Answered step by step

Verified Expert Solution

Question

1 Approved Answer

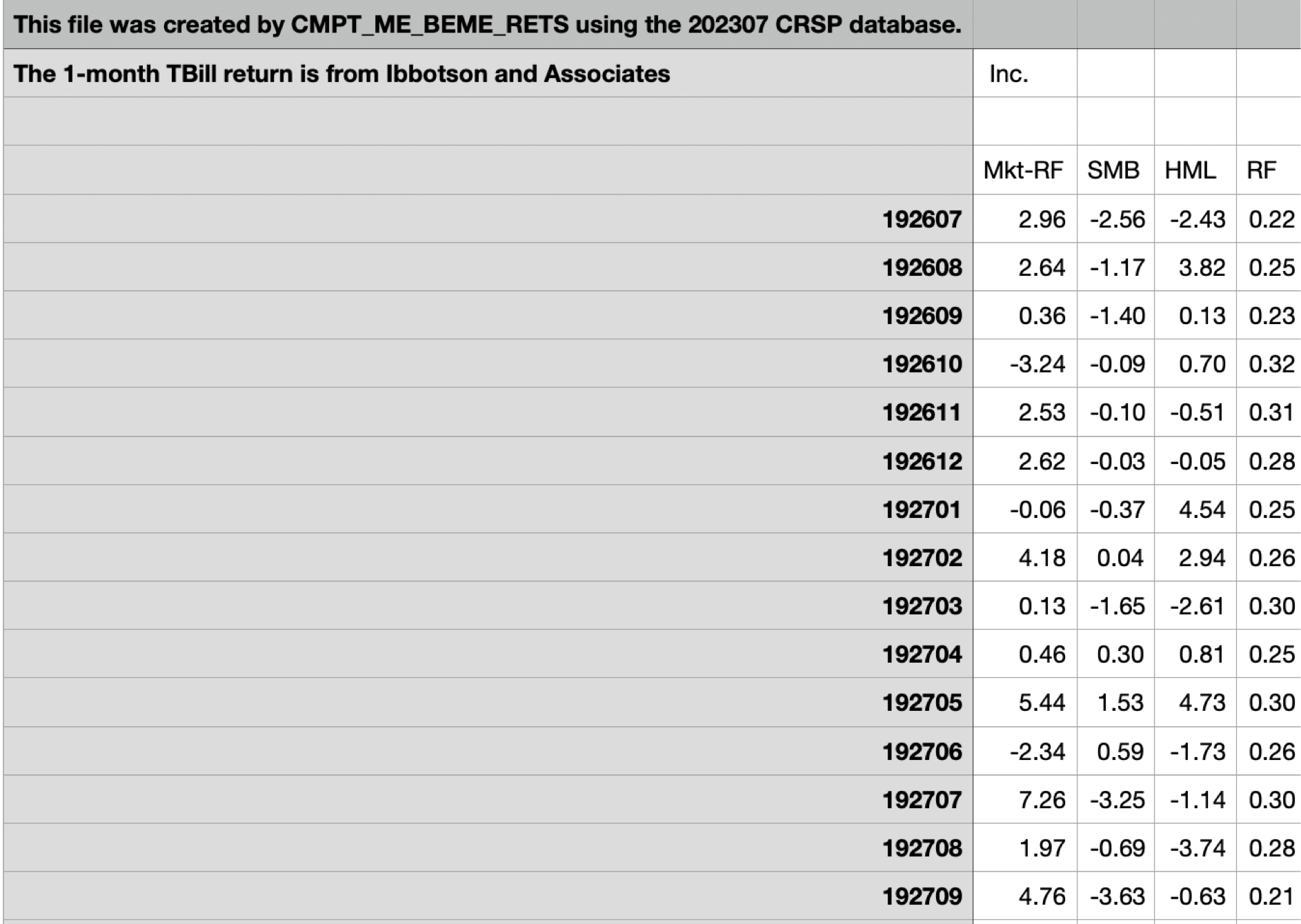

Calculate the average monthly return and the volatility (i.e., standard deviation of returns) for the full sample. This file was created by CMPT_ME_BEME_RETS using the

Calculate the average monthly return and the volatility (i.e., standard deviation of returns) for the full sample.

This file was created by CMPT_ME_BEME_RETS using the 202307 CRSP database. \begin{tabular}{|c|c|c|c|c|c|} \hline The 1-month TBill return is from Ibbotson and Associates & & Inc. & & & \\ \hline & & Mkt-RF & SMB & HML & RF \\ \hline & 192607 & 2.96 & -2.56 & -2.43 & 0.22 \\ \hline & 192608 & 2.64 & -1.17 & 3.82 & 0.25 \\ \hline & 192609 & 0.36 & -1.40 & 0.13 & 0.23 \\ \hline & 192610 & -3.24 & -0.09 & 0.70 & 0.32 \\ \hline & 192611 & 2.53 & -0.10 & -0.51 & 0.31 \\ \hline & 192612 & 2.62 & -0.03 & -0.05 & 0.28 \\ \hline & 192701 & -0.06 & -0.37 & 4.54 & 0.25 \\ \hline & 192702 & 4.18 & 0.04 & 2.94 & 0.26 \\ \hline & 192703 & 0.13 & -1.65 & -2.61 & 0.30 \\ \hline & 192704 & 0.46 & 0.30 & 0.81 & 0.25 \\ \hline & 192705 & 5.44 & 1.53 & 4.73 & 0.30 \\ \hline & 192706 & -2.34 & 0.59 & -1.73 & 0.26 \\ \hline & 192707 & 7.26 & -3.25 & -1.14 & 0.30 \\ \hline & 192708 & 1.97 & -0.69 & -3.74 & 0.28 \\ \hline & 192709 & 4.76 & -3.63 & -0.63 & 0.21 \\ \hline \end{tabular}

This file was created by CMPT_ME_BEME_RETS using the 202307 CRSP database. \begin{tabular}{|c|c|c|c|c|c|} \hline The 1-month TBill return is from Ibbotson and Associates & & Inc. & & & \\ \hline & & Mkt-RF & SMB & HML & RF \\ \hline & 192607 & 2.96 & -2.56 & -2.43 & 0.22 \\ \hline & 192608 & 2.64 & -1.17 & 3.82 & 0.25 \\ \hline & 192609 & 0.36 & -1.40 & 0.13 & 0.23 \\ \hline & 192610 & -3.24 & -0.09 & 0.70 & 0.32 \\ \hline & 192611 & 2.53 & -0.10 & -0.51 & 0.31 \\ \hline & 192612 & 2.62 & -0.03 & -0.05 & 0.28 \\ \hline & 192701 & -0.06 & -0.37 & 4.54 & 0.25 \\ \hline & 192702 & 4.18 & 0.04 & 2.94 & 0.26 \\ \hline & 192703 & 0.13 & -1.65 & -2.61 & 0.30 \\ \hline & 192704 & 0.46 & 0.30 & 0.81 & 0.25 \\ \hline & 192705 & 5.44 & 1.53 & 4.73 & 0.30 \\ \hline & 192706 & -2.34 & 0.59 & -1.73 & 0.26 \\ \hline & 192707 & 7.26 & -3.25 & -1.14 & 0.30 \\ \hline & 192708 & 1.97 & -0.69 & -3.74 & 0.28 \\ \hline & 192709 & 4.76 & -3.63 & -0.63 & 0.21 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started