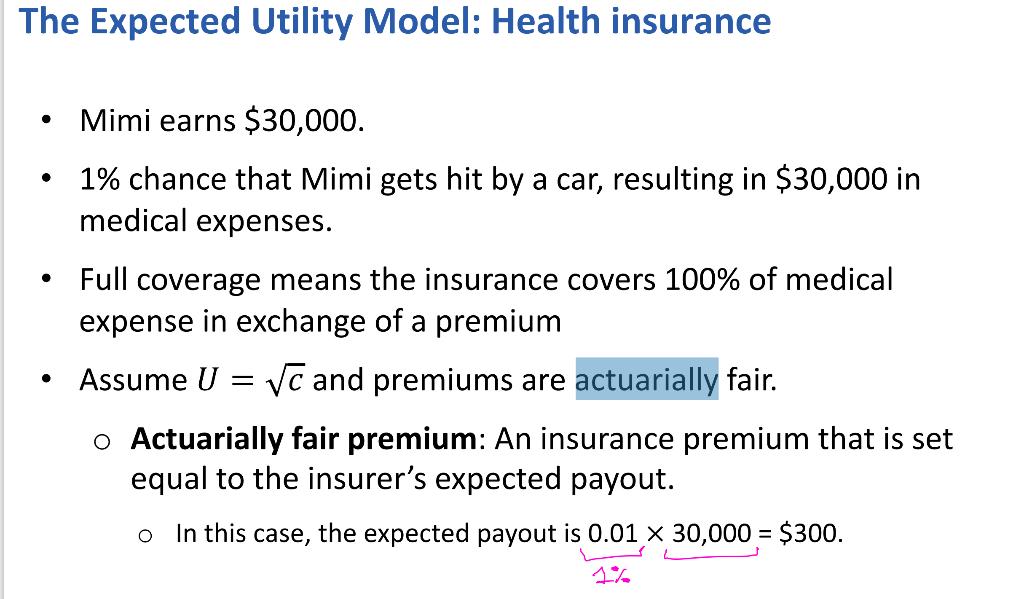

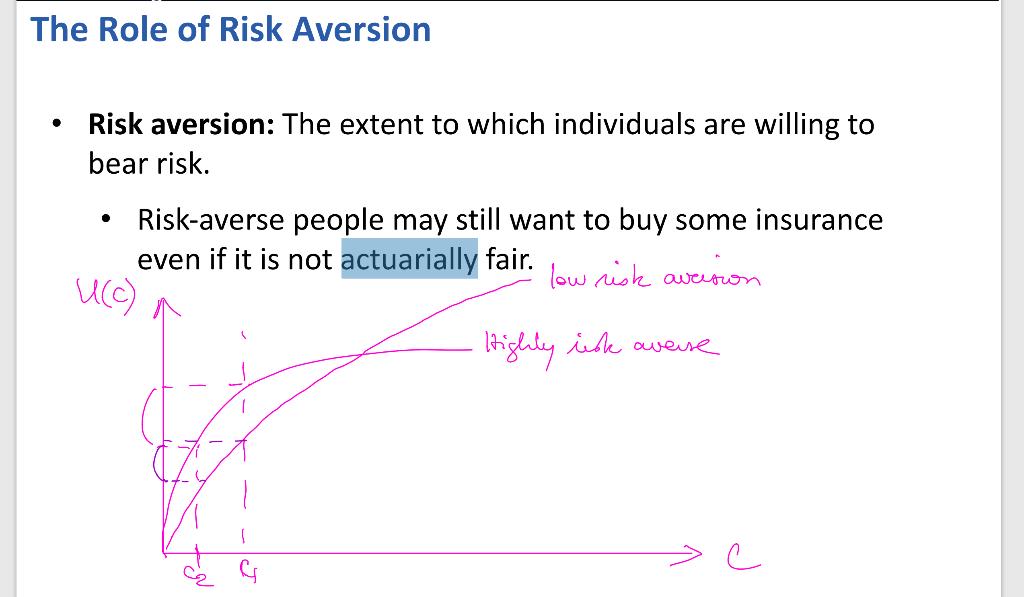

Calculate the actuarially fair premium in the high deductible plan for the careless driver. (Hint: you have to think as if you were the insurance company and consider the expected amount of money that you would expect to reimburse in case of an accident). O C 30 93 300 930 Does Asymmetric Information Necessarily Lead to Market Failure? If low-risk people have a high enough risk premium, they will subsidize high-risk people in a pooling equilibrium. Risk premium: The amount that risk-averse individuals will pay for insurance above and beyond the actuarially fair price. Pooling equilibrium: A market equilibrium in which all types of people buy full insurance even though it is not fairly priced to all individuals. The Expected Utility Model: Health insurance Mimi earns $30,000. 1% chance that Mimi gets hit by a car, resulting in $30,000 in medical expenses. Full coverage means the insurance covers 100% of medical expense in exchange of a premium Assume U = c and premiums are actuarially fair. o Actuarially fair premium: An insurance premium that is set equal to the insurer's expected payout. o In this case, the expected payout is 0.01 x 30,000 = $300. 1% The Role of Risk Aversion Risk aversion: The extent to which individuals are willing to bear risk. Risk-averse people may still want to buy some insurance even if it is not actuarially fair. low risk aversion. U(c) Highly risk averse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given Mimis Income 30000 and Probability of accident p1 001 and medical ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started