Answered step by step

Verified Expert Solution

Question

1 Approved Answer

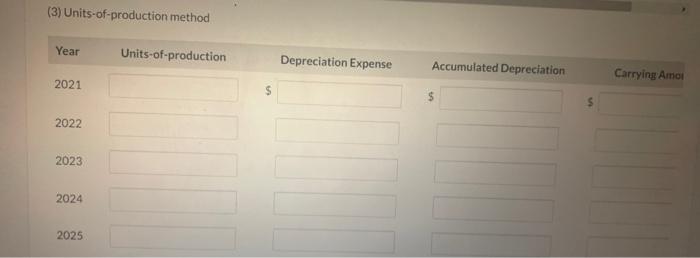

Calculate the annual depreciation and total depriciation over the asset's life using 1.Straight line method 2. Double diminishing balance method 3. Units of production method

Calculate the annual depreciation and total depriciation over the asset's life using

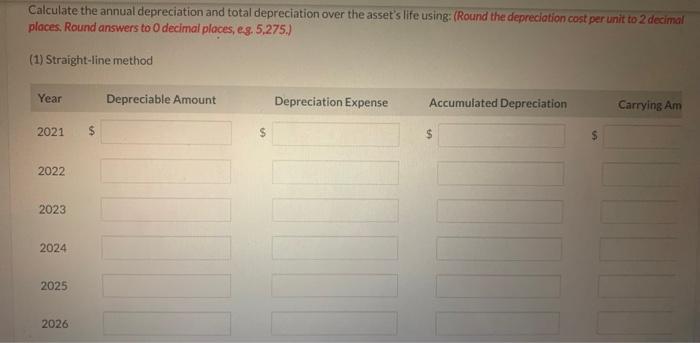

1.Straight line method

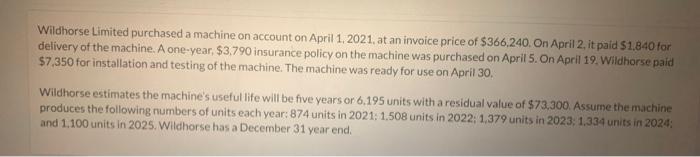

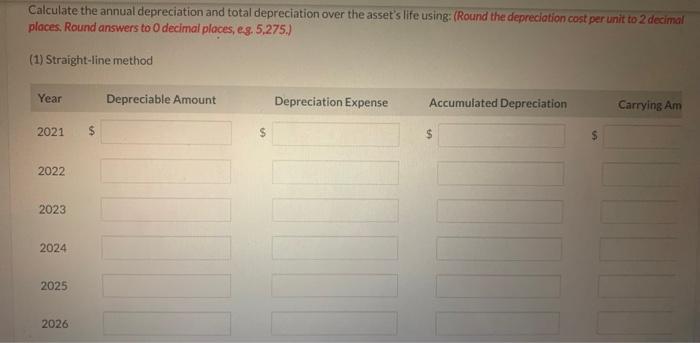

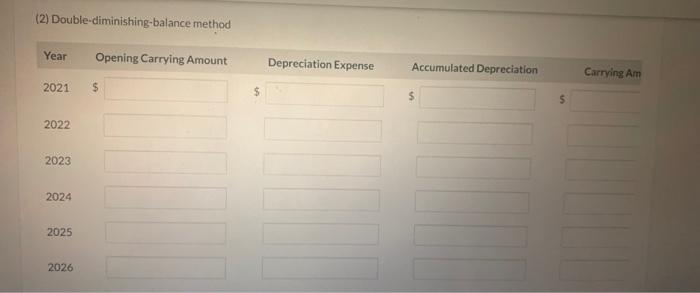

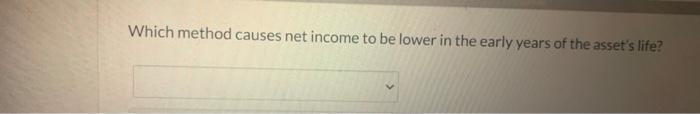

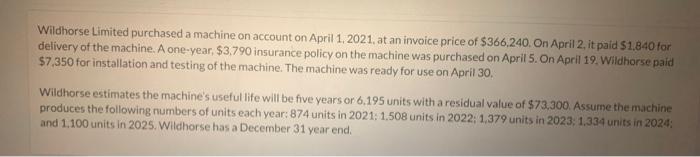

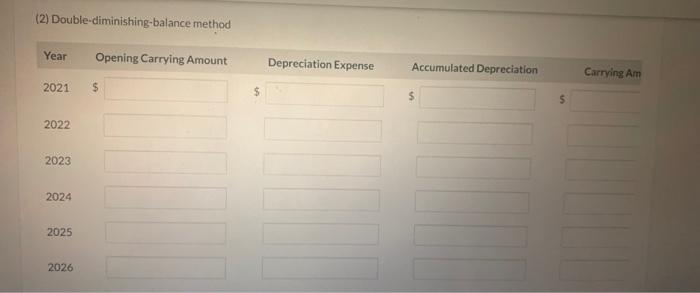

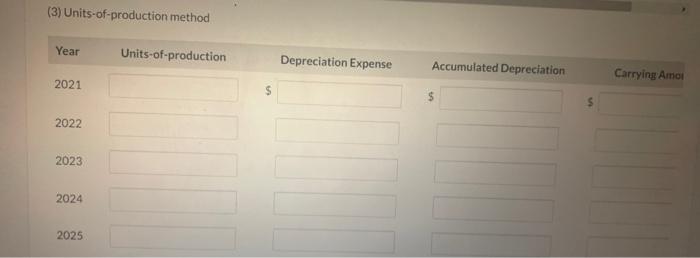

Wildhorse Limited purchased a machine on account on April 1, 2021, at an invoice price of $366,240. On April 2, it paid $1.840 for delivery of the machine. A one-year, $3,790 insurance policy on the machine was purchased on April 5. On April 19. Wildhorse paid $7,350 for installation and testing of the machine. The machine was ready for use on April 30 . Wildhorse estimates the machine's useful life will be five years or 6.195 units with a residual value of $73.300. Assume the machine produces the following numbers of units each year: 874 units in 2021:1.508 units in 2022; 1.379 units in 2023; 1.334 units in 2024: and 1,100 units in 2025. Wildhorse has a December 31 year end. Calculate the annual depreciation and total depreciation over the asset's life using: (Round the depreciation cost per unit to 2 decimal places. Round answers to 0 decimal places, eg. 5.275 .) (1) Straight-line method (2) Double-diminishing-balance method (3) Units-of-production method Which method causes net income to be lower in the early years of the asset's life 2. Double diminishing balance method

3. Units of production method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started