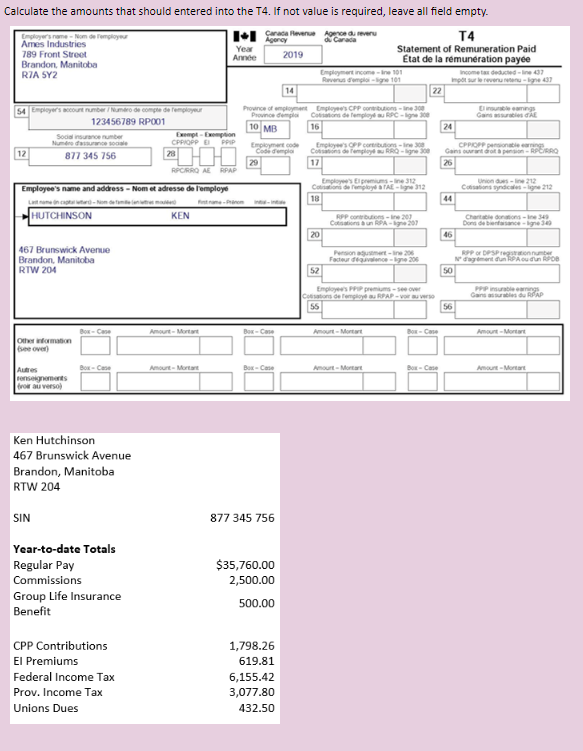

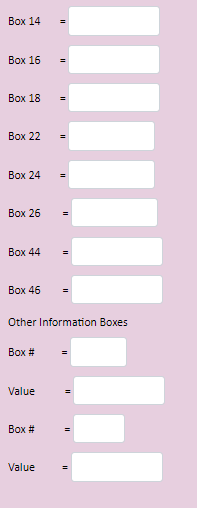

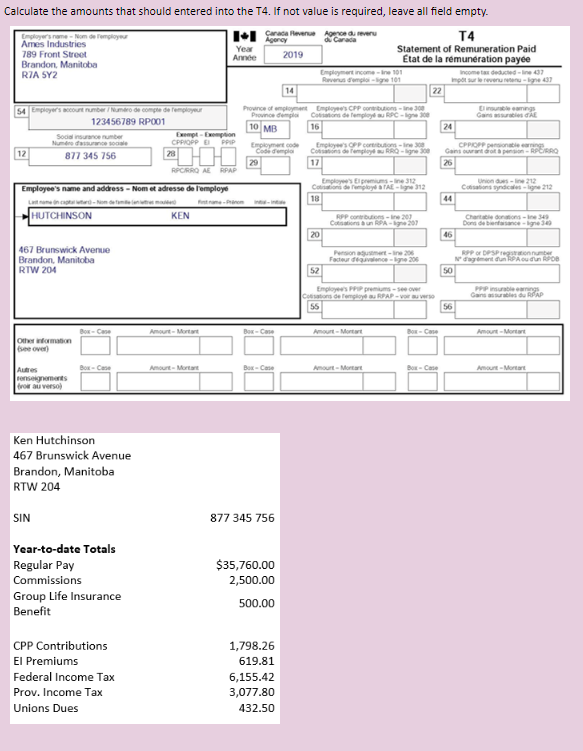

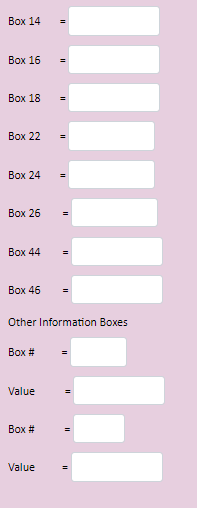

Calculate the amounts that should entered into the T4. If not value is required, leave all field empty Can Revenue Agence d e Employers momeNom delom Ames Industries 789 Front Street Brandon Manitoba RIA SY2 I Year Ande 2019 Statement of Remuneration Paid Etat de la rmunration paye come in 101 Income tax deducted line 7 14 22 Province of employment Employee's CPP butions in 300 10 MB 16 54 Employer's curtumbumero de compte de remployeur 123456789 RP001 S umber 12 8 77 345 756 28 Employee's OPP o bution- Employs Episne 33 Employee's name and address - Nom et adresse de l'employd Commer HUTCHINSON KEN 467 Brunswick Avenue Brandon, Manitoba RIW 204 Employer- Other Woman se over enseignements viru verso) Ken Hutchinson 467 Brunswick Avenue Brandon, Manitoba RTW 204 SIN 877 345 756 Year-to-date Totals Regular Pay Commissions Group Life Insurance Benefit $35,760.00 2,500.00 500.00 CPP Contributions El Premiums Federal Income Tax Prov. Income Tax Unions Dues 1,798.26 619.81 6,155.42 3,077.80 432.50 Box 14 = Box 16 = Box 18 = Box 22 = Box 24 = Box 26 = Box 44 = Box 46 = Other Information Boxes Box# = Value Box# Value Calculate the amounts that should entered into the T4. If not value is required, leave all field empty Can Revenue Agence d e Employers momeNom delom Ames Industries 789 Front Street Brandon Manitoba RIA SY2 I Year Ande 2019 Statement of Remuneration Paid Etat de la rmunration paye come in 101 Income tax deducted line 7 14 22 Province of employment Employee's CPP butions in 300 10 MB 16 54 Employer's curtumbumero de compte de remployeur 123456789 RP001 S umber 12 8 77 345 756 28 Employee's OPP o bution- Employs Episne 33 Employee's name and address - Nom et adresse de l'employd Commer HUTCHINSON KEN 467 Brunswick Avenue Brandon, Manitoba RIW 204 Employer- Other Woman se over enseignements viru verso) Ken Hutchinson 467 Brunswick Avenue Brandon, Manitoba RTW 204 SIN 877 345 756 Year-to-date Totals Regular Pay Commissions Group Life Insurance Benefit $35,760.00 2,500.00 500.00 CPP Contributions El Premiums Federal Income Tax Prov. Income Tax Unions Dues 1,798.26 619.81 6,155.42 3,077.80 432.50 Box 14 = Box 16 = Box 18 = Box 22 = Box 24 = Box 26 = Box 44 = Box 46 = Other Information Boxes Box# = Value Box# Value