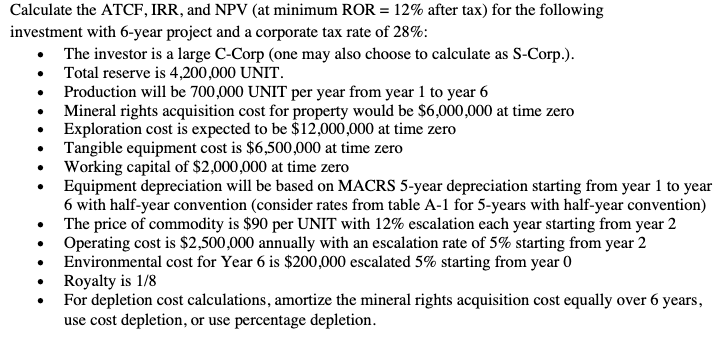

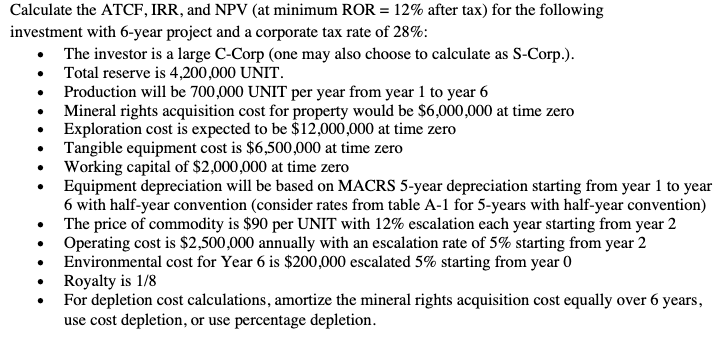

Calculate the ATCF, IRR, and NPV (at minimum ROR = 12% after tax) for the following investment with 6-year project and a corporate tax rate of 28%: The investor is a large C-Corp (one may also choose to calculate as S-Corp.). Total reserve is 4,200,000 UNIT. Production will be 700,000 UNIT per year from year 1 to year 6 Mineral rights acquisition cost for property would be $6,000,000 at time zero Exploration cost is expected to be $12,000,000 at time zero Tangible equipment cost is $6,500,000 at time zero Working capital of $2,000,000 at time zero Equipment depreciation will be based on MACRS 5-year depreciation starting from year 1 to year 6 with half-year convention (consider rates from table A-1 for 5-years with half-year convention) The price of commodity is $90 per UNIT with 12% escalation each year starting from year 2 Operating cost is $2,500,000 annually with an escalation rate of 5% starting from year 2 Environmental cost for Year 6 is $200,000 escalated 5% starting from year 0 Royalty is 1/8 For depletion cost calculations, amortize the mineral rights acquisition cost equally over 6 years, use cost depletion, or use percentage depletion. . . Calculate the ATCF, IRR, and NPV (at minimum ROR = 12% after tax) for the following investment with 6-year project and a corporate tax rate of 28%: The investor is a large C-Corp (one may also choose to calculate as S-Corp.). Total reserve is 4,200,000 UNIT. Production will be 700,000 UNIT per year from year 1 to year 6 Mineral rights acquisition cost for property would be $6,000,000 at time zero Exploration cost is expected to be $12,000,000 at time zero Tangible equipment cost is $6,500,000 at time zero Working capital of $2,000,000 at time zero Equipment depreciation will be based on MACRS 5-year depreciation starting from year 1 to year 6 with half-year convention (consider rates from table A-1 for 5-years with half-year convention) The price of commodity is $90 per UNIT with 12% escalation each year starting from year 2 Operating cost is $2,500,000 annually with an escalation rate of 5% starting from year 2 Environmental cost for Year 6 is $200,000 escalated 5% starting from year 0 Royalty is 1/8 For depletion cost calculations, amortize the mineral rights acquisition cost equally over 6 years, use cost depletion, or use percentage depletion