Question

Calculate the average monthly and average annual returns, and annual standard deviations for these stocks for the two subperiods of five years. (i.e. you should

Calculate the average monthly and average annual returns, and annual standard deviations for these stocks for the two subperiods of five years. (i.e. you should have one average monthly return and one average annual return for each 5-year period, because you will decompose the 10-year period into two subperiods of 5 years.)

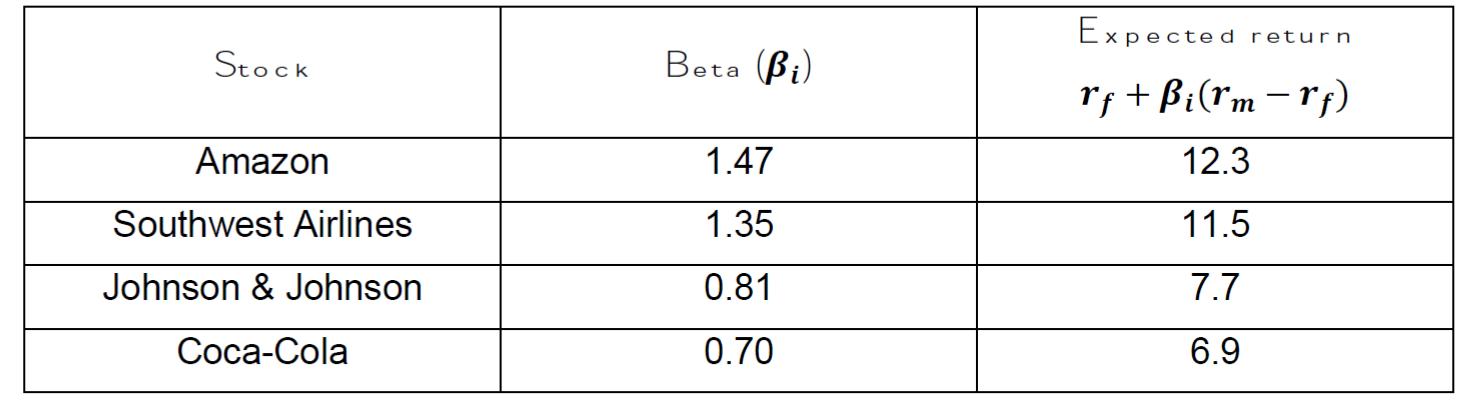

Comment on these returns and standard deviations. What can you say about the actual returns you have in your data and the ones that are given in the table below?

Stock Amazon Southwest Airlines Johnson & Johnson Coca-Cola Beta (Pi) 1.47 1.35 0.81 0.70 Expected return rf + Bi (rm -rf) 12.3 11.5 7.7 6.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the average monthly and average annual returns as well as the annual standard de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Finance The Logic and Practice of Financial Management

Authors: Arthur J. Keown, John D. Martin, J. William Petty

8th edition

132994879, 978-0132994873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App