Answered step by step

Verified Expert Solution

Question

1 Approved Answer

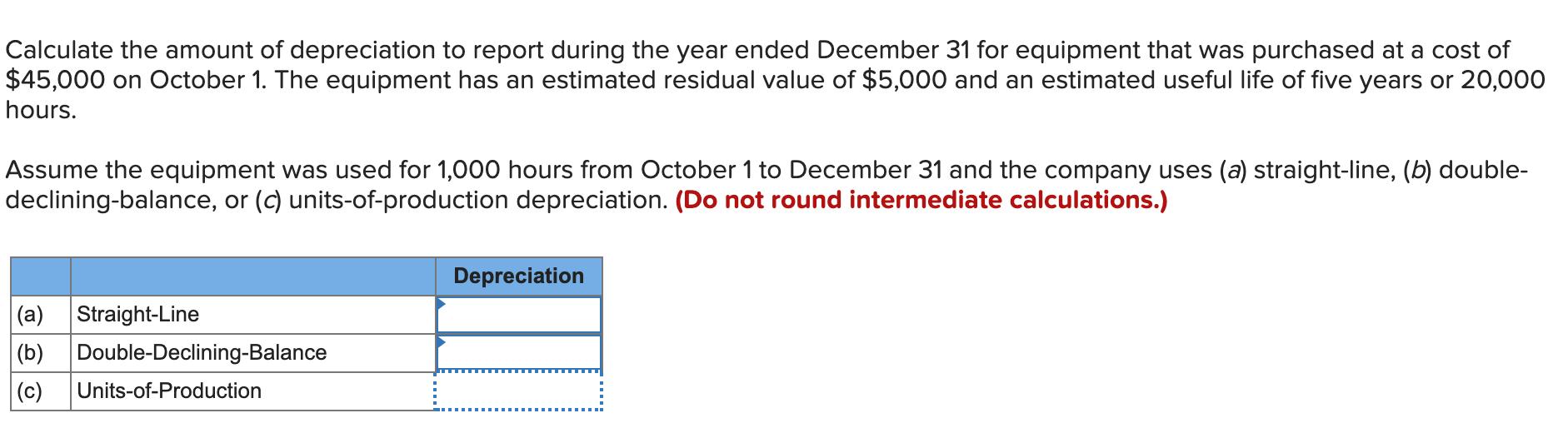

Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $45,000 on

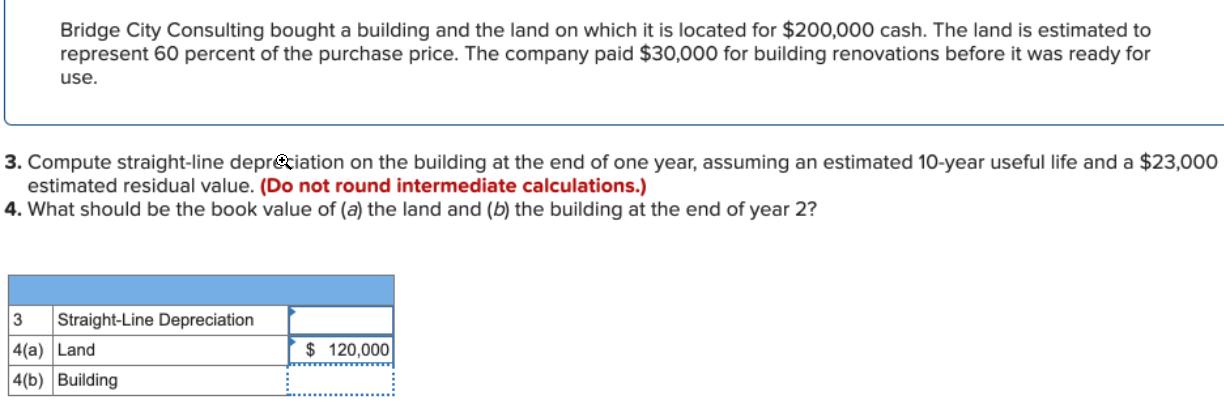

Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $45,000 on October 1. The equipment has an estimated residual value of $5,000 and an estimated useful life of five years or 20,000 hours. Assume the equipment was used for 1,000 hours from October 1 to December 31 and the company uses (a) straight-line, (b) double- declining-balance, or (c) units-of-production depreciation. (Do not round intermediate calculations.) Depreciation (a) Straight-Line (b) Double-Declining-Balance (c) Units-of-Production Bridge City Consulting bought a building and the land on which it is located for $200,000 cash. The land is estimated to represent 60 percent of the purchase price. The company paid $30,000 for building renovations before it was ready for use. 3. Compute straight-line depreciation on the building at the end of one year, assuming an estimated 10-year useful life and a $23,000 estimated residual value. (Do not round intermediate calculations.) 4. What should be the book value of (a) the land and (b) the building at the end of year 2? 3 Straight-Line Depreciation 4(a) Land $ 120,000 4(b) Building

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Workings Cost Residual Value Depreciable base Life in years Annual SLM depreciation SLM Rate 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started