Answered step by step

Verified Expert Solution

Question

1 Approved Answer

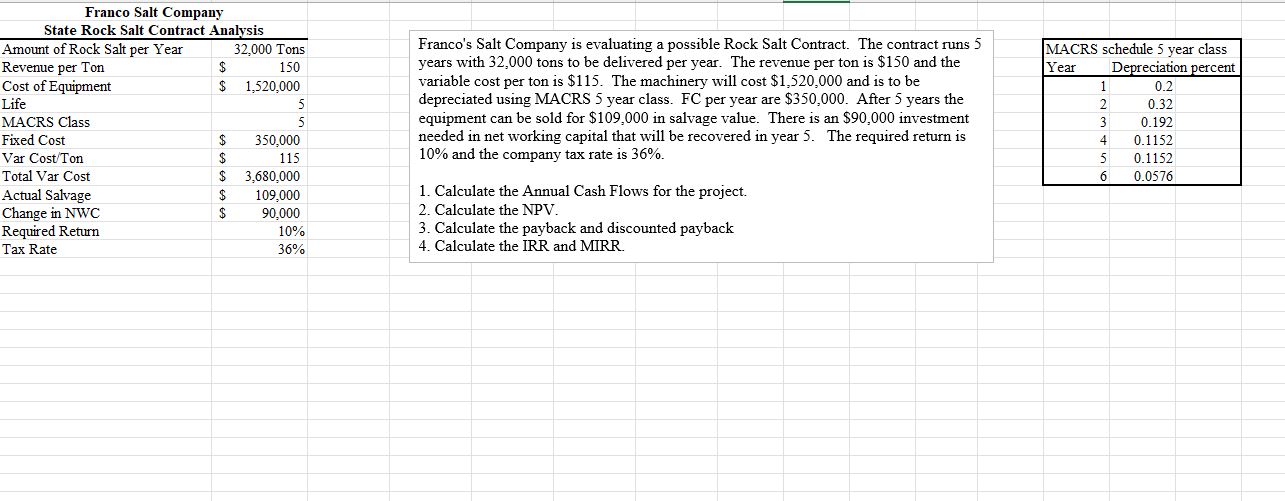

Calculate the Annual Cash Flows, Calculate NPV , Calculate PFranco's Salt Company is evaluating a possible Rock Salt Contract. The contract runs 5 years with

Calculate the Annual Cash Flows, Calculate NPVCalculate PFranco's Salt Company is evaluating a possible Rock Salt Contract. The contract runs years with tons to be delivered per year. The revenue per ton is $ and the variable cost per ton is $ The machinery will cost $ and is to be depreciated using MACRS year class. FC per year are $ After years the equipment can be sold for $ in salvage value. There is an $ investment needed in net working capital that will be recovered in year Franco Salt Company

State Rock Salt Contract Analysis

Amount of Rock Salt per Year Tons

Revenue per Ton $

Cost of Equipment $

Life

MACRS Class

Fixed Cost $

Var CostTon $

Total Var Cost $

Actual Salvage $

Change in NWC $ MACRS schedule year class

Year Depreciation percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started