Question

Calculate the amount of the child and dependent care credit allowed before any tax liability limitations or other credits for 2022 in each of the

Calculate the amount of the child and dependent care credit allowed before any tax liability limitations or other credits for 2022 in each of the following cases, assuming the taxpayers had no income other than the stated amounts.

Question Content Area

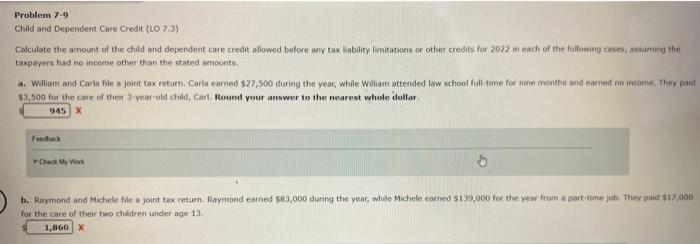

a. William and Carla file a joint tax return. Carla earned $27,500 during the year, while William attended law school full-time for nine months and earned no income. They paid $3,500 for the care of their 3-year-old child, Carl. Round your answer to the nearest whole dollar.

b. Raymond and Michele file a joint tax return. Raymond earned $83,000 during the year, while Michele earned $139,000 for the year from a part-time job. They paid $17,000 for the care of their two children under age 13.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started