Answered step by step

Verified Expert Solution

Question

1 Approved Answer

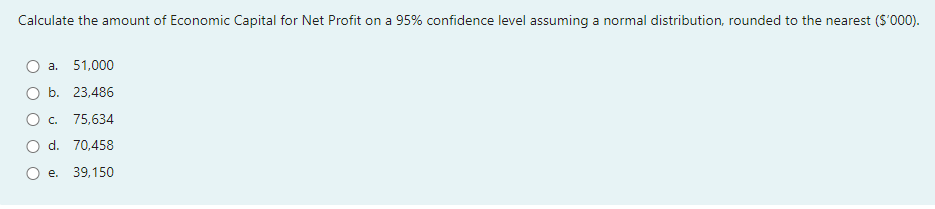

Calculate the amount of Economic Capital for Net Profit on a 95% confidence level assuming a normal distribution, rounded to the nearest ($'000). a.

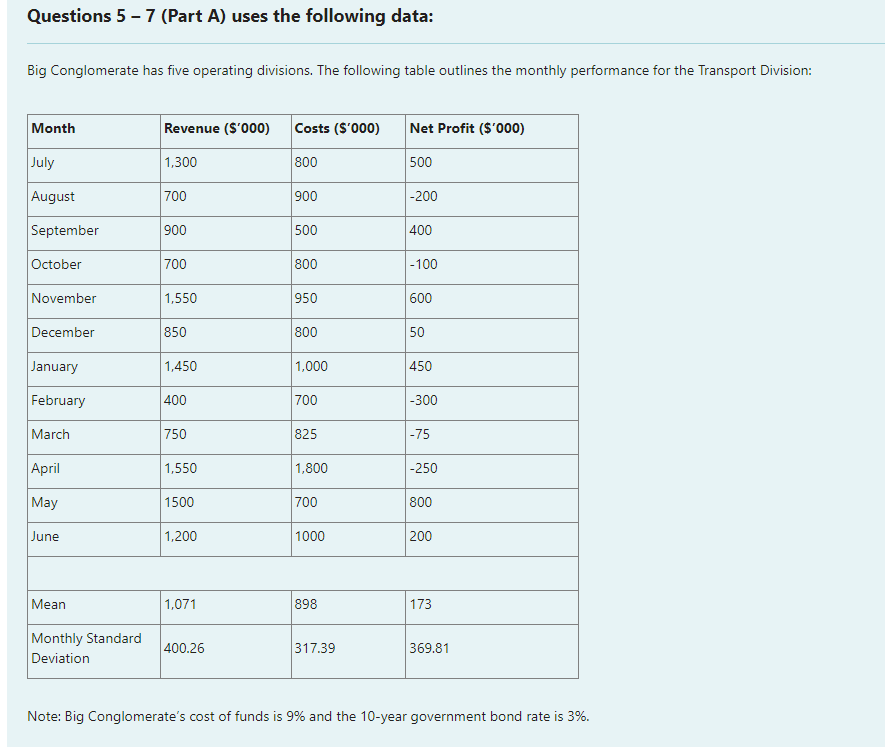

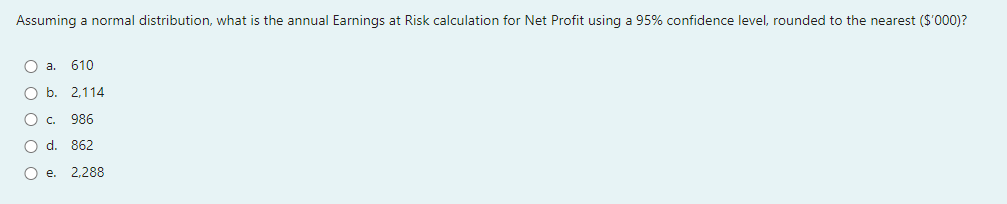

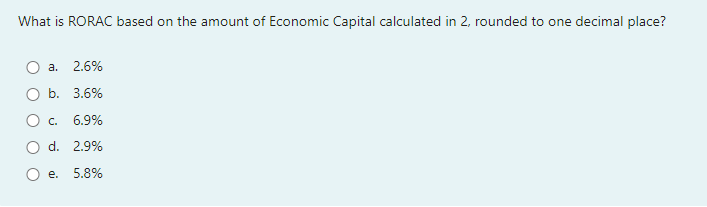

Calculate the amount of Economic Capital for Net Profit on a 95% confidence level assuming a normal distribution, rounded to the nearest ($'000). a. 51,000 b. 23,486 C. 75,634 d. 70,458 e. 39,150 Questions 5-7 (Part A) uses the following data: Big Conglomerate has five operating divisions. The following table outlines the monthly performance for the Transport Division: Month July August September October November December January February March April May June Mean Monthly Standard Deviation Revenue ($'000) Costs ($'000) 1,300 700 900 700 1,550 850 1,450 400 750 1,550 1500 1,200 1,071 400.26 800 900 500 800 950 800 1,000 700 825 1,800 700 1000 898 317.39 Net Profit ($'000) 500 -200 400 -100 600 50 450 -300 -75 -250 800 200 173 369.81 Note: Big Conglomerate's cost of funds is 9% and the 10-year government bond rate is 3%. Assuming a normal distribution, what is the annual Earnings at Risk calculation for Net Profit using a 95% confidence level, rounded to the nearest ($'000)? O a. 610 O b. 2,114 O C. 986 O d. 862 Oe 2,288 What is RORAC based on the amount of Economic Capital calculated in 2, rounded to one decimal place? 2.6% b. 3.6% a. C. 6.9% d. 2.9% e. 5.8%

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Answers to Finance Questions 1 Economic Capital for Net Profit Confidence level ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started