Answered step by step

Verified Expert Solution

Question

1 Approved Answer

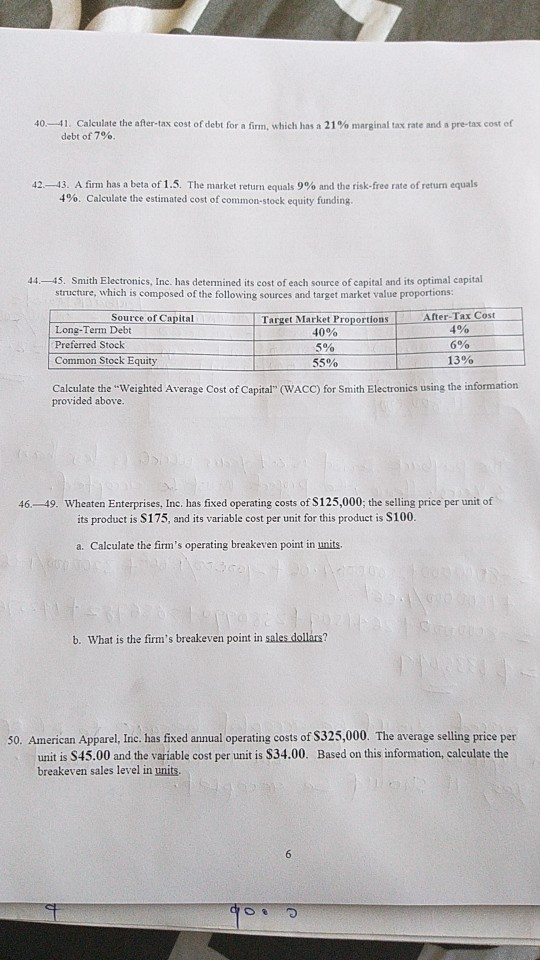

Calculate the after-tax cost of debt for a firm, which has a 21 % marginal tax rate and a pre-tax cost of debt of 7%

Calculate the after-tax cost of debt for a firm, which has a 21 % marginal tax rate and a pre-tax cost of debt of 7% 40-41. A firm has a beta of 1.5. The rmarket return equals 9% and the risk-free rate of return equals 400. 42.-43. Calculate the estimated cost ofcommon-stock equity funding. 44-45. Smith Electronics, Inc. has determined its cost of each source of capital and its optimal capital structure, which is composed of the following sources and target market value proportions: After-Tax Cost 4% 690 13% Source of Capital Target Market Proportions 40% Long-Term Debt Preferred Stock Common Stock Equity 55% Calculate the "Weighted Average Cost of Capital" (WACC) for Smith Electronics using the information provided above. 46.-49. Wheaten Enterprises, Inc. has fixed operating costs of S125,000; the selling price per unit of its product is $175, and its variable cost per unit for this product is $100 a. Calculate the firm's operating breakeven point in units. b. What is the firm's breakeven point in sales dollars? S0. American Apparel, Inc. has fixed annual operating costs of S325,000. The average selling price per unit is S45.00 and the variable cost per unit is $34.00. breakeven sales level in units. Based on this information, calculate the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started