Answered step by step

Verified Expert Solution

Question

1 Approved Answer

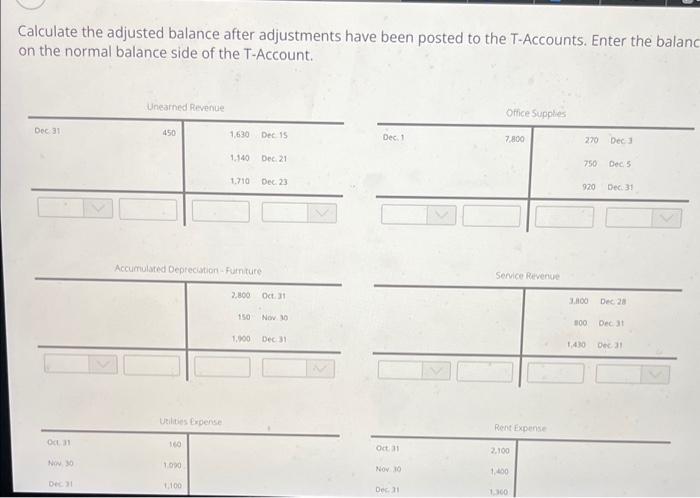

Calculate the adjusted balance after adjustments have been posted to the T-Accounts. Enter the balanc on the normal balance side of the T-Account. Dec. 31

Calculate the adjusted balance after adjustments have been posted to the T-Accounts. Enter the balanc on the normal balance side of the T-Account. Dec. 31 Oct. 31 Nov. 30 Dec. 31 Unearned Revenue 450 Utilities Expense 160 1,090 1,630 1,100 1,140 Accumulated Depreciation - Furniture 1,710 2,800 150 Dec. 15 1,900 Dec. 21 Dec. 23 Oct. 31 Nov. 30 Dec. 31 Dec. 1 Oct. 31 Nov. 30 Dec. 31 Office Supplies 7,800 Service Revenue Rent Expense 2,100 1,400 1,360 270 750 920 3,800 800 1,430 Dec. 3 Dec. 5 Dec. 31 Dec. 28 Dec. 31 Dec. 31

it is multiple questions, tbey are in order

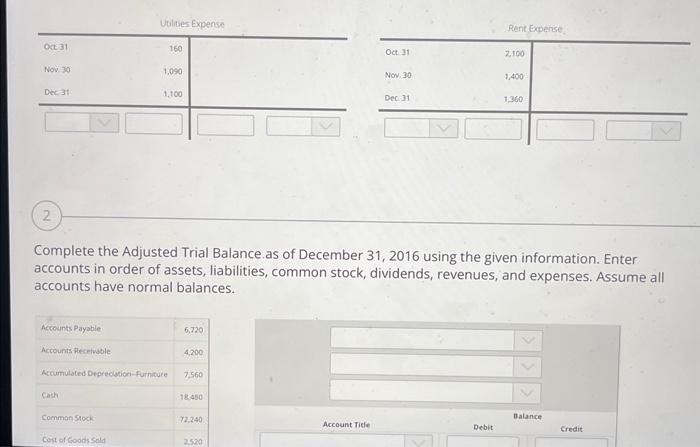

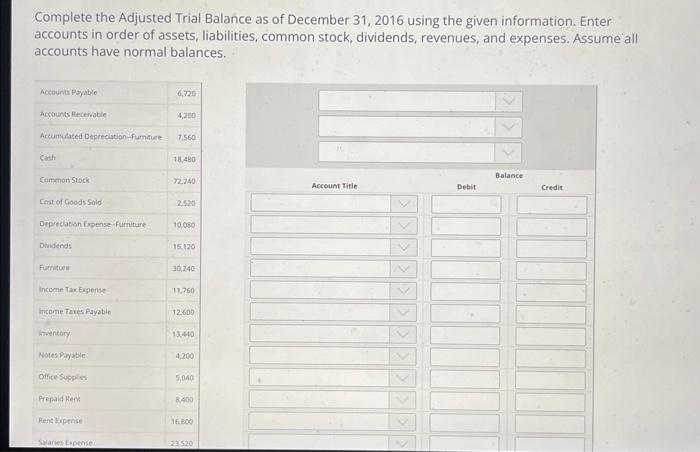

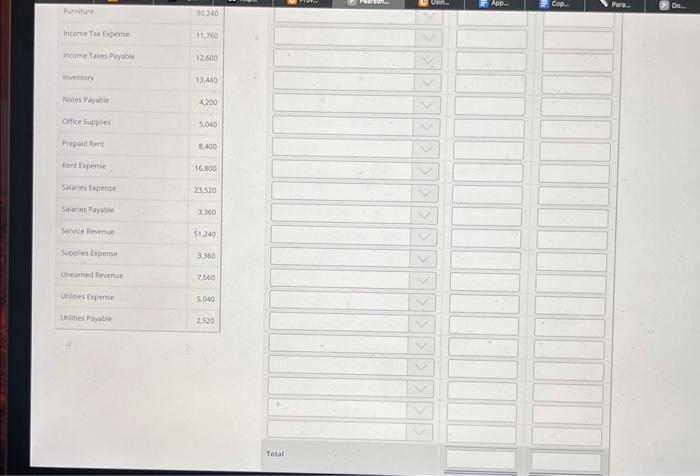

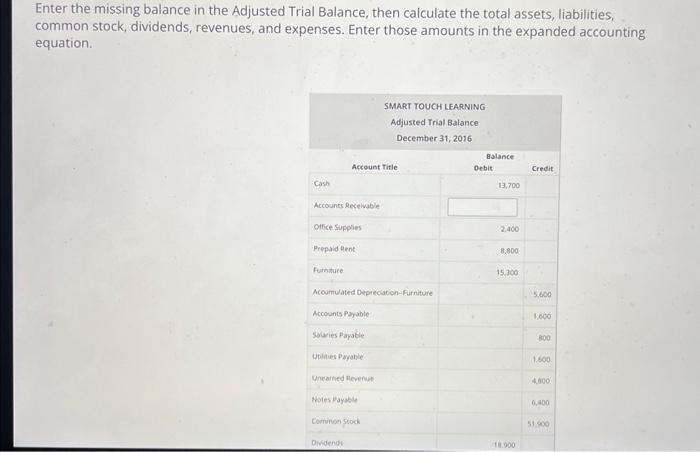

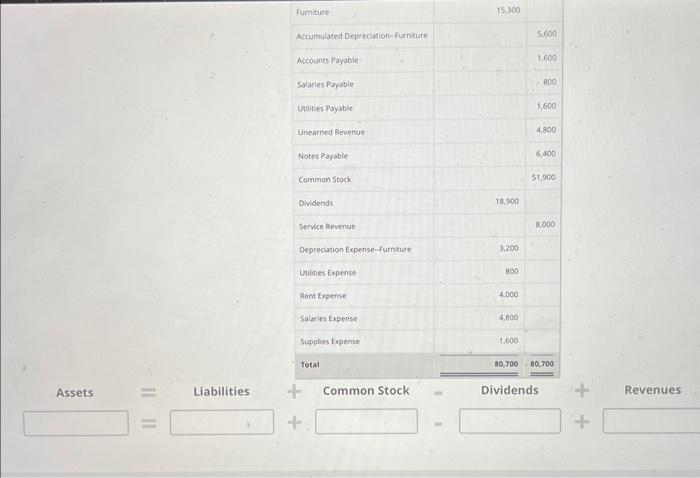

Calculate the adjusted balance after adjustments have been posted to the T-Accounts. Enter the balan on the normal balance side of the T-Account. Complete the Adjusted Trial Balance. as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, common stock, dividends, revenues, and expenses. Assume all accounts have normal balances. Complete the Adjusted Trial Balance as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, common stock, dividends, revenues, and expenses. Assume all accounts have normal balances. Enter the missing balance in the Adjusted Trial Balance, then calculate the total assets, liabilities, common stock, dividends, revenues, and expenses. Enter those amounts in the expanded accounting equation. Calculate the adjusted balance after adjustments have been posted to the T-Accounts. Enter the balan on the normal balance side of the T-Account. Complete the Adjusted Trial Balance. as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, common stock, dividends, revenues, and expenses. Assume all accounts have normal balances. Complete the Adjusted Trial Balance as of December 31, 2016 using the given information. Enter accounts in order of assets, liabilities, common stock, dividends, revenues, and expenses. Assume all accounts have normal balances. Enter the missing balance in the Adjusted Trial Balance, then calculate the total assets, liabilities, common stock, dividends, revenues, and expenses. Enter those amounts in the expanded accounting equation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started